BY SALIL PANCHAL, Forbes India Staff 6 min read PUBLISHED: Dec 27, 2021 11:16:26 AM IST UPDATED: Dec 27, 2021 11:55:49 AM IST

With the sudden exit of its veteran chief executive and no clarity on RBI's stern intervention, the bank's new business strategy is unclear, say analysts

“RBL has been unable to provide clarity...

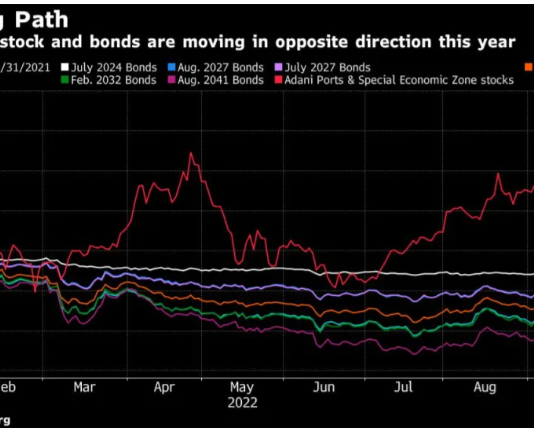

Divya Patil and Anto AntonyThu, September 22, 2022 at 4:30 AM·4 min read

World’s Second-Biggest Fortune Fails to Halt Rout in Adani Bonds

(Bloomberg) -- Surging share prices of Gautam Adani’s companies have helped make him the world’s second-richest person. The bond market isn’t quite as enthusiastic.

Stocks of firms in his...

Chloe Cornish

Entire article can be read here

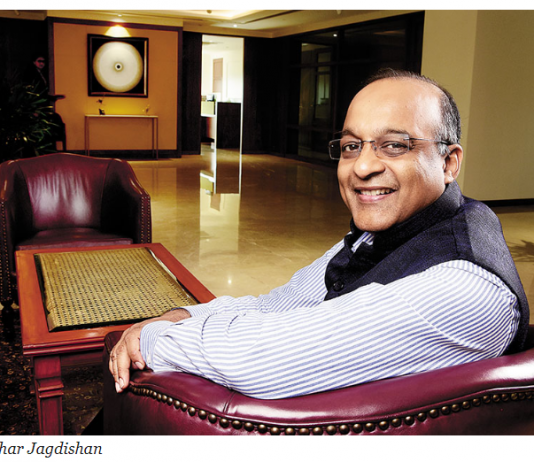

Sashidhar Jagdishan inherits a proven entity from predecessor Aditya Puri. However, the 'bank insider' will have to rebuild trust among business leaders and devise his own strategy when NPAs rise

BY SALIL PANCHAL, Forbes India Staff 5 min readPUBLISHED: Aug 10, 2020 05:04:27 PM IST

Sashidhar Jagdishan, HDFC Bank’s new managing director and...

Grappling with bad loans, weak loan growth and leadership uncertainty, its valuation is under pressure

Prathamesh Mulye

Getty images

It’s now an accepted fact that Indian banks leave too much to be desired in terms of maintaining clean books. One of the most high-profile bankers fell from grace due to his willingness...

BY CHARLIE CAMPBELL / SINGAPORE

JANUARY 30, 2023 6:00 AM EST

Article can be read here

Shares of Zomato, Paytm parent One 97 Communications Ltd and Nykaa owner FSN E-Commerce Venture have fallen to their lowest levels since listing.

MarketEdited by Prashun TalukdarUpdated: January 24, 2022 1:30 pm IST

New Delhi: Shares of Zomato, Paytm parent One 97 Communications Ltd and Nykaa owner FSN E-Commerce Venture have fallen...