Does anyone remember why India opened up the insurance sector to private, including foreign, investment at the start of this century?

A quarter of a century has passed since then. At the time, the government claimed that private sector/foreign investment in the life insurance sector would accelerate life insurance penetration (life insurance premium to GDP), and thereby provide the much-required long-term funds for infrastructure development. The idea was that life funds are an ideal fit for the long tenures and low-risk, moderate returns provided by infrastructure investment.

After the nationalisation of the life insurance sector in 1956 and the establishment of the Life Insurance Corporation of India (LIC), the LIC became the sole life insurer in India, and its performance was consistent.

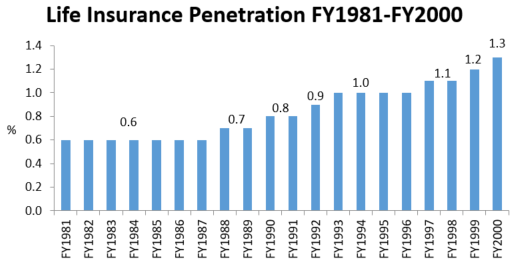

In the two decades preceding the opening up of the insurance sector to private sector and foreign investment, life insurance penetration was rising at a steady pace, from 0.6% of GDP in the early to mid-1980s to 1.3% of GDP in FY2000. India’s life insurance penetration was considerably better than other countries at a comparable level of per capita income.

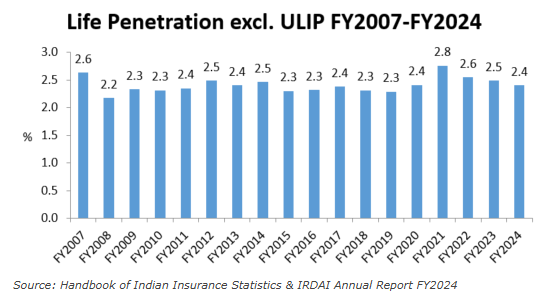

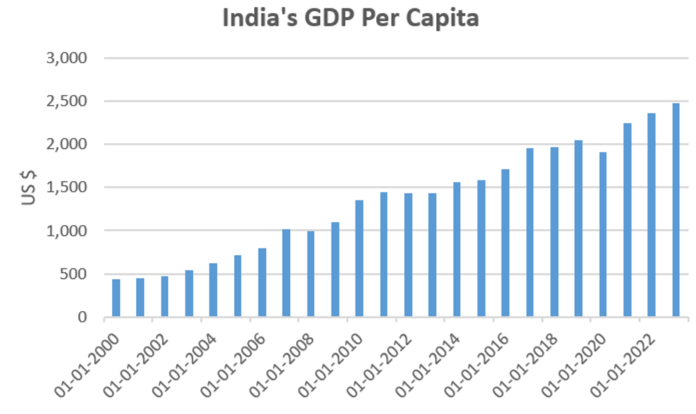

Internationally, life insurance penetration rises with the rise of per capita income and the rise of a middle class. India’s per capita income has continued to rise in the period since liberalisation of the insurance sector. With the entry of an additional 25 private sector life insurance companies (some with foreign participation) since FY2000, one would have expected the increase in life insurance penetration of the past to have continued, indeed at a faster rate. It took some time for private firms to start full-fledged operations, and so we can look at data for the period since FY2007 to understand the impact of the opening up.

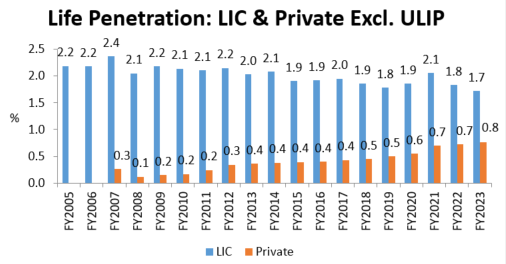

The surprising finding is that life insurance penetration since FY2007 (excluding Unit-linked policies, which are essentially mutual fund products promoted primarily by private sector life insurance companies) has stagnated at 2.4-2.5% of GDP.

In FY2005, when private sector life insurance companies were in their infancy, LIC’s penetration was 2.2%. Segregating LIC’s and private sector penetration reveals clearly that the entry of the private sector, instead of expanding penetration, only managed to take away part of LIC’s market share, more likely in the higher-income segment. LIC’s penetration excluding ULIPs has fallen from 2.4% in FY2007 to 1.7% in FY2023, while the private sector has increased from 0.3% in FY2007 (separate ULIP data not disclosed from FY2001 to FY2006 for the industry) to 0.8% in FY2023.

