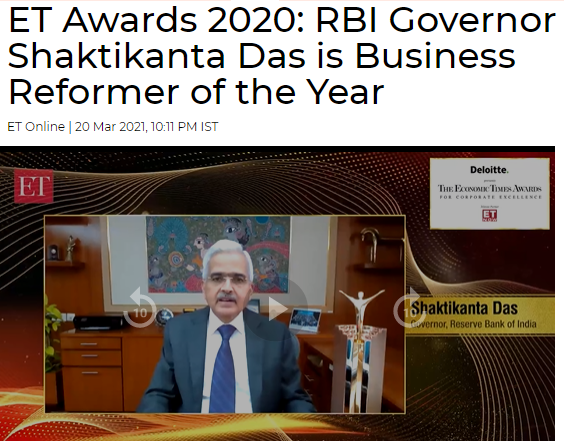

EXECUTIVE SUMMARY. Following in the footsteps of Raghuram Rajan, who during his tenure as Reserve Bank of India (RBI) governor accepted the fifth Deutsche Bank award in 2013 for financial economics, Shaktikanta Das, the present RBI governor accepted the Economic Times 2020 award for ‘Business Reformer of the Year’. That the head of India’s central bank, the regulator of the financial sector, accepts awards from entities which he regulates, or which are in the private sector, does little for the credibility of the RBI as an institution.

The issue is one of principle. There is a reason why regulators and judges maintain a healthy distance from the entities they regulate or whose matters they adjudicate. It is necessary to maintain the dignity of the office they hold. In a world where cronyism is rampant, the closeness reflected in accepting awards from private sector entities, conveys a message harmful to the institution, even when it may not reflect an immediate quid pro quo or a favour to be returned at some subsequent date. It is surprising that these organisations have not laid down internal policies disallowing their officials from accepting such awards, leaving it to individual commentators to state the obvious.

Perhaps the governor should have examined the company he will be keeping when he joins the recipients of such corporate awards. As this analyst has exposed, similar awards have been granted to bank CEOs with a track record of fudging the financial accounts (a criminal offence as per the Banking Regulation Act, 1949) and undertaking high risk lending. The Economic Times (ET) Excellence awards appear to be no different. In the past ET has bestowed awards on Chanda Kochhar (2011), the now disgraced former CEO of ICICI Bank, Shikha Sharma (2009) then CEO, ICICI Prudential Life whose subsequent track record at Axis Bank resulted in the RBI refusing to renew her term as CEO, companies such as Amtek Auto (2006) and Shree Renuka Sugar (2011) which subsequently defaulted on their loans (here and here). The Economic Times award jury also bestows awards on its own members: in 2018, HDFC Bank received the ‘Company of the Year’ award while Aditya Puri, the bank CEO was on the jury (he may have recused himself when the jury was deciding the ‘company of the year’ award, but never the less it was highly unusual).

RBI’s credibility was further diminished by the governor’s cringeworthy acceptance speech,

“I would like to thank Economic Times and the members of the jury for selecting me for this award for the reformer of the year. It’s indeed an honour, a privilege….”

Awards organised by the media are public relations exercises, where corporate chieftains preen themselves in front of cameras. That Shaktikanta Das, as governor of the RBI willingly participates in this circus reveals the depths to which India’s central bank has plummeted.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in some of the banks/companies mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.