A high-profile bank collapses on account of high-risk, bulky non-performing corporate loans. With the intervention of the Reserve Bank of India (RBI), the errant bank gets bailed out, and the RBI nominates two directors to the board. The new management and the restructured board of directors would then take stringent action to recover their bad loans, right? Apparently not, if the borrower is Reliance Infrastructure (RInfra).

Instead, Yes Bank worked out a special deal for RInfra. The first part seems straightforward: The bank obtained a valuable property of RInfra in lieu of repayment of its debt of the same value. The catch is, Yes Bank couldn’t just liquidate the property and take the cash. By a separate agreement, it entered into RInfra has the option of buying back the property from Yes Bank at any time during the following 9 years!

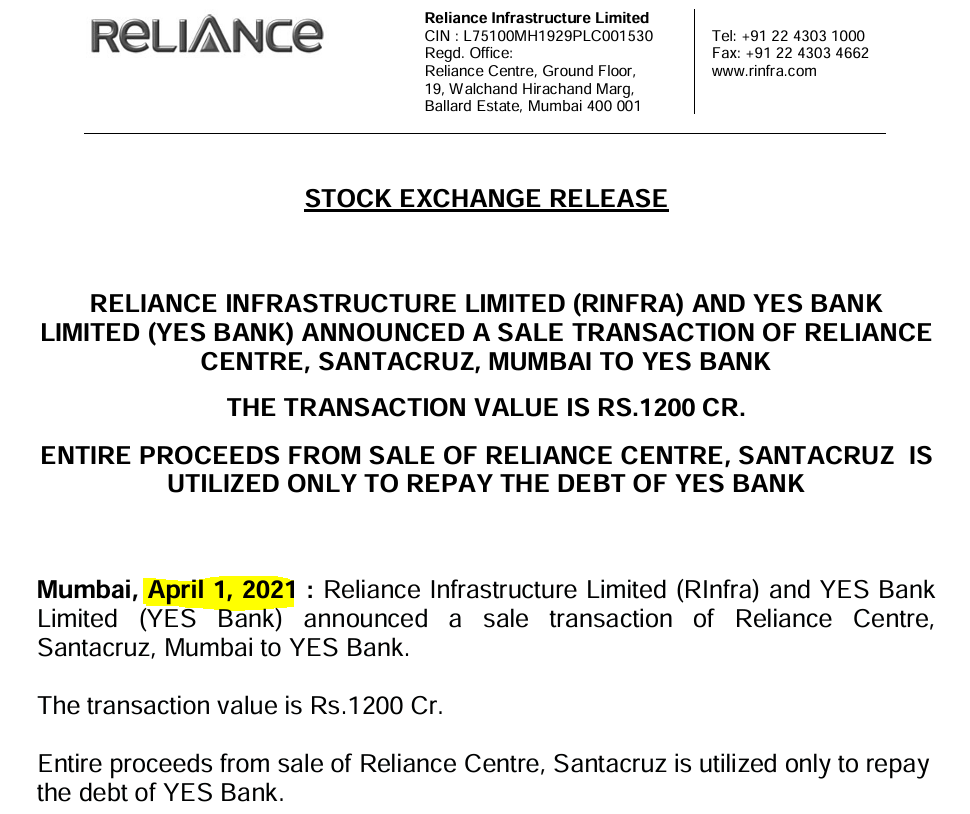

Let us start at the beginning. RBI imposed a moratorium on Yes Bank on March 5, 2020. The moratorium was lifted 13 days later, after a new CEO had taken charge and the board was reconstituted. A year later, on March 31, 2021, Yes Bank signed an unusual agreement with RInfra: a debt-asset swap whereby the latter’s bad debt of Rs 12 bn was swapped for a real estate property which housed RInfra’s head office. This property later became Yes Bank’s registered office at CTS No 34, Final Plot No. 61A of TPS V Village Bandra, Taluka Andheri, Off Western Express Highway, Santacruz (East), Mumbai – 400055, Maharashtra.

