Reliance Naval Engineering (RNE) will in all likelihood be classified as non-performing by all the concerned banks in the consortium for the quarter ended March 31, 2018. Long facing difficulty meeting its financial obligations, the company finally fell short in the December quarter. In the March quarter, banks in the consortium were unable to agree on a restructuring proposal and the account became 90 days’ overdue; a press release by the company may compel the majority of banks to classify the account as non-performing.

Although the major hit from RNE will be borne by State Bank of India and IDBI Bank, HDFC, the evergreen darling of foreign investors, known for its pristine asset quality, has an exposure of Rs 1.75 bn. on the company. Interestingly, till the December quarter, in the banking industry RNE was classified as a non-restructured standard asset, and was not included in any of the restructuring mechanisms/disclosures introduced by the regulator; hence it sailed below the radar of most analysts.

Although the exposure is marginal to HDFC, given the size of its loans and capital, it highlights once again the neglected research subject of HDFC’s corporate exposure: in 1QFY2018, HDFC took a hit on its exposure to Essar Steel, and now we are aware of its exposure to a cash-stricken company belonging to a troubled business group. It remains to be seen whether HDFC, like most banks, will classify the account as non-performing when it declares its 4QFY2018 results, and if it does not, it needs to explain to the market why such an account is classified as standard in a company respected for its conservatism and asset quality. In a span of one year, two cockroaches have crawled out, and the market should ask itself whether there are any more in the nooks and crannies of this august home.

The Indian banking industry has a large exposure of around Rs 90 – 100 bn on RNE (formerly, Reliance Defence and Engineering Limited/Pipavav Defence and Offshore Engineering Company). An Economic Times article dated September 15, 2017 quoted two unnamed bankers as stating,

“Reliance Naval is classified as special mention account-2 or SMA-2 [not received dues for over 60 days but less than 90 days] with all banks. Somehow, in the past few months, the company has managed to make critical payment before the end of the 90-day deadline to prevent the account from slipping into the bad loan basket,”

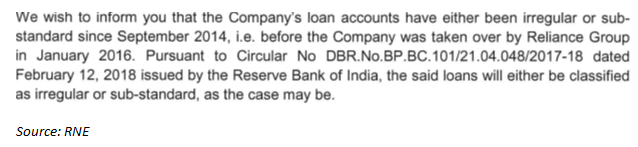

Since then, according to bankers this writer interacted with, RNE was unable to service its interest for the December 2017 quarter and it was negotiating a restructuring with banks which did not materialise. Consequently, on March 1, 2018, RNE issued a disclosure to the stock exchanges which stated,

