Mumbai: It is the season of resignations for the independent directors of India Inc’s corporate boards.

The recent stormy exit of R. Chandrashekhar from the board of Yes Bank caught the media’s attention, after which the private sector lender had to issue an apology to the stock exchanges and retract its earlier statement that his resignation was...

India’s private sector banks were held up for years as the standard of efficency and corporate governance to which public sector banks should aspire. But now it emerges that private bank after private bank has in fact been harbouring bad debts, fudged accounts, corrupt deals, gross mismanagement, overly paid CEOs and...

February 23, 2018 by rupeindia

— Hemindra Hazari writes:

The Punjab National Bank (PNB) Nirav Modi scam has led to a clamour from certain quarters for the privatization of India’s Government banks. It was only to be expected that Assocham , the corporate sector body, saw in this development a chance to ask for...

The fact that the RBI supported the administrator’s actions in the court case indicates that, in all likelihood, it had orally instructed him to proceed.

On January 20, 2023, the Bombay high court dealt a body blow to Yes Bank. It set aside the decision of the then Administrator (and...

For the last 5 years, the capital market in contrast to the Bank Nifty has been signalling a major concern with Kotak Mahindra Bank (KMB), with a stagnant share price and a secular de-rating of the bank’s price-to-book value multiple. But it is only now that sell-side analysts and...

Hemindra Hazari BANKING BUSINESS ECONOMY 12/APR/2017

Uday Kotak’s much hyped press conference on March 29 promised a bang. But all we got was a whimper. Kotak’s announcement was a new digital-based saving account, christened “811”, no doubt in honour of the Modi government’s demonetisation move, which was announced on November...

Hemindra Hazari

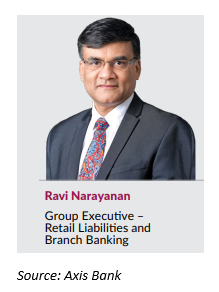

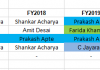

Axis Bank is one of the favoured stars among the new private sector banks in India, with an enviable reputation. The Banker gave it the Bank of the Year award in 2014; Brand Equity termed it the “Most Trusted Private Sector Bank” two years in a row (2013, 2014); Asiamoney called it the “Best...

Hemindra Hazari

ICICI Bank, India’s largest private sector bank by assets, posted shocking results for the quarter ended March 31, 2016. The consensus analyst forecast for the bank’s net profit was Rs. 3,100 crores; the bank reported a paltry Rs. 702 crores. This was an annual decline of 76% (compared to Rs....

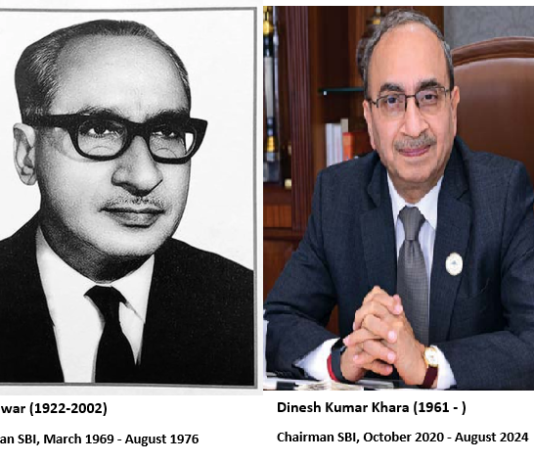

The State Bank of India (SBI) is India’s largest bank by assets and the government’s most prestigious bank. Formerly the Imperial Bank of India under British rule, the SBI long remained something of an empire, its chairmen exalted figures ruling over an army of 235,858 employees. Unfortunately, the SBI...

The bank’s promoter-cum-CEO and its board of directors have not understood the letter and spirit of an important banking rule, but have instead sought to take it as a starting point for negotiation.

Uday Kotak. Credit: Reuters

Hemindra HazariBANKING17/AUG/2018

In an indictment of Kotak Mahindra Bank (KMB) and its promoter-CEO, Uday Kotak,...