Source: RInfra

Source: RInfra

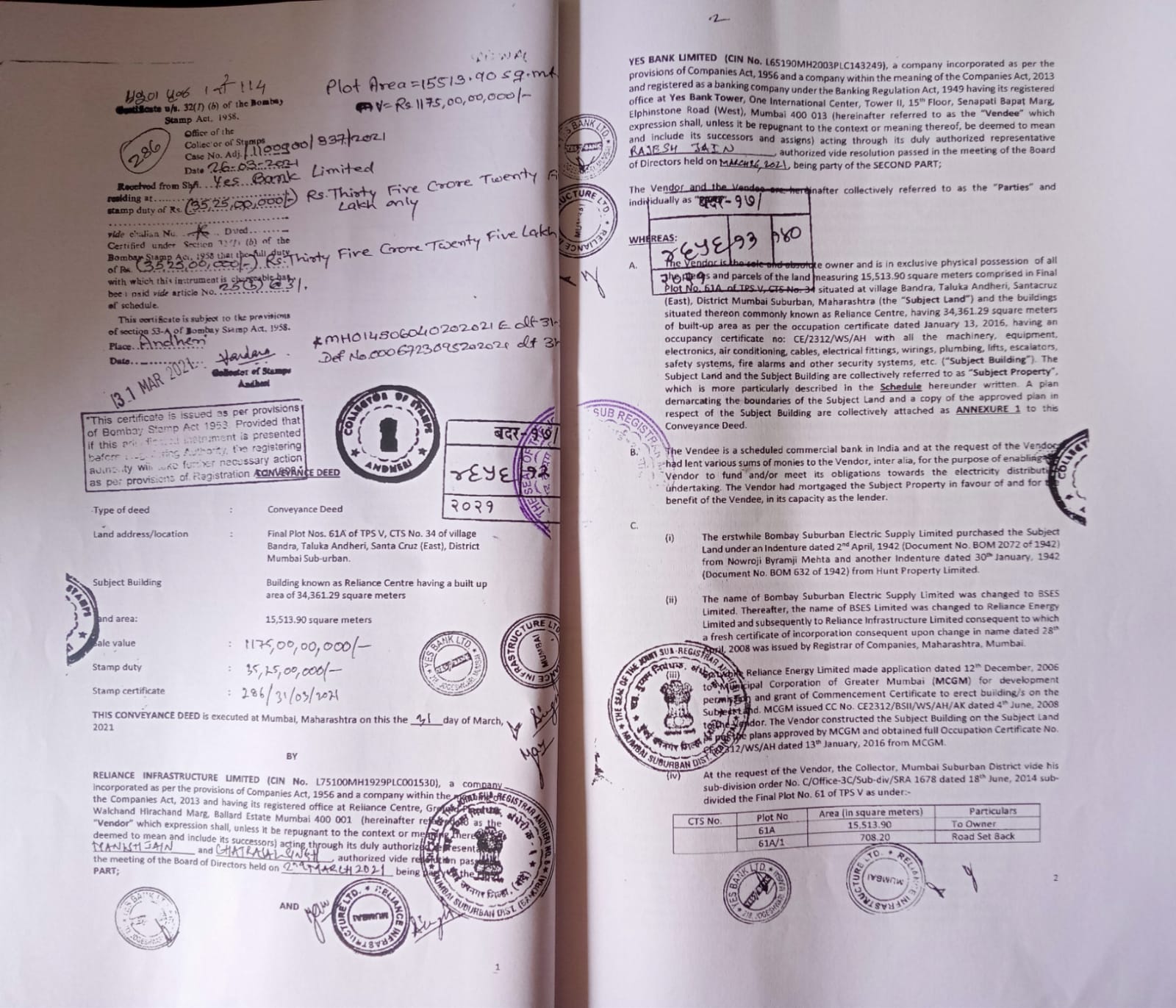

The property, consisting of a land area of 15,514 square metres and a building with a built-up area of 34,361 square metres, was valued at Rs 11.75 bn, with a stamp duty of Rs 350 mn, aggregating to Rs 12.1 bn. Yes Bank acquired the property from RInfra in a registered conveyance/sales deed (BDR 17/4656/2021 Sub-Registrar’s office, Mumbai) and reduced the company’s outstanding non-performing loan by Rs 12 bn.