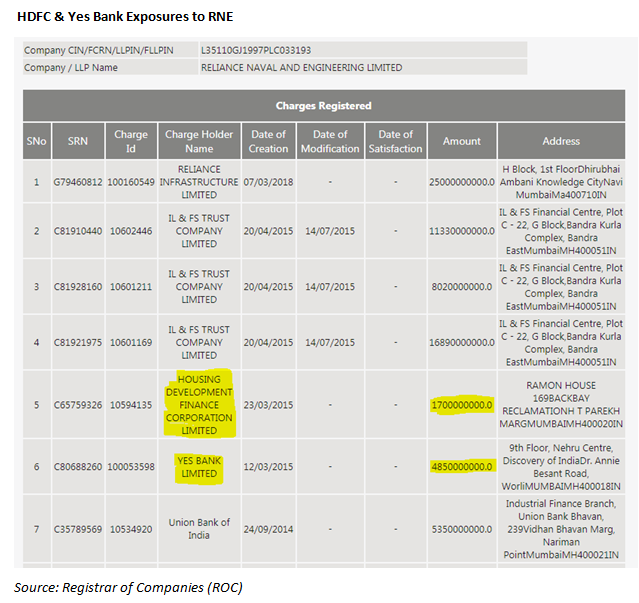

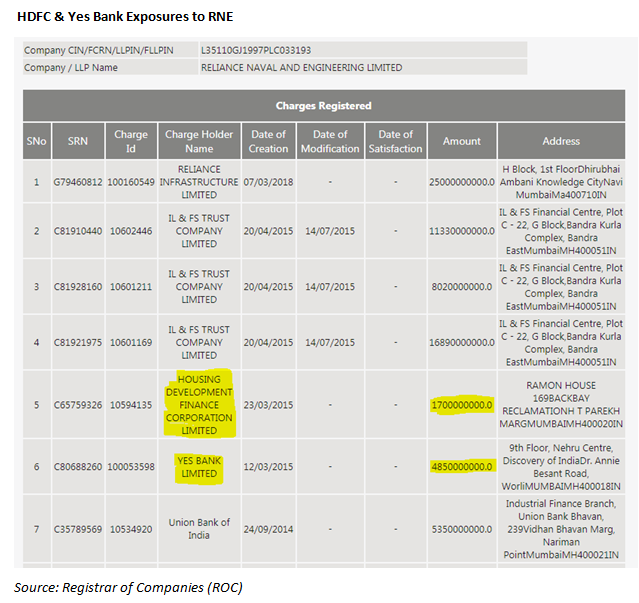

Some of the banks this analyst interacted confirmed that RNE has been classified as NPA by them for the quarter ended March 31, 2018 as a result of the RBI notification. The company has now 180 days for the creditors to accept the resolution plan, failing which the company will be admitted to the National Company Law Tribunal (NCLT). Government banks like State Bank of India (SBI) and IDBI have the largest exposures on RNE, and, interestingly, according to the Registrar of Companies (ROC), Yes Bank and HDFC also have exposures on the company.

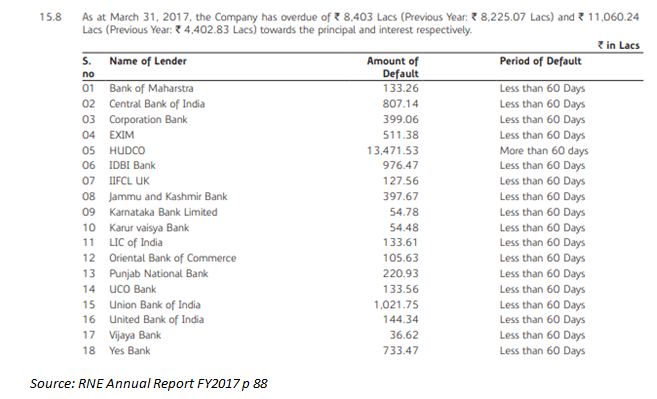

As per the ROC filing, HDFC since March 23, 2015 has an exposure of Rs 1.7 bn. on RNE, and there has been no change in the modification of charge since that date. In RNE’s FY2017 annual report, the auditors highlighted that the company had overdues in repayment of interest and principal aggregating to Rs 1.95 bn.

Loan Payments in Arrears by RNE as on March 31, 2017

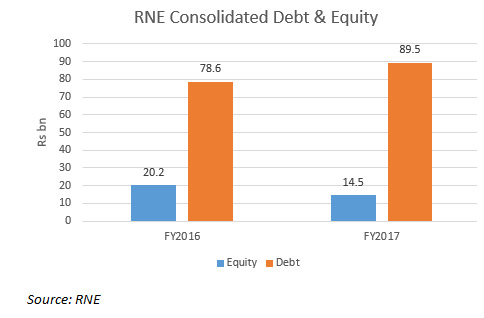

The debt for RNE has been mounting since FY2016. In FY2017 the consolidated debt was Rs 89.5 bn as compared to Rs 78.6 bn in FY2016, and its debt to equity is clearly unsustainable.

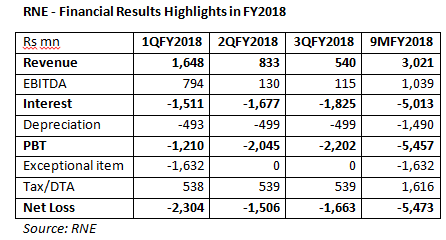

The financial results of RNE in FY2018 have only got worse. Revenue has plummeted, interest costs have not only soared but are significantly higher than revenue, and losses are mounting.

