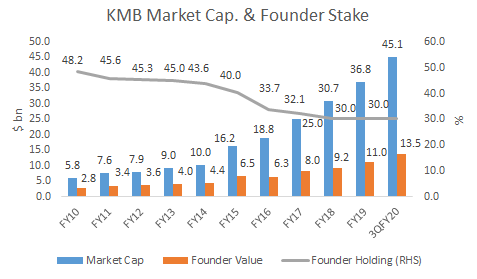

EXECUTIVE SUMMARY. In a surprise capitulation, the Reserve Bank of India (RBI) has relaxed its rules regarding the ceiling on the percentage of shares held by founders of a private bank. But it has carved out this exception for just one bank, Kotak Mahindra Bank (KMB), which has been permitted to reduce the founders’ stake to 26% (from the existing 30%) within 6 months from the date of final approval of the RBI. Thereafter no timeline has been set by the banking regulator for the founders’ stake to be reduced to 15%. Prior to this decision, KMB had agreed to the RBI’s decision of reducing the founders’ stake to 15% by March 31, 2020; even this timeline was a major regulatory forbearance, as the original February 22, 2013 notification required the founders’ stake to be reduced to 15% by March 31, 2015. In late 2018, KMB had filed a case against the RBI to permit preference capital (essentially debt) to be included in paid-up capital, so as to reduce the founders’ stake in the bank. As part of the ‘settlement’ with the regulator, KMB will withdraw the case against the RBI.

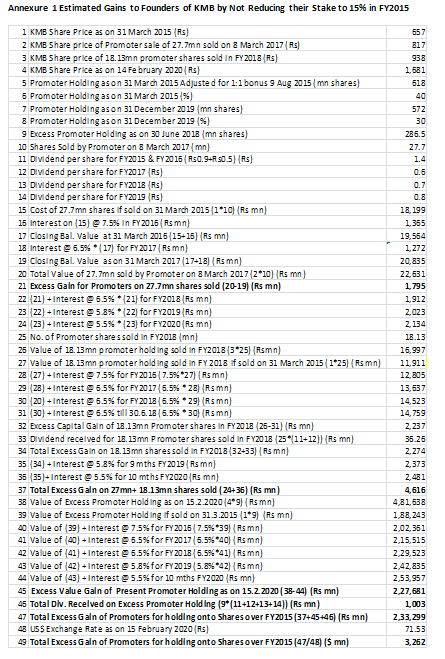

This major relaxation, given to only one bank, has seriously undermined the credibility of the banking regulator. To date, it has led to a staggering gain estimated at US$ 3.3 bn (Rs 233 bn) to the founders of KMB (essentially one individual, Uday Kotak) by allowing the original March 31, 2015 deadline to be ignored. In contrast, the RBI took stringent action against Bandhan Bank in September 2018; when the bank did not reduce the founders’ stake, the RBI restricted its business by barring the opening of new branches. That the RBI has been partial only to one bank with regard to complying with the RBI’s guidelines on reducing founders’ ownership stakes in private sector banks has not resulted in any media outcry. Nor have the 44 sell-side analysts who cover KMB highlighted the huge potential loss to non-founder shareholders in KMB from this special treatment meted out by the banking regulator. In the normal course, the business media and sell-side analysts should have been in favour of the non-founder shareholder (majority) interests in KMB, but strangely, even when KMB filed a case against the RBI, the media by and large supported KMB. This writer has been the sole exception in highlighting (here and here) how the RBI has been extra-partial to KMB; how it has given KMB an extended time line not given to other banks to reduce the founder stake; and how the bank did not even comply with that extended time line, and had the temerity to take the regulator to court.

Bear in mind. Kotak may get fixated like Bharati Airtel, Vodaphone idea, Tatadocomo, Jio, once the matter reaches SC as a PIL on RBIs decision.

Never under estimate the ruler.