Altico Capital’s default could put more pressure on Yes Bank’s balance sheet and lead to greater scrutiny

BY SALIL PANCHAL, Forbes India Staff 2 min read PUBLISHED: Sep 24, 2019 12:00:00 PM IST UPDATED: Sep 24, 2019 12:05:17 PM IST

Bad news surrounding yes Bank doesn’t seem to stop. In September, the default of unlisted NBFC Altico Capital for ₹19.97 crore of interest income on an external commercial borrowing of ₹340 crore from UAE-based Mashreq Bank led to a ratings downgrade by various agencies. According to an India Ratings note, Yes Bank has a ₹450 crore exposure to Altico.

In an unrelated development, Yes Bank founder Rana Kapoor is considering selling stakes of his family-owned stakes in Yes Bank to Paytm, in a bid to repay dues.

Yes Bank’s stock has fallen by 80 percent to ₹54.15 on the BSE, from a high of ₹280 in April. Concerns over corporate governance and exposure to the commercial real estate which continues to slow down and impact in asset quality are hurting the bank.

Altico’s chairperson Naina Lal Kidwai, who had 14 committee and board meetings over the past 60 days, has quit from her post, citing “the burden impossible to keep up”.

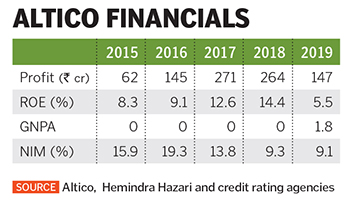

“It is apparent that either Altico’s strategy of concentrated lending to high-risk real estate developers had the board’s full support or they were ignorant of it,” says Hemindra Hazari, an independent banking analyst who publishes his writings on Singapore-based research platform Smartkarma.

Hazari says the lesson from Altico’s default is loud and clear: Companies’ financial accounts and the senior management commentary maybe misleading and excessively optimistic.

This could put more pressure on Yes Bank’s balance sheet. It also indicates the incompetence of credit ratings agencies.