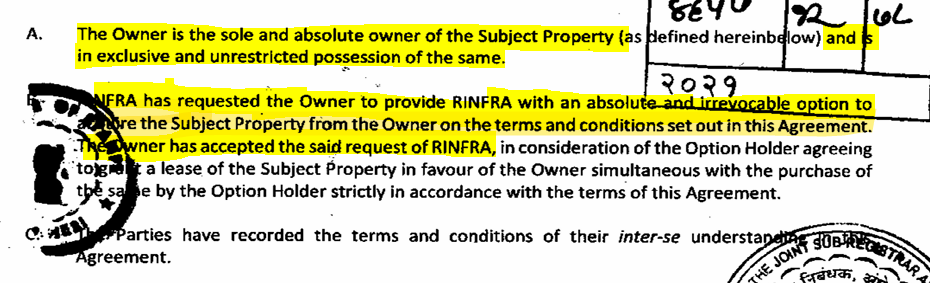

Extract of Conveyance/Sales Deed – BDR 17/4656/2021 between RInfra and Yes Bank

Normally, when banks acquire property in a bad debt settlement, their immediate task is to liquidate the security and offset the bad loan dues. This is the normal procedure, as banks are not in the business of property acquisition or management. But, in this case, Yes Bank decided to make this property its registered corporate office. The bank may argue that its registered office would be rent free for 9 years but commercial rental yields are lower than the lending yield of Yes Bank’s incremental loans i.e. if the bank had liquidated the security and lent the funds, the return would have been higher than the rental savings from the property.

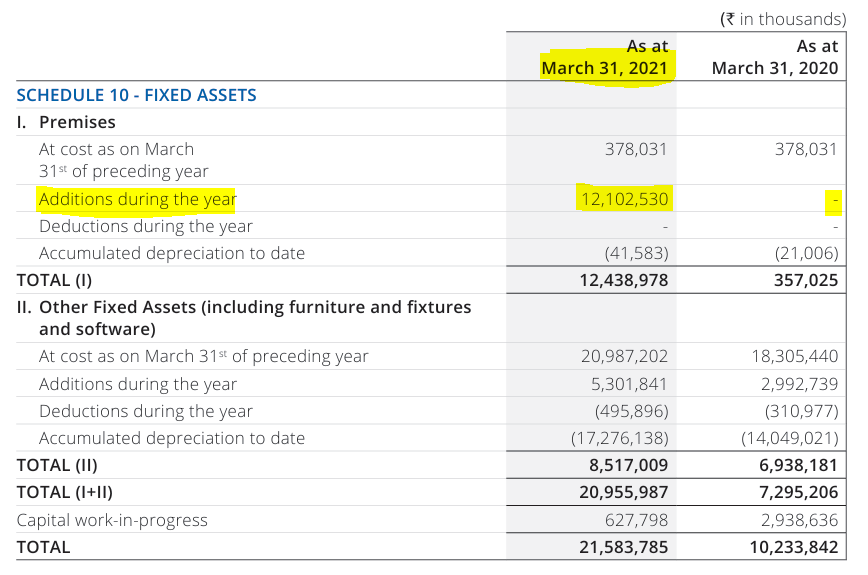

Source: Yes Bank FY2021 Annual Report p. 228

Source: Yes Bank FY2021 Annual Report p. 228

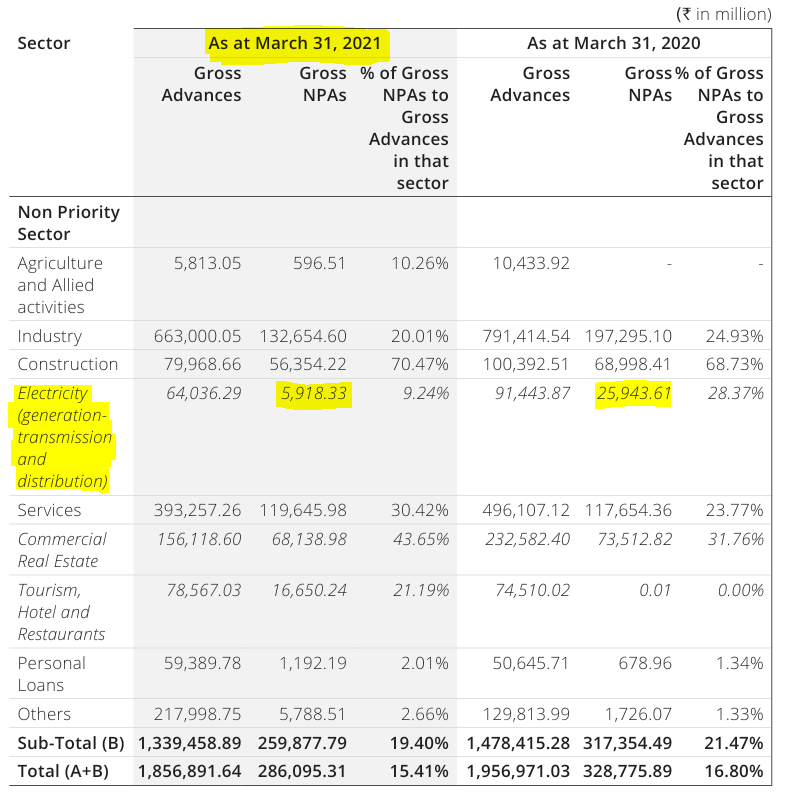

Correspondingly, Yes Bank reported a reduction in its electricity (generation, transmission and distribution) gross Non Performing Assets (NPAs) by Rs 20 bn to Rs 5.9 bn in FY2021 from Rs 25.9 bn in FY2020

Yes Bank Non-Priority Sector Gross Loans and Gross NPAs

Source: Yes Bank FY2021 Annual Report p. 183

Source: Yes Bank FY2021 Annual Report p. 183

It is pertinent to note that the debt-swap sales agreement between Yes Bank and RInfra was signed on the last date of FY2021 i.e. March 31, 2021, as the restructured board of directors was keen to report lower gross NPAs in its first year of operations and RInfra was a large NPA account (as was the Anil Ambani group) in Yes Bank.

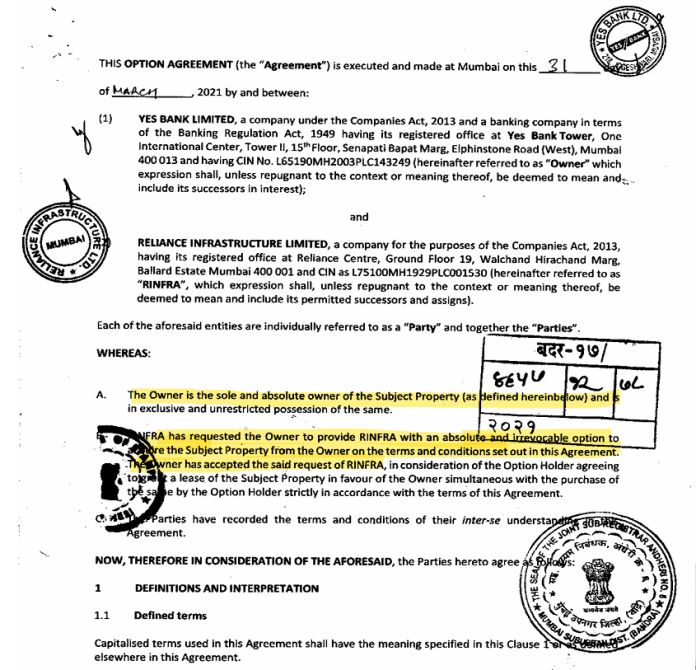

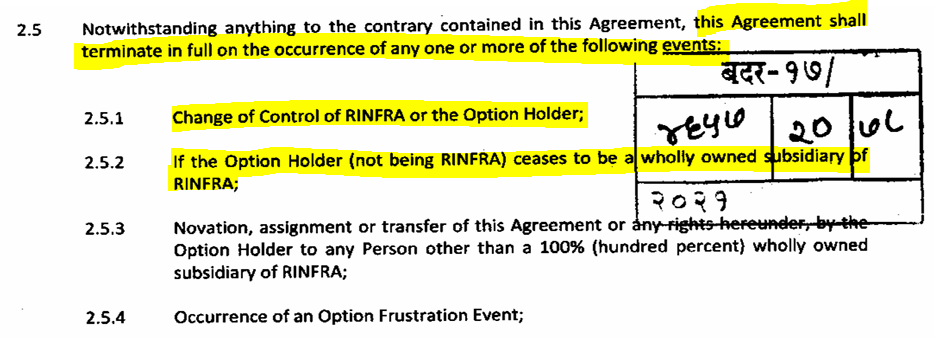

Here’s the catch: A highly unusual component of the debt-asset swap was the simultaneous registration of an option agreement (BDR 17/4657/2021, Sub-registrar’s office, Mumbai) between RInfra and Yes Bank on March 31, 2021 which gave the right to the option holder (RInfra) to buy back the property from Yes Bank within 9 years of the sale to Yes Bank i.e by March 30, 2030. At the peak of Covid (from end February 2021), the Yes Bank board was confident that one of the largest defaulter corporate groups in India would be able to buy back RInfra’s corporate office.

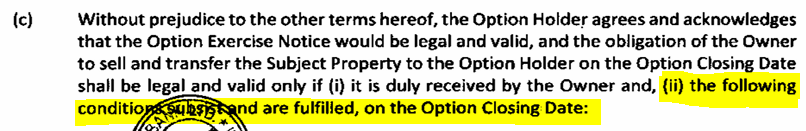

The option agreement disclosed some important issues which in effect challenge the validity of the sale to Yes Bank (owner). The option agreement makes the two following statements:

The irony in these two paragraphs of the option agreement is that the second para starkly contradicts the first paragraph. How can Yes Bank be the “sole and absolute owner” when the bank has simultaneously agreed to an “absolute and irrevocable option” on the same property with RInfra which has the following restrictive clauses?

Clause 4.4.3 of the option agreement states,

“The Owner [Yes Bank] and the Option Holder [RInfra] shall not utilise or monetise or deal with any additional/unused floor space index [FSI] whether directly or indirectly on the Subject Land during the subsistence of this Option Agreement and the Lease Deed, respectively.”

Clause 4.2.4 of the option agreement states,

“The Option Holder [RInfra] agrees that the Owner [Yes Bank] shall have the absolute right to create a mortgage and/or other security interest over the Subject Property, whether in whole or in part or on any of its rights, title and interest in the Subject Property. The Owner further agrees that if at any time during the subsistence of this Agreement, the Owner seeks to sell the said Property, such sale of the Subject Property shall be subject to the rights of the Option Holder under this Agreement and any new owner of the Subject Property shall be bound by the terms of this Agreement in its capacity as the successor in title of the Subject Property. The Owner shall disclose this Agreement to any person/entity with which the Owner engages for dealing in any manner with the Subject Property, including for creation of encumbrances or sale or otherwise howsoever.”

Both these clauses restrict the rights of Yes Bank as the absolute owner of the said property. Yes Bank should have had the right to utilise/monetise any additional or unused FSI on the said property, but this clause places restrictions on Yes Bank’s ability to take advantage of any unutilised FSI on the property.

