Hemindra Hazari

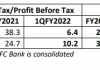

ICICI Bank, India’s largest private sector bank by assets, posted shocking results for the quarter ended March 31, 2016. The consensus analyst forecast for the bank’s net profit was Rs. 3,100 crores; the bank reported a paltry Rs. 702 crores. This was an annual decline of 76% (compared to Rs. 2,922 crores in 4QFY2015) and a quarterly decline of 77% (Rs3,018 crores in 3QFY2016).

The main culprit for this precipitous fall was the “exceptional item” and “over and above” provisions made for non-performing and restructured loans as per Reserve Bank of India guidelines” of Rs. 3,600 crores. The management’s commentary indicated that this supposedly exceptional item was a prudent measure fulfilling the RBI’s “early and conservative recognition of stress and provisioning.”

In fact, the results were far worse than the reported numbers suggest.

Overall profits were inflated by including exceptional items – Rs. 2,131 crores of profits on sale of part of ICICI Bank’s shareholding in ICICI Prudential Life Insurance and ICICI Lombard General Insurance, and a deferred tax asset of Rs. 2,200 crores. These items in effect considerably negated the impact of the special provision of Rs. 3,600 crores. Excluding these two items, ICICI Bank has posted a huge loss for the quarter. The stock market penalised the bank, and the stock closed at Rs. 215 on May 5, a decline from Rs. 240 on April 28. With that, ICICI Bank lost its position as the second largest private sector bank by market capitalisation to Kotak Mahindra Bank.

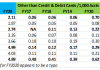

ICICI Bank also finally reported that it had Rs. 44,000 crores “below investment grade” in power, iron and steel, mining, cement and rigs sectors. This was in addition to its net non-performing loans of Rs. 12,963 crores and net restructured standard loans of Rs. 8,573 crores. The bank expects its future non-performing loans to emerge from the category of below investment grade.

Negative reaction from stock market

The stock market reacted negatively to these numbers as all along the expectation had been that the new (set up post-1991) private sector banks’ asset quality, credit monitoring and appraisal management was superior to that of the government banks. The latter had started reporting losses in 3QFY2016, and hence most sell-side analysts were positive on private sector banks and negative on government banks.

The under-performance of ICICI Bank vis-à-vis the broader market since it posted its dismal results, indicates that the market does not believe the bank is being overly conservative in identifying future problems. Rather, the market feels that the skeletons of the past are tumbling out and problems will persist in the future. However, equity analysts who cover the stock, and who have consistently under-estimated the asset quality issue in the bank, continued to give a “buy” recommendation even as they slashed future profit projections by 8-25%.

These analysts’ continuing faith (“risk seems to be priced in”) in new private banks, despite everything, is because financials (banks, housing finance companies and non-bank finance companies) have high weightages in stock indices. For example, in the Sensex, financials account for around 28-30%. So institutional investors cannot be significantly underweight on financials; and since government banks are reporting poor results, they have to be overweight the new private sector banks. The latter have so far have been defying the broader economic slowdown by reporting growth in profits.

Not many in the analyst community question how these banks continue to report strong profits and low non-performing loans when there has been a long stagnation in the index of industrial production, anaemic sales growth by the large companies, collapse in corporate capital expenditure, faltering imports, fall in exports and a huge build-up of poor quality loans by the government banks. As long as private sector banks report profit increases, or any signs of faltering can be explained as a one-off, analysts are content in maintaining their optimistic outlook for this special breed of banks.

ICICI Bank, in its press release attributed the decline in profits to the “weak global environment, the sharp downturn in the commodity cycle and the gradual nature of the domestic economic recovery,” and stated that senior management will forego their performance bonus for FY2016.