What is even more interesting is that in early to mid-March 2018, i.e. after RNE had informed stock exchanges that it was going to be classified as irregular and/or non-performing by banks, HDFC was not sounding any alarm bells on its exposure to RNE, and sell-side analysts after interacting with HDFC were releasing a positive commentary on the company’s corporate exposure.

A research note by Deutsche on HDFC, rated a ‘Buy’, dated March 22, 2018 titled, “Management meeting takeaways: exuding confidence,” specifically stated,

“asset quality stress on the wholesale book should now ease… Stress in wholesale book should ease; retail stress to rise marginally. The worst of corporate stress seems to be behind us, with the chunky Essar exposure also likely to see favourable resolution under NCLT (likely in 1QFY19).”

A Credit Suisse note dated March 20, 2018 rated, ‘Outperform’ and titled, “Notes from the AIC: Growth outlook remains strong,” said,

“We hosted HDFC Ltd.’s management at Credit Suisse’s Annual Investor Conference 2018. They remain positive on growth prospects,…”

Nowhere in these notes is any reference made of any worrying corporate exposure that investors should be concerned about. The absence of such a caution is because HDFC apparently did not specifically highlight it.

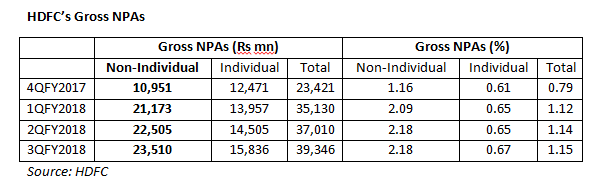

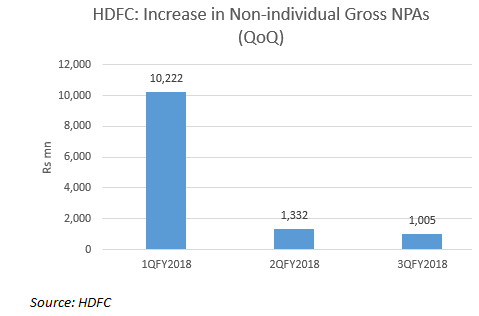

Sell-side banking analysts though have been concerned regarding corporate NPAs in banks, as an RBI circular dated February 12, 2018 compelled the banking industry to classify those accounts as NPA which were under various corporate restructuring mechanisms, and hence the industry was expected to be badly hit with a surge in corporate NPAs. Although HDFC is not a bank, and is subject to separate but related rules, it has corporate exposure on its books, and indeed its corporate exposure has higher NPAs in percentage as well as in absolute amount in FY2018.

The relevance of HDFC’s RNE exposure of Rs 1.7 bn is that it is higher than the total incremental non-individual (essentially corporate) NPAs in 2QFY2018 and in 3QFY2018. Hence in the opinion of this writer, HDFC should have forewarned analysts that it had an exposure (without necessarily naming the company) which was weak and may slip into NPA.

Post the listing of its subsidiaries, HDFC has created a huge buffer of special provisions from the capital gains thereof to absorb any losses from bad loans. As of end December, 2017, it has a special provision of Rs 48.89 bn as compared with its gross NPAs of Rs 39.35 bn. Therefore incremental credit costs hitting profits and capital is not a concern. However, if HDFC classifies RNE as a standard loan when the majority of banks are expected to classify the account as NPA in 4QFY2018, it needs to provide a credible explanation of why it has done so, especially when it can easily absorb the credit cost of it becoming a NPA. In light of the faltering performance of RNE, no creditor can maintain the account as standard for long. Given HDFC’s pedigree and financial strength, it should have proactively announced its exposure soon after RNE’s public announcement and classified the account as NPA.

In the span of one year, HDFC’s corporate asset quality has come under some strain, first with Essar Steel in 1QFY2018 and now to a lesser extent with RNE. It is important for analysts to closely examine HDFC’s corporate exposures because when two cockroaches have crawled out, there may be more in the nooks and crannies of this august home.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594). I have no position in any of the securities referenced in this note. Views expressed in this note accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This note does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this note comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this note or hold any specific opinion on the securities referenced therein. This note is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.