Similarly, clause 4.2.4 also imposes restrictions on Yes Bank. If Yes Bank decides to sell the property during the 9 years to a third party, the buyer will have to abide and will also be bound by this agreement. This clause restricts Yes Bank’s absolute ownership, as it constrains Yes Bank’s right to sell and reduces the market value of the property as any new owner after Yes Bank will have to contend with the Option Holder’s rights which include buying the property from the new owner anytime during the remaining period of the option agreement.

These restrictions impact the value of the property, and have been deliberately inserted to protect the interests of RInfra, the defaulting party. It is apparent from these clauses that the sale by RInfra to Yes Bank of the said property is a conditional, and not an absolute, sale, which may not stand scrutiny in a court of law.

It is important to note that the sale/conveyance deed between the 2 parties does not contain any restrictions, and states that the sale is in consideration of a NPA settlement. Therefore no alarm bells ring in the conveyance deed. The nuances and restrictions of the entire transaction are to be found in the option agreement, which has these important restrictive clauses highlighting the fact that the sale is not absolute, but is in fact a conditional sale.

As the said property, which is Yes Bank’s registered office, resides on the bank’s balance sheet, the bank should have disclosed in the accounts that the sale was conditional, as it did not have the rights to monetise the unutilised FSI, and in case of a sale to a third party, the option agreement would be binding on the buyer. Neither has the bank disclosed this vital information nor has the auditor, M P Chitale & Co. chosen to comment on it and bring it to the notice of the shareholders. These impact the valuation of the property, and shareholders needed to be informed about this development. It is unfortunate that the restructured board of directors, which had nominees of the Reserve Bank of India and State Bank of India, agreed to these clauses and was comfortable with this non-disclosure to shareholders.

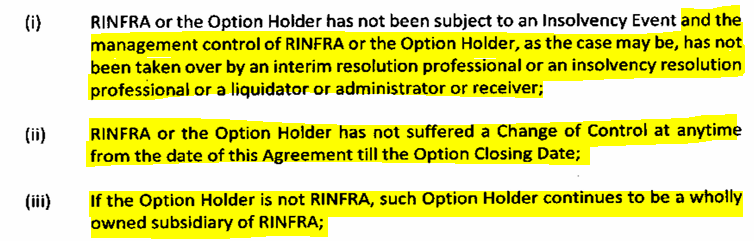

Another unusual clause is on pages 7-8 of the option agreement:

It was RInfra that was the defaulter with Yes Bank, and not the promoters of RInfra; yet for some inexplicable reason, the agreement states that if control of RInfra were to change from the existing promoters, or if the option holder ceases to be a wholly-owned subsidiary of RInfra, the buyback agreement would be null and void. It appears from the option agreement that the promoters of RInfra are more interested in the buyback of the property than RInfra itself, which owned the property and was the entity which defaulted on its debt with Yes Bank.

It is interesting to note that the restrictive clauses challenging Yes Bank’s right as the “sole and absolute” owner of the property are not included in the sale/conveyance agreement, but are set forth in the option agreement. Moreover, even though both agreements are inter-linked and sequentially registered with the sub-registrar’s office in Mumbai on March 31, 2021 with numbers BDR 17/4656/2021 (sale/conveyance agreement) and BDR 17/4657/2021 (option agreement), no reference is made in each of the agreements to the other agreement. In the option agreement the only mention of a conveyance deed between RInfra as vendor and Yes Bank as vendee is seen in Annexure 3 to Schedule 4. This Schedule 4 is a pre-agreed draft/format of the Option Exercise Conveyance Deed, should RInfra purchase it back from the Bank. Surprisingly, there are two un-numbered Annexures to this Schedule 4. One, Board Resolution of Yes Bank dated March 26, 2021 and the other is Minutes of Meetings of the RInfra Board, dated March 25, 2021, mentioning Option Agreement (no disclosure of the restrictive clauses) and buy back, respectively. It is apparent that if the restrictive clauses were included in the sales/conveyance agreement, registering the agreement may have been difficult.

While the debt asset swap of RInfra and Yes Bank, with the latter acquiring a new registered office, was widely reported in the media (here and here), the highly material option agreement was not disclosed, as its restrictive clauses would have raised concerns regarding the genuineness of the sale.