Contrary to the expectation that the re-entry of the private sector would accelerate life insurance penetration, the effect of privatisation has been to divert LIC’s efforts to unsuccessfully protecting its own market share, while the private sector has been content to merely eat into LIC’s market share. As a result, life penetration in India has stagnated. The private sector and LIC have been unable to take advantage of the GDP growth in the past two decades to significantly increase life penetration in India.

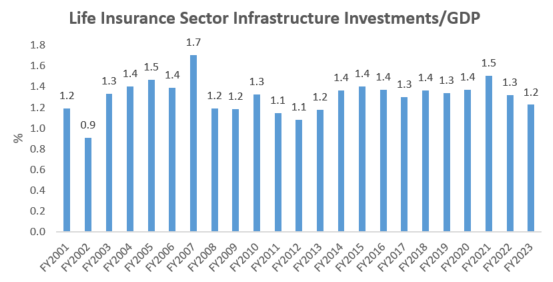

When the issue of permitting private sector and foreign investment in life insurance was debated in parliament, Yashwant Sinha (then Finance Minister) stated that there was an absence of long-term resources for infrastructure and that “insurance would provide long term funds for infrastructure development.” (Economic Times, October 23, 1998). L.K. Advani (then Union Home Minister), persuading parliamentary members of the Bharatiya Janata Party (BJP), stated[1]

“that the country needed at least $25 billion to upgrade the infrastructure sector. That this was possible only if foreign investment was allowed in the insurance sector. That private funds collected by private insurance sector were for infrastructure.” (Times of India, December 13, 1998)

The advocates of private/foreign investment in life insurance believed that their entry would increase competition raising life insurance penetration and channelize financial savings to long-term investments in infrastructure. But just as life penetration has stagnated, so too have infrastructure investments by life insurance companies stalled at 1.2-1.4% of GDP.

The advocates of allowing the re-entry of private sector in life insurance, including political leaders of both the BJP and the Congress who cited the need for raising life penetration and thereby generating the higher funds required for infrastructure, have remained silent.

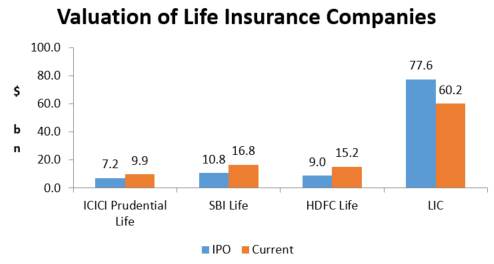

While the national objectives of the re-opening of life insurance have not been achieved, investors who subscribed in the listed private insurance companies’ initial public offerings (IPOs) have been rewarded. Thus the major beneficiaries of privatisation appear to be the promoters and IPO shareholders of private sector insurance companies. Those investors who subscribed to the LIC IPO though have been disappointed and their loss parallels the trajectory of LIC’s performance in the post-privatisation period.

Source: IPO documents, National Stock Exchange.

The stated purpose of privatisation of life insurance, namely, that it would lead to an acceleration in life penetration and rising long-term funds for infrastructure development, has failed, as both life premiums and life insurance infrastructure investment have stagnated as shares of GDP. Worse, the entry of the private sector has led to widespread mis-selling of life insurance resulting in huge losses to policy holders. Many bank staff have mis-sold policies to bank customers on account of the high commissions, and many bank customers have lost funds, undermining confidence in the concerned banks.

This comes even as India’s present coverage of life insurance is very low by international standards. A study by Swiss Re Institute indicates that India’s life insurance (private and public sector) covers less than 10% of existing needs for mortality risk protection. This is less than one-third of the emerging markets average, and less than one-fourth of the global average. (India’s insurance market: growing fast, with ample scope to build resilience, Swiss Re Institute, January 2024, p. 10)

The question of why the pre-2007 LIC succeeded in increasing life penetration to levels higher than its comparator countries, and why opening up the sector to private competition has not resulted in any major improvement, needs a separate study. But what is striking is that the entire argument originally advanced for opening up has now disappeared without a trace, and is not mentioned anywhere.

[1] Cited in Aspects of India’s Economy, No. 28, December 1999

_______________________________________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594), BSE Enlistment No. 5036. Please see SEBI disclosure here. I own HDFC Life Insurance equity shares. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: