By Hemindra Hazari

Even on their best days, India’s financial newspapers are watchdogs that rarely bark. For the most part, they prefer not to place large companies under the scanner, let alone try and fix accountability on influential promoters and powerful chief executive officers.

On March 20, 2019, Business Standard (BS) announced that Indusind Bank CEO Romesh Sobti had been unanimously selected as ‘Business Standard Banker of the Year for 2017-2018’ by a five-member “high profile jury”.

The newspaper was not the only media agency to select Sobti for such a distinction: in the first week of January, another pink paper, Financial Express, recognised him as “Banker of the Year for 2016-17”.

The juries in both cases consisted of individuals from the corporate world and retired banking regulators. The Business Standard jury was chaired by S.S. Mundra, former deputy governor, Reserve Bank of India. Other members were Arundhati Bhattacharya, former chairman, State Bank of India, ICRA managing director and Group CEO Naresh Takkar, IIFL Group chairman Nirmal Jain, and Ican Investment Advisors chairman Anil Singhvi.

Naresh Takkar heads ICRA, the credit rating agency that maintained an ‘AAA’ rating for Infrastructure Leasing & Financial Services (IL&FS), the private sector infrastructure developer and financier, till just prior to its default becoming public in early September 2018. (IL&FS group companies had started defaulting on their commercial paper in June 2018.)

This was despite IL&FS’s consolidated financial accounts in the public domain showing that the company had a negative net worth (adjusting for intangibles as per regulatory norms) since at least FY’ 2014 and was reporting consolidated losses since FY’2016. Negligence on the part of rating agencies like CARE and ICRA – who endorsed IL&FS as not only investment grade but ‘AAA’ – is why many banks, mutual funds and other institutions in the market are saddled with huge losses on their IL&FS exposure.

After the IL&FS default, the credibility of credit rating agencies has come under sharp scrutiny from the banking regulator and even from parliament’s standing committee on finance. But that didn’t stop the head of ICRA from being invited as a member of a jury, a mere six months after the largest default in Indian capital market and corporate history.

The inclusion of a representative from IIFL also comes at a peculiar time. IIFL Commodities, a group company, has been under investigation by the Securities and Exchange Board of India (SEBI) for some years for serious irregularities. On February 22, 2019, the capital markets regulator passed an order stating that the company was not ‘fit and proper’ as a commodity derivatives broker. IIFL has maintained that it enjoys an impeccable track record and will be appealing SEBI’s order.

Nevertheless, the fact that a regulator determined that a group company was unfit to be a broker isn’t good news. Yet the group’s founder and executive chairman ended up on the ‘high profile jