AuthorRanina Sanglap Gaurav RaghuvanshiThemeBanking

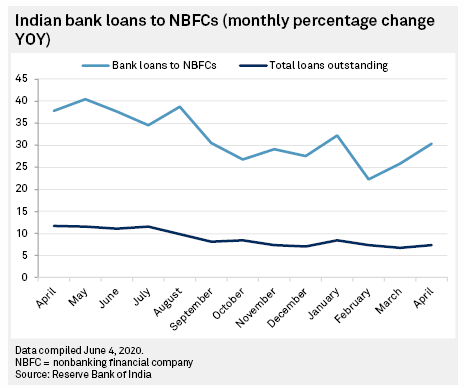

Many Indian nonbanking financial companies may remain short of funds as investors become more cautious and the economy contracts, adding risks...

The Yes Bank turmoil came with a one-off solution, but newer banks will not be spared from the infectious effect. And Covid-19 will only...

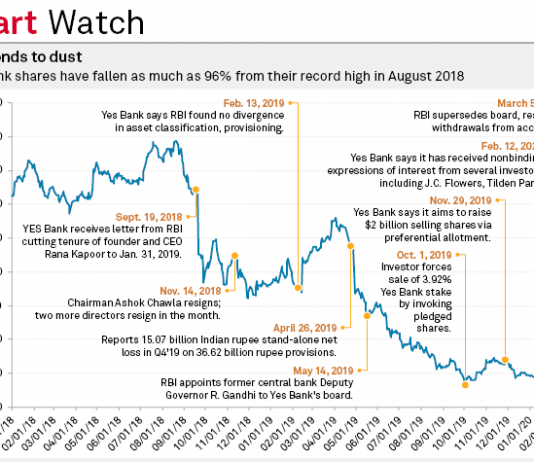

“Once a bank is put under a moratorium, its deposit franchise is irrevocably eroded, as banking is all about trust,” Hazari wrote.

Kumar told media that investment in Yes Bank will not hurt SBI's balance sheet. The focus now shifts to Yes Bank earnings, scheduled for...

AUNINDYO CHAKRAVARTY 20H 14M AGO OPINION5 min read 4.7k ENGAGEMENT

By the time Narenda Modi became Prime Minister of India, it was common knowledge that he...

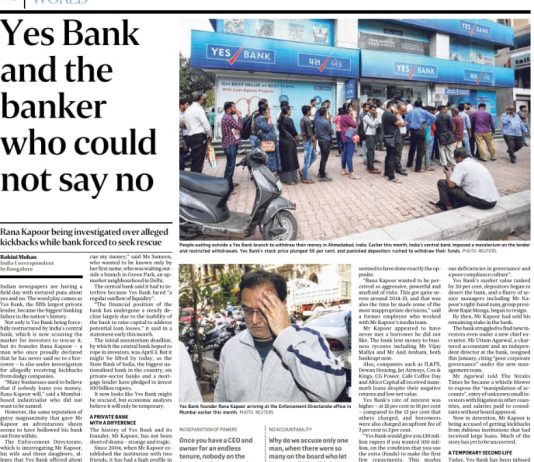

Worried customers have been queuing to withdraw money from India's Yes Bank after the country's central bank seized control of the troubled lender.

The Reserve...

Source : SIFY Author : Finance Desk Last Updated: Tue, Feb 18th, 2020, 15:27:53 hrs

India's most trusted, rich, and successful banker - Uday Kotak is...

THE NEWS SCROLL 17 FEBRUARY 2020 Last Updated at 8:56 PM | SOURCE: IANS

''RBI relaxation led to Uday Kotak gaining over Rs 23,000 cr''

New Delhi,...