The abrupt resignation of Indusind Bank’s Chief Human Resources Officer (CHRO), Zubin Mody, on July 25, 2025 is another symptom of the internal churn at the senior echelons of the bank’s executive management. His resignation came nearly 3 months after the equally sudden resignations, in quick succession, of Arun Khurana, the deputy CEO, on April 28, followed by Sumant Kathpalia, the CEO, on April 29, 2025. These departures indicate that the board of directors is carrying out a clean-up. The board is possibly reassuring stakeholders, including the regulators, that the bank is planning a reboot on a clean senior executive slate.

Pertinently, at the 4QFY2025 results call on May 21, 2025, Sunil Mehta, chairman, Indusind Bank board of directors said,

“The Board is also in the process of taking necessary steps to assess roles and responsibilities and fixing staff accountability as per the extant laws and internal code of conduct. We are approaching these aspects with utmost seriousness, without fear or favour to anyone involved in precipitation of these issues.”

Zubin Mody’s Resignation Letter

Senior-level Exits at Indusind Bank

| Name | Designation | Age | Date of Resignation | Date of Departure | Date of Joining |

| Zubin Mody | Chief Human Resource Officer | 56 | 25 July 2025 | 24 October 2025 | 09 December 2005 |

| Sumant Kathpalia | CEO and Managing Director | 63 | 29 April 2025 | 29 April 2025 | 01 February 2008 |

| Arun Khurana | Deputy CEO and Executive Director | 56 | 28 April 2025 | 28 April 2025 | 01 November 2011 |

Source: Indusind Bank

Even though Zubin Mody’s letter states his resignation is on account of his “wish to pursue new opportunities outside”, it is difficult for any 56-year old executive to depart to seek “new opportunities” with only 4 years left to retirement. It therefore appears that, as in the case of the departures of the deputy CEO and CEO, Mody’s resignation may not have been voluntary. However, unlike the executive directors, whose resignations were with immediate effect, Mody has been given a 3-month notice period, and will depart the bank on October 24, 2025.

The CHRO’s abrupt resignation, without any immediate replacement, in an executive environment in which the bank is being managed by only a limited tenure of Committee of Executives, with no CEO, no deputy CEO or any whole-time directors, puts an enormous strain on the board of directors. The CHRO plays a critical role in all senior executive appointments. With the CHRO’s resignation, and in the absence of a CEO and a deputy CEO, it is uncertain who will short-list candidates for the senior-level positions. In effect the Indusind Bank board of directors will have to play a greater role in senior executive recruitment.

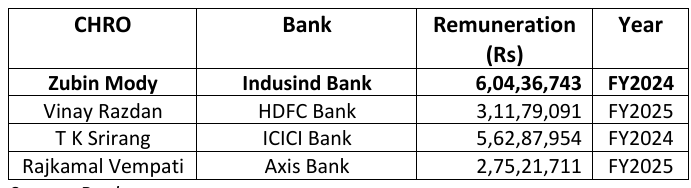

Zubin Mody is no ordinary CHRO, he is the longest-serving and highest-paid CHRO in the banking industry. He has held the position since December 2005, when he joined Indusind Bank from ICICI Lombard. It remains a mystery why Indusind Bank paid such a high remuneration to Zubin Mody as compared with the CHROs in much larger banks.

Remuneration of Select CHROs in Private Sector Banks

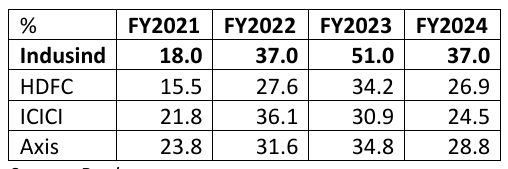

Attrition in a bank should be a key performance indicator to evaluate the CHRO and the human resource policies and staff welfare in a bank. Since FY2022, Indusind Bank has reported the highest attrition amongst prominent private sector banks such as HDFC Bank, ICICI Bank and Axis Bank. But strangely, it appears to have had no bearing on the Indusind Bank CHRO’s remuneration, as he has been the highest paid CHRO despite reporting the highest attrition amongst select banks.

Attrition of Select Private Sector Banks

In any professional organisation such a poor performance with respect to attrition should have led to either the replacement of the CHRO or a remuneration much lower than peer banks. The fact that Indusind Bank’s CHRO has remained in place till now despite such a performance is significant.

