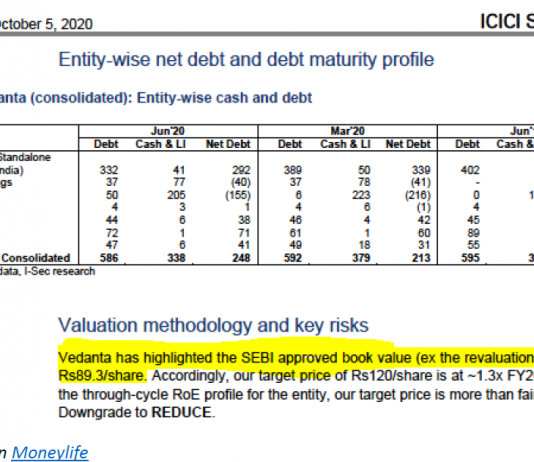

EXECUTIVE SUMMARY. On the opening date of Vedanta’s delisting offer (October 5, 2020), ICICI Securities (I-Sec) issued a results research note on Vedanta with...

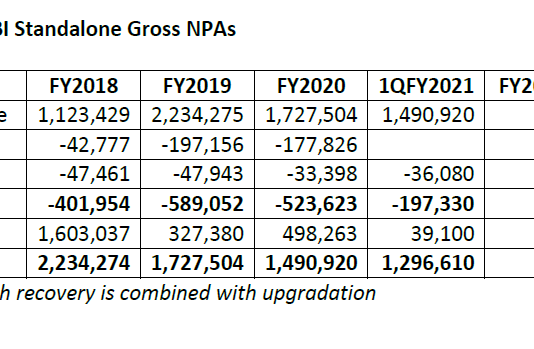

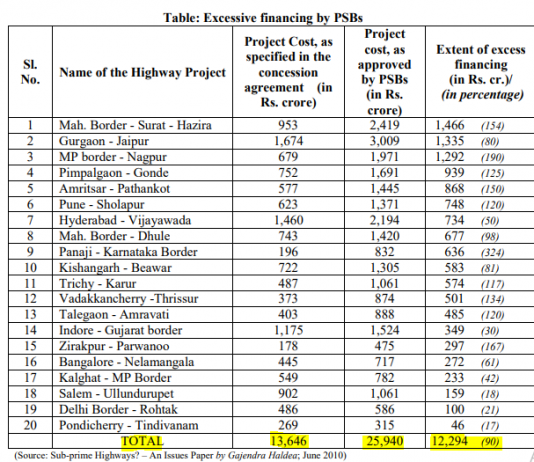

EXECUTIVE SUMMARY. Media commentators analysing the tenure (October 7, 2017 to October 6, 2020) of Rajnish Kumar as chairman of the State Bank of...

In the corporate sector it is extremely rare to find a whistleblower who consistently puts out internal information on malpractices and confidential internal communication,...

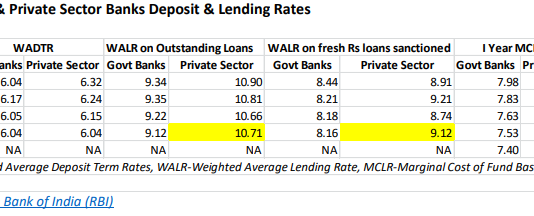

EXECUTIVE SUMMARY. Data from the Reserve Bank of India (RBI) reveal that, in the recent period of declining interest rates, while all banks have...

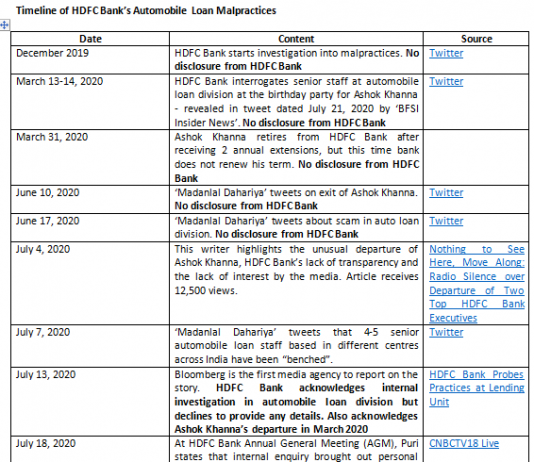

EXECUTIVE SUMMARY. US law firms, Rosen Legal, Pomerantz and Schall have filed class action suits (here, here and here) against HDFC Bank. The grounds...

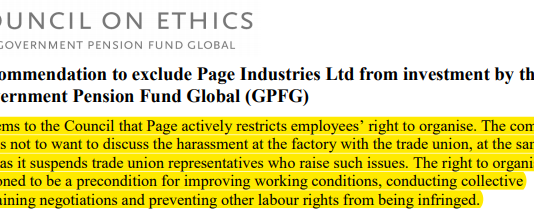

EXECUTIVE SUMMARY. The Council of Ethics of the Government Pension Fund Global (GPFG), the Norwegian sovereign fund, recommended on February 19, 2020 that Page...

EXECUTIVE SUMMARY. The near-absence of a government stimulus to revive the Indian economy from the Covid-19 meltdown portends a severe and prolonged economic slowdown....

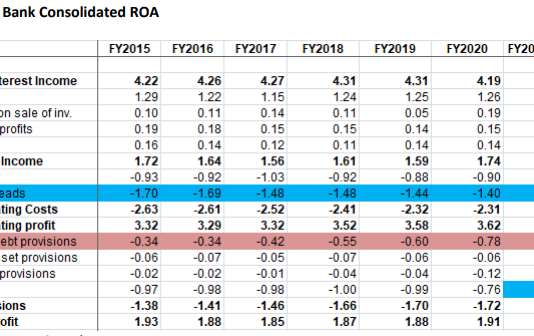

EXECUTIVE SUMMARY. A 6-year profitability analysis of HDFC Bank, India’s most valuable bank, reveals that it has been able to maintain it ROA despite...

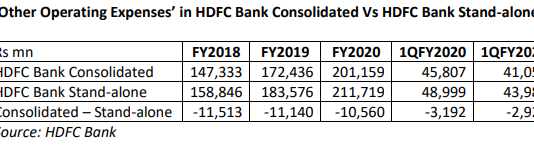

EXECUTIVE SUMMARY. In comparing a company’s stand-alone expenses with its consolidated accounts, it is highly unusual for the consolidated numbers to be lower than...

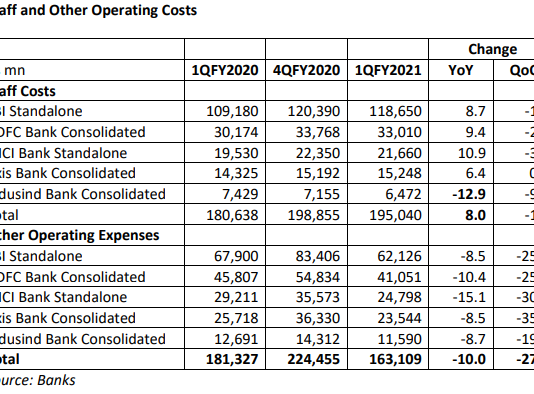

EXECUTIVE SUMMARY. The Covid-19 outbreak and the resulting lockdown have caused widespread economic devastation, particularly in urban and commercially developed centres. Taking into account...