In foreign banks, when significant problems arise, the senior management is replaced as it is unlikely that the management, which created the problem will reveal the true extent of the loss; secondly there will be a lack of confidence among investors whether the same management can address the issue. In India, the government banks periodically reveal the problem as the tenure of the CEOs tend to be short but in the new private banks, the tenure is lengthy (for example, Chanda Kochhar has been the ICICI Bank CEO since May 2009) and hence the problems may not emerge for a long period of time. Hence not giving performance bonus for FY2016 is a mere rap on the knuckles for the senior management of ICICI Bank considering the remuneration they enjoyed while taking on excessive risk for the bank.

No questions asked

No questions are asked and no one is held to task on why the bank under the same management took on such huge exposures to leveraged business groups like Essar and Jaypee and aggressively financed high risk infrastructure projects. Media reports in November 2015 highlighted that ICICI Bank, Axis Bank and Standard Chartered Bank had lent US$3.5 billion to Essar Global, the London-based unlisted holding company of the Essar group. All such large credit sanctions and disbursements in ICICI Bank had to have been endorsed by the CEO, Head of Credit and Head of Risk Management apart from being cleared by the Board of Directors.

The executive directors at ICICI Bank, including the CEO earn annual remuneration in excess of Rs. 5 crores each apart from stock options. Indeed, in the last 5 years, the remuneration of Chanda Kochhar, ICICI Bank CEO and its executive management kept increasing with a significant performance bonus in each year, when presumably the bank was taking on these high-risk exposures. When the bank reports increase in profits, it is attributed to their managerial skills, but when significantly lower profits are declared, the external environment is held responsible.

| Remuneration | |||||

| Source: ICICI Bank Annual Reports | |||||

| Chanda Kochhar | |||||

| Rs | FY2011 | FY2012 | FY2013 | FY2014 | FY2015 |

| Basic | 11,520,000 | 13,260,000 | 15,249,000 | 17,536,440 | 20,166,960 |

| Performance Bonus | 8,286,336 | 12,996,000 | 17,989,541 | 15,516,081 | 16,655,570 |

| Allowances & Perquisites | 8,000,493 | 11,510,057 | 14,882,587 | 15,664,964 | 17,631,924 |

| Contribution to Provident Fund | 1,382,400 | 1,591,200 | 1,829,880 | 2,104,373 | 2,420,036 |

| Contribution to Superannuation Fund | 1,728,000 | 1,989,000 | – | – | – |

| Contribution to Gratuity Fund | 959,616 | 1,104,558 | 1,270,242 | 1,460,785 | 1,679,908 |

| Total | 31,876,845 | 42,450,815 | 51,221,250 | 52,282,643 | 58,554,398 |

| Increase (%) | 33.2 | 20.7 | 2.1 | 12.0 | |

| Stock Options (nos.) | 210,000 | 210,000 | 1,250,000 | 1,450,000 | 1,450,000 |

By contrast, when Standard Chartered Bank’s India operations similarly took on exposures to stressed business, and as a result reported a loss of US$981 million in 2015, not only were the senior management of its Indian operations removed, the global CEO was also sacked. In contrast, ICICI Bank’s board of directors appears to be being unduly charitable to the executive management and withholding the annual bonus is deemed to be the only punishment.

ICICI Bank’s Rs. 44,000 crores of risk assets may not be the end of their asset quality problems. Although they maintain that it includes their small and medium enterprise (SME) exposure, that may not be the whole story. There are huge problems in this sector and extending further loans to defaulting SMEs and not classifying them as non-performing is a rampant industry practice. This is especially for those SMEs that have limits of Rs. 100 crores and less, to which the regulator does not pay close attention. Two years of consecutive drought and lack of water for even drinking will result in a huge surge in agricultural and rural non-performing loans, and even the much fancied retail (mainly urban) loans of banks may start getting impacted.

The market is belatedly acknowledging that there may not be much difference between ICICI Bank and the government banks. While other new private banks still report growth in net profits or a marginal decline in earnings, a similar fate awaits them, as there is unlikely to be a significant difference between the corporate portfolio of the government banks and the new private sector banks.