“Groups that are perceived as politically connected can still tap the banks for loans,” says Hemindra Hazari, a Mumbai-based banking analyst. “If you are any other highly stressed group, then it is difficult for you.”

3 min read. Updated: 29 Oct 2020, 09:39 AM IST Tauseef Shahidi , Nikita Kwatra

Indian CEOs are increasingly likely to ‘resign’ rather than retire, a Mint analysis...

9 min read. Updated: 22 Oct 2020, 08:48 PM IST Shayan Ghosh

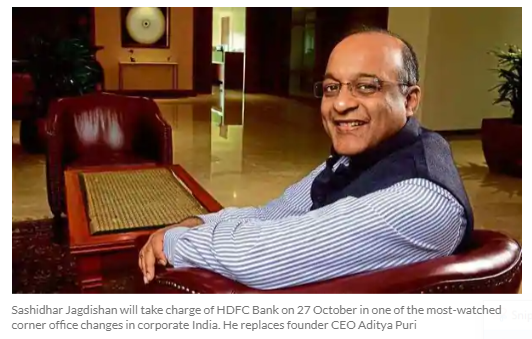

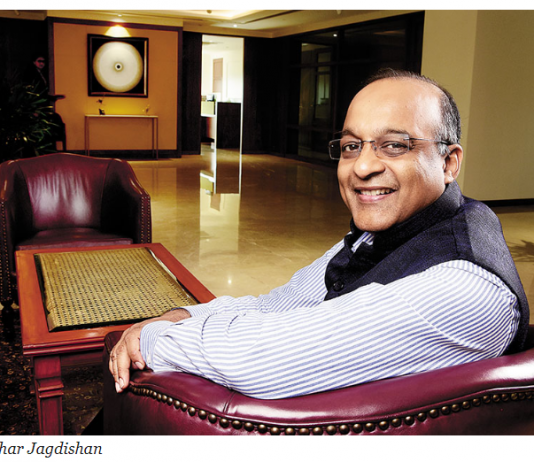

Incoming CEO Sashidhar Jagdishan inherits a bank in fine fettle. Where will he take...

13 Sep, 2020Zia Khan Gaurav Raghuvanshi Mohammad Abbas Taqi

Banking

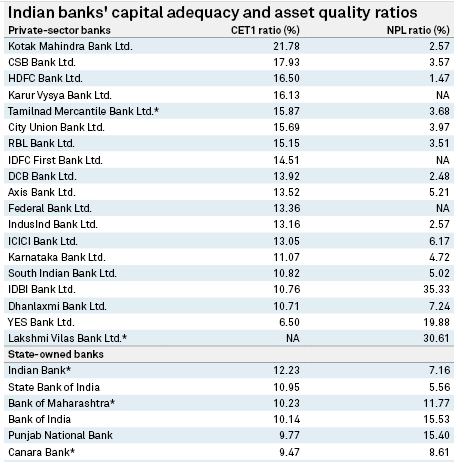

India's state-owned banks have lagged behind their private-sector peers in tapping equity capital markets so far...

Sashidhar Jagdishan inherits a proven entity from predecessor Aditya Puri. However, the 'bank insider' will have to rebuild trust among business leaders and devise...

2 min read. Updated: 04 Aug 2020, 10:52 PM IST Shayan Ghosh

It remains to be seen how Jagdishan steers HDFC Bank's Massive loan book of...

The RBI wants to see improved governance from private banks through proposed rules that limit the roles and tenures of CEOs. But will they...