Axis Bank is back in the spotlight for rewarding senior management for a disastrous performance. It was a year in which profits and profitability collapsed with the souring of corporate loans, the regulator penalised the bank for fudged accounts, the share price stagnated and no dividend was declared. Yet the board of directors hiked the salaries of Shikha Sharma, the CEO, and V Srinivasan, the deputy managing director with overall responsibility for corporate credit. Jairam Sridharan, the Chief Financial Officer (CFO), got a huge salary increase for the second year in succession. Such largesse for individuals responsible for the debacle, and a particularly handsome reward for an individual directly responsible for two consecutive years of mis-reported accounts, indicate the dysfunctional nature of the Axis Bank board of directors and the complete lack of accountability of its senior management. Instead of being focused on shareholders’ interest, this board is more interested in rewarding an incompetent management. It is shocking that despite the induction of significant capital and a nominee director by Bain Capital, a prominent private equity firm, geared towards shareholder returns, salary hikes to senior management have been approved. Such a board needs to be completely overhauled, and since the majority institutional shareholders do not find such conduct objectionable, the banking regulator should step in and replace all the directors.

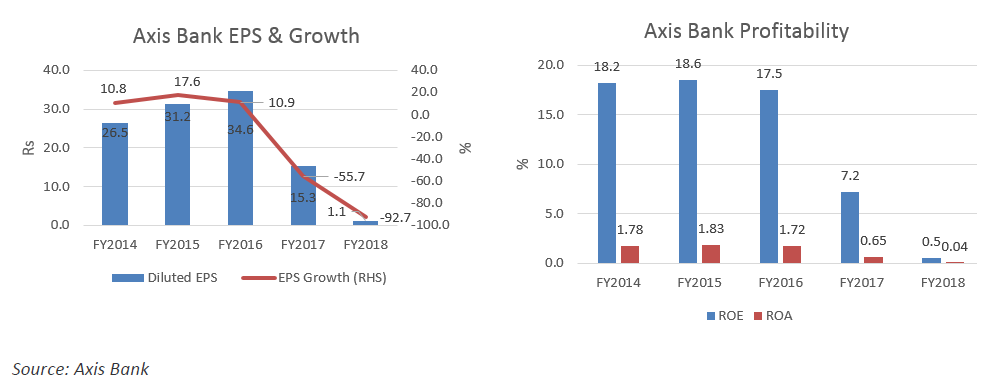

For the second consecutive year, Axis Bank reported disastrous results, as profits and profitability collapsed, resulting in the bank not declaring a dividend. In the year ended March 31, 2018 (FY2018), the bank’s EPS fell by 93%, following a year when the EPS had fallen by 56% and the bank’s ROE was reduced to a single positive decimal point.

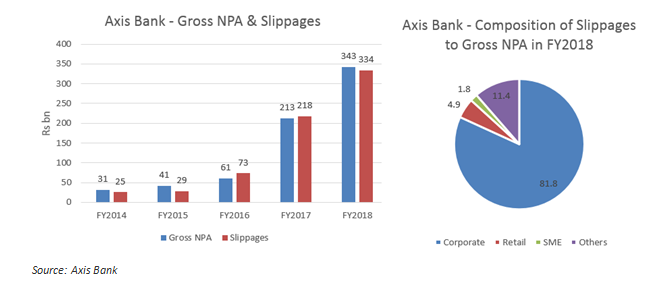

The disastrous performance was on account of corporate loans going bad. Under the leadership of Shikha Sharma and V Srinivasan, deputy managing director and in-charge of corporate credit since his appointment in 2009, the bank had focused on large ticket corporate and infrastructure loans to boost asset size. In FY2018, 82% (85% in FY2017) of the slippages to gross NPAs was on account of corporate loans. Gross NPAs in the bank’s industrial portfolio shot up from 10.7% in FY2017 to 17.2% in FY2018, and in infrastructure it went from 8% to 29.6% in the same period. The state of its corporate loan book reveals the poor credit appraisal and monitoring systems at the bank under the direct leadership of Shikha Sharma and V Srinivasan.

For shareholders, the poor fundamental performance of the bank under the present management was also reflected in its share price, which has been unable to cross Rs 636 since September 6, 2016.