By keeping a prime real estate property with Yes Bank for a maximum of 9 years, RInfra has effectively ring-fenced this property from its other creditors, and Yes Bank has been used as a custodian.

Another issue is how was the value of the property determined at Rs 12 bn? And was it determined by the valuers after factoring the option to buyback? If the valuers were unaware of the buyback option agreement then they overvalued the asset and Yes Bank showed a higher settlement of NPAs through accounting.

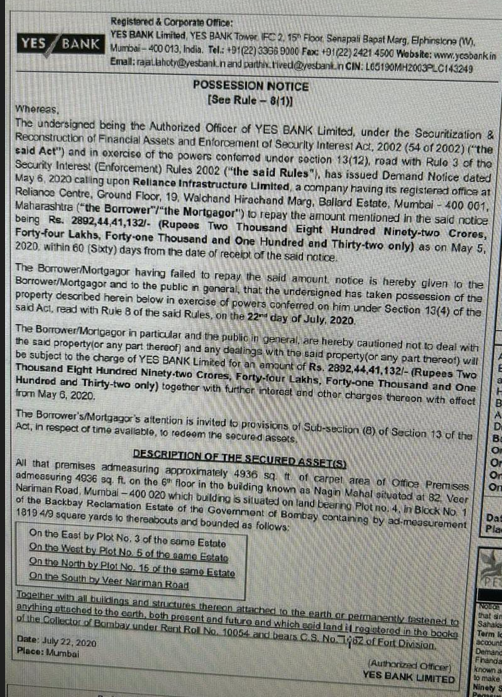

In the NPA resolution between RInfra and Yes Bank, another real estate property of the former was given as security to Yes Bank. On July 22, 2020 Yes Bank had issued a possession notice of taking over another prime property of RInfra, measuring 4,936 sq ft., on the 6th floor at Nagin Mahal, Veer Nariman Road, Mumbai 400020. It is unknown whether a similar buyback arrangement has been done with RInfra, or the bank continues to hold the property as security, or the bank has released its charge.

On account of this unusual NPA settlement with a prominent corporate defaulter, Yes Bank needs to be transparent on the size of the total dues of the Anil Ambani group of companies, and, in the settlement of the NPAs, what, if any, was the haircut the bank took on its total exposure to the group.

A valid question to Yes Bank would be whether a buyback option was given to all the NPAs of the bank by the new management and if it was not given, it will be helpful for stakeholders to understand why only RIfra was given such a buyback option.

This analyst sent a query to Yes Bank requesting clarifications and explanations of why the bank had undertaken the buyback clause with these restrictive clauses in the option agreement, and how many such buybacks the bank had undertaken with other defaulters. Yes Bank responded with the following statement:

“The Bank does not make public disclosures about its transactions with its customers/counter parties, unless it is mandated by law/regulations.”

While there may be no standard template for NPA resolution in large corporate exposures, and each may differ on a case-to-case basis depending on the circumstances and the type of security, the debt-asset swap and option of buyback by RInfra is highly unusual. It is also a matter of concern that the restructured board of directors of Yes Bank accepted the restrictive clauses that challenged Yes Bank’s absolute ownership of a property, which presently is its registered office.

Stakeholders, bankers and especially the RBI should closely examine the option agreement. It is possible that RInfra may want to exercise its option in the coming years to buy back the premises. If the RBI approves of such buybacks, will such an option be offered to all defaulters, including retail and small and medium enterprises, and not just to large companies with influential promoters?

If such an option is permitted to all defaulters, banks will do such deals instead of enforcing security, making a mockery of NPA resolution. Apparently this was the reason why the option agreement between RInfra and Yes Bank to buy back the property was never made public, apart from the mandatory filing with the Sub-Registrar’s office.

This article was also published in The Wire and can be read here. Post its publication the article was one of the “Most Read’ articles.

______________________________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). BSE Enlistment No. 5036. Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in Yes Bank and RInfra. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.