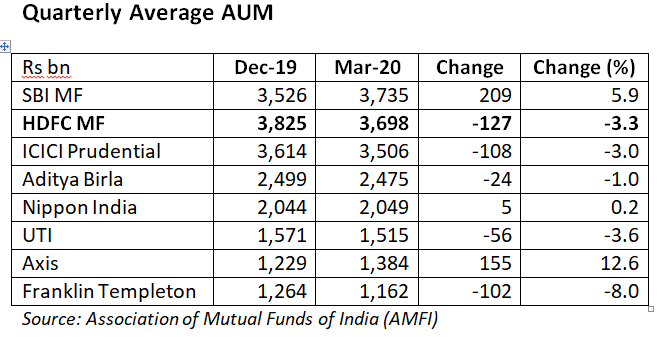

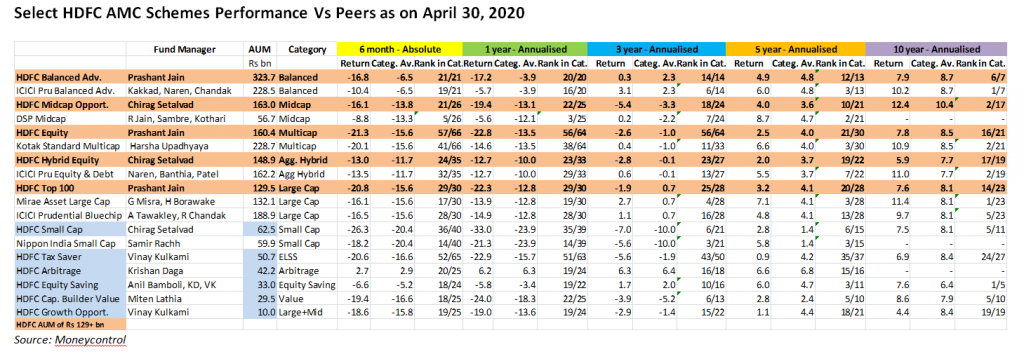

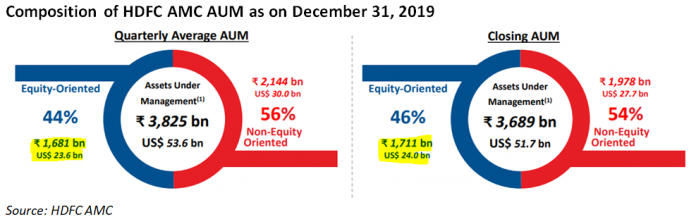

EXECUTIVE SUMMARY. In the quarter ended March 31, 2020 HDFC AMC was dethroned as the market leader by SBI Mutual Fund, based on quarterly average assets under management (AUM). But worse may be in store in its lucrative actively managed equity-oriented AUM, as its large equity schemes are reporting abysmal performance across the time spectrum, and rank near the bottom of their respective categories (with the exception of one scheme). So far the dismal track record in its equity schemes appears to have not adversely impacted its share price, as the HDFC brand, backed by public relations muscle and the strong sales team of the AMC, have protected its equity AUM. But if the AMC does not improve the performance of its equity AUM, investors may flee to better performing competitors, and the AMC’s minority shareholders may also abandon the ship.

The aura of HDFC has to date insulated the AMC, but a year ago this analyst had exposed its poor credit appraisal and risk management policies in its debt schemes when it invested in securities of the Zee founder companies. And while its under par performance in its actively traded equity schemes has persisted for some time, which is visible in the daily performance data disclosed by the industry, the business media and the sell-side are reluctant to highlight the same for reasons of corporate access, advertising and because the AMC is a high-value client for the sell-side. However, the valuation of the AMC depends on the cream churned by actively managing equity AUM, and if its poor performance continues unchecked, it is doubtful its minority shareholders will tolerate sour milk in place of cream.

Indian retail equity and mutual fund investor has been very resilient … Last 3-4 years, the economy and markets have had numerous shocks – demon, steep mkt correction of 2018 after LTCG and GST implementation, significantly slower GDP growth and now the global sell off. They have been very patient and persistent with consistent inflows through SIP… IF for any reason, the 30% sell off in March 2020 breaks the inflow, are these valuations really sustainable?

As of last week March:

Aberdeen Standard Life (promoter shareholder of HDFC AMC) Mkt cap : Rs 45kcrs

HDFC AMC mkt Cap : Rs 43kcrs

Standard Life AMC AUM : Rs 21 tn

Standard Life Total AUM : Rs 45 tn

HDFC AMC AUM : Rs 3.7 tn

*Standard life mkt cap / AMC AUM : 2%

HDFC AMC mkt cap / AUM : 12%*

Do people believe that India AUMs only go up? Indian retail investors are the most patient who will NEVER redeem their mutual fund silvers?

This stock is ripe for a fall not only because of its valuation but also because of the poo performance that you have highlighted.