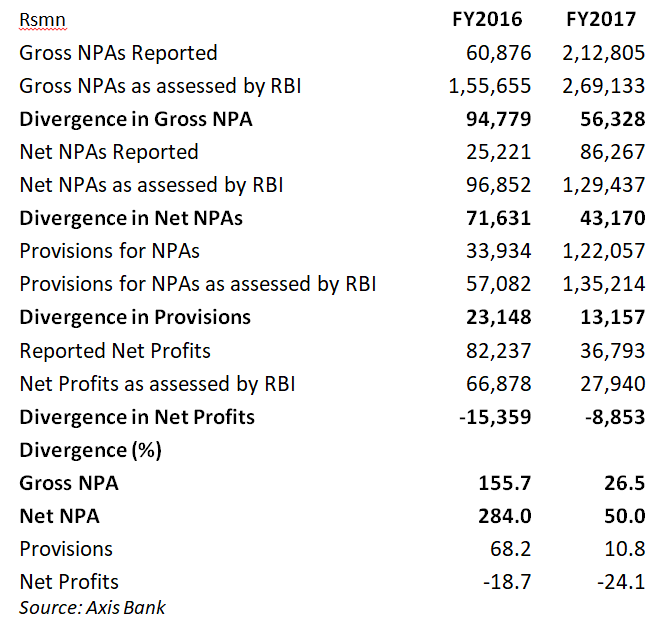

For shareholders, the poor performance was compounded by unreliable accounts. For two years in succession (FY2016 and FY2017), the bank was guilty of fudging its books, as the RBI detected significant under-reporting of non-performing loans and inflating of profits. The reliability of the bank’s FY2018 accounts will only be known later, when the regulator completes its onsite inspection of the bank. On March 7, 2018, the Reserve Bank of India (RBI) imposed a penalty of Rs 30 mn on the bank for inflating its profits and under-stating its non-performing loans. Pertinently, there is no discussion in the annual report on fixing accountability for such a serious offense. The primary responsibility of Jairam Sridharan, the CFO appointed since October 2015, is the integrity of accounts, and hence he is the individual, along with the CEO, to be held accountable for the two consecutive years of mis-reported accounts.

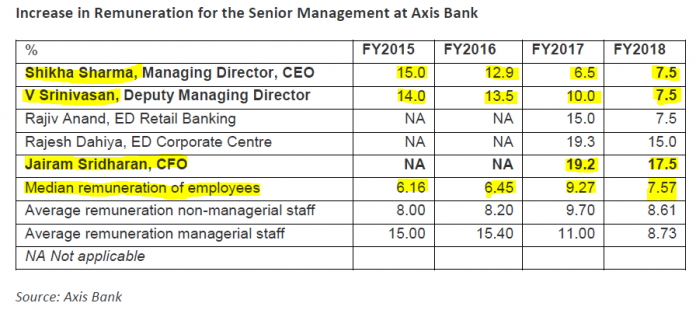

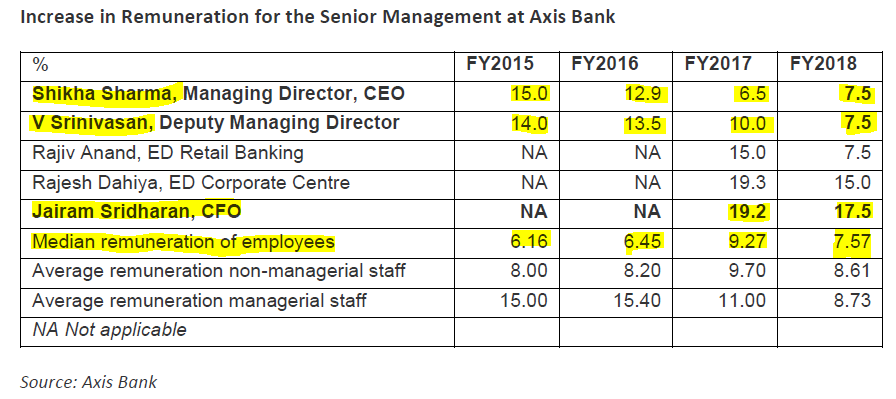

With such a pathetic track record of performance, shareholder returns and unreliable accounts, a professional board would have removed the CEO and individuals responsible for these management-created calamities. Not only were the concerned individuals not removed, the board of directors rewarded them with hikes in their remuneration. All the executive directors (including the CEO) received minimum hikes in FY2018 of 7.5% per annum, with Jairam Sridharan, the architect of the unreliable accounts receiving a substantial hike of 17.5%. In FY2017, the board also rewarded him with a 19.2% increase.

In the FY2018 annual report, the board has not provided any specific explanation of why the CEO and the executive directors were entitled to salary hikes in a year of such a disastrous performance. The only comment on the subject is

“Remuneration increase is dependent on the Bank’s performance as a whole, individual performance level and also market benchmarks. (P. 119 of annual report)

Going by this statement, it appears that the only rationale for giving hikes to Shikha Sharma, V. Srinivasan, Jairam Sridharan and the others was that the market benchmarks were so high that the board was compelled to disregard the pathetic overall performance of the bank and their own individual performance of huge corporate NPAs and unreliable accounts.

Bain Capital, a prominent global private equity firm committed around US$ 1.2 bn as capital in Axis Bank in end 2017 and inducted a nominee director. Private equity firms are solely focused on shareholder returns and play an important role in management and hence it is shocking for an active institutional investor to approve managerial rewards which are decoupled from performance.

By presiding over such poor performance and rewarding the senior management, the board of Axis Bank has clearly demonstrated that it is not ‘fit and proper’ to manage the affairs of the bank. And as the major shareholders, such as the Life Insurance Corporation of India, Specified Undertaking of the Unit Trust of India (SUUTI) and Bain Capital, who have their nominee directors on the board, are endorsing and rewarding such performance, it is time the banking regulator stepped in and restructured the board before further calamities are inflicted by this management.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594). I have no position in any of the securities referenced in this note. Views expressed in this note accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This note does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this note comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this note or hold any specific opinion on the securities referenced therein. This note is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.