For the last 5 years, the profitability of HDFC Bank, India’s largest bank by market capitalisation, has declined even though its critical net interest margin (NIM) has remained constant. Interestingly, to maintain its pristine margin, the bank has focused on taking on more risk in the form of unsecured retail loans. Such a strategy has inevitably led to a higher growth rate in non-performing loans.

No doubt, this problem appears to be manageable at the moment. High growth in loans has enabled the bank to keep gross NPAs in the sector below 2%. The bank also may take advantage of the current problem in the non-bank financial company (NBFC) sector by picking quality assets from these companies, and from the space vacated by the NBFCs. However, with the economy showing no sign of recovery, such a strategy for a large retail-oriented bank like HDFC Bank may not be sustainable.

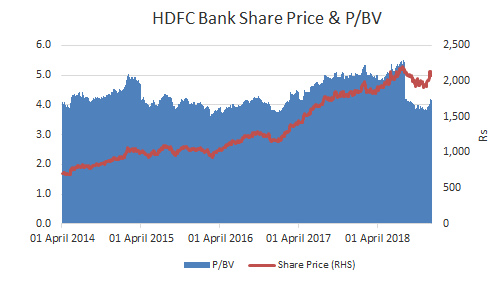

Despite the higher risk strategy and the fall in profitability, the capital market has rewarded the bank with a secular rise in the share price and an upward re-rating of its P/BV multiple. Whether its fabled risk management in future will justify the market’s faith, even as the economy continues to stagnate, remains to be seen.

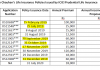

In the last 5 years declining interest rate scenario, HDFC Bank’s profitability, as measured by its ROE (Indian GAAP), has declined by 270 basis points, while its NIM has remained relatively constant at 4.7%. Interestingly, the bank’s yield on wholesale credit came under greater pressure as it probably focused on blue-chip companies. But to compensate for the low yield on wholesale it sought higher yields in retail.

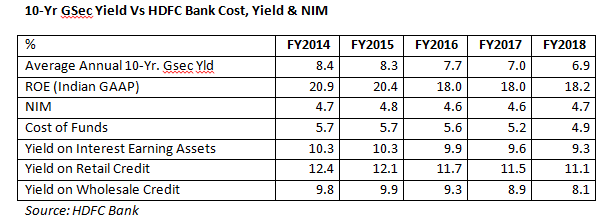

For HDFC Bank, even though the NIM remained constant, the composition of loans changed as retail loans rose. But more importantly, the bank took on higher risk: unsecured loans rose from 20.3% of gross loans in FY2014 to 26.3% of gross loans by FY2018. The bank’s unsecured loans mainly consist of retail and credit card loans.

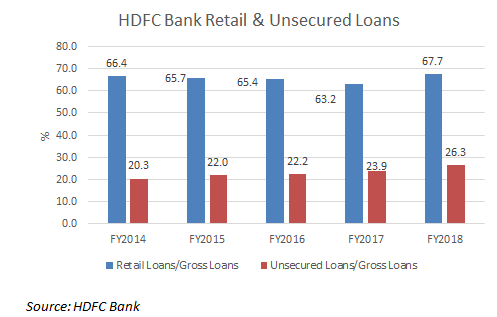

The emphasis on retail and particularly on unsecured retail loans to maintain the bank’s NIM in the last 5 years has come at the cost of asset quality. Retail NPAs surged in absolute amounts (albeit on a low base); nevertheless they remained low as a share of the total, as the bank grew overall retail loans. In the last 5 years, retail NPAs rose 3.6x (unsecured NPAs went up even higher at 6.5x), with an acceleration in the last 3 years. The significant surge in retail NPAs has not resulted in any problem for the bank till now, since the NPAs as a proportion of the overall book remain small at only 1.5% in FY2018. In unsecured loans the NPAs went up from 0.7% of gross unsecured loans in FY2014 to 1.5% by FY2018. The trend continued in 2HFY2019 with consumer loans up by 28.6% to Rs 2,288 bn and consumer loan gross NPAs up 59% to Rs 18.8 bn (0.8% of consumer loans).

Even though in absolute amounts gross NPAs have increased in retail and unsecured loans, a combination of quality selection of loans, aggressive write-offs and overall growth in the bank’s loans has kept NPAs low for HDFC Bank for the time being.

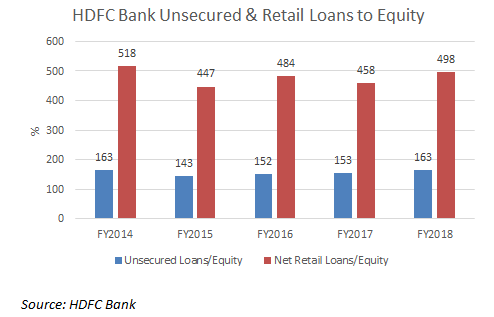

Apart from keeping its retail NPAs low as a proportion of loans, the bank also appears to have capped the exposure as a proportion of its equity. In the last 4 years, retail loans have remained at close to 500% of equity while unsecured loans have been capped at 163%. With a significant equity issue in mid FY2019, the percentage should have become even lower.

In the last 5 years, to maintain its NIM and stemming its decline in profitability, the bank appears to have implemented a strategy of targeting retail and unsecured loans. Till now the strategy appears to have worked, although Daniel Tabbush, Asian banks’ analyst on Smartkarma, has been highlighting concerns regarding HDFC Bank’s rising credit costs for some time.

Even though HDFC Bank’s profitability has declined and the risk has increased, the stock market appears not only unconcerned, but has rewarded the bank by a rerating of its P/BV multiple. In FY2015, the bank’s P/BV rose from 4.1x and reached a peak of 5x. It thereafter touched a trough of 3.5x in February 2016, and went on a secular uptrend to 5.4x in mid July 2018, just prior to its major equity issue, which significantly increased its book value. During this entire period, the bank was focusing on higher risk unsecured retail loans.

It is possible that with the current liquidity and possible solvency issues with the non-bank finance companies, HDFC Bank will use its own liquidity and capital adequacy to boost quality growth from cherry picking assets from NBFCs who are offloading their loans. It can also capture market share from the space vacated by the NBFCs. So far, HDFC Bank apparently has maintained its asset quality in a period of economic stagnancy. But in FY2018, HDFC Bank’s retail loans touched as much as 3.1% of India’s GDP. As the slowdown persists in India, the bank may find it increasingly difficult to continue with such a strategy.