Zubin Mody was appointed as Indusind Bank’s CHRO on December 9, 2005, slightly more than 2 years prior to Romesh Sobti being appointed as CEO in Indusind Bank on February 1, 2008. When Sobti joined from ABN AMRO he replaced most of the key senior executives in Indusind Bank with former ABN AMRO executives. For example, Sumant Kathpalia joined Indusind Bank from ABN AMRO on the same date as Sobti, and Arun Khurana too had done a stint in ABN AMRO in 2004-2006. The post of CHRO is very important in an organisation, as the CEO has to work closely with the CHRO to induct senior and key managerial personnel. The fact that Zubin Mody continued in the post for so many years even after Sobti retired, and continued under Sumant Kathpalia with such a high remuneration despite poor attrition, indicates to this analyst that he enjoyed the support of the Hindujas, the promoters of Indusind Bank.

In any family-owned company, especially when the promoters are not in managerial positions, certain key executives are closely associated with the promoters, who develop these individuals as a parallel source of information apart from the formal mechanism (directors appointed by promoters). These individuals develop a parallel command structure which rivals the CEO’s chain of command. Decisions regarding their remuneration are influenced by the promoters, and their responsibilities and posts cannot be easily changed by the CEO. Interestingly, in Indusind Bank, there have been instances when senior executives have quit/retired and have been employed directly with Hinduja companies.

Under such circumstances the sudden resignation of Zubin Mody is extremely significant, and can be on account of either the promoters having lost their faith in him, or the board having defied the promoters and compelled him to resign. If it is the latter, the board must believe that to restore confidence with stakeholders, it has to remove all the old timers in senior positions, even if they were not directly linked with the problems in the treasury and in micro finance. The board probably believes that there should be a complete break from the past and the injection of new blood from outside.

The continued absence of a new CEO since Kathpalia’s departure on April 29, 2025 is also a matter of concern. At the 4QFY2025 results call on May 21, 2025, Indusind Bank chairman had stated that the “search process for the new CEO was in an advanced stage.” Yet, worryingly, the Reserve Bank of India has given a further one month extension till August 28, 2025 for the 3-member executive committee to continue managing the bank till a new CEO is appointed. This clearly indicates that the original 3 months given from April 29 to appoint a CEO was insufficient, as the short-listed candidates, for whatever reason, were uninterested in the job.

When a private sector bank is hit with multiple concerns regarding accounting fraud pertaining to treasury investments and bad debts in micro finance, and when it faces a vacuum of executive leadership at the top, depositors rush for the exit. Until 4QFY2025, while institutional depositors retained their confidence in the bank there was an outflow of retail deposits as compared with 3QFY2025. With no certainty regarding when a CEO will be appointed, and with concern that there may be more hidden losses to surface, liquidity could become an issue for the bank.

Indusind Bank Deposits

| Rs bn | 3QFY2025 | 4QFY2025 | Change (%) |

| Deposits | 4,094 | 4,109 | 0.3 |

| Retail | 1,887 | 1,852 | -1.9 |

| Institutional | 2,207 | 2,257 | 2.3 |

Source: Indusind Bank

Indusind Bank’s announcement that it plans to raise Rs 300 bn (US$ 3.47 bn), Rs 200 bn in private issue of rupee debt and Rs 100 bn in equity, indicates that it wants to create a liquidity and capital buffer, as there may be an outflow of deposits. Indusind Bank reported Common Equity Tier 1 (CET1) of 15.1% (Rs 633 bn) in 4QFY2025, which is more than adequate. Hence the additional proposed equity issue may be to provide for hidden losses, which might surface at a later date.

Though the bank’s share price has recovered from the immediate fall after the announcement of its treasury losses, the bank has been a significant under-performer as compared with the Nifty-50 and Bank Nifty since March 10, 2025. In such an environment, for the board of directors to have decided to add to the leadership vacuum by letting go of a long-serving CHRO, one who may have been close to the promoters, is a major development.

Indusind Share Price Vs NSE-50 and Bank Nifty

| 10 March 2025 | 25 July 2025 | Change (%) | |

| Indusind (Rs) | 900.5 | 825.5 | -8.3 |

| NSE-50 | 22,460 | 24,837 | 10.6 |

| Bank Nifty | 48,217 | 56,529 | 17.2 |

Source: National Stock Exchange

_________________________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). BSE Enlistment No. 5036. Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in all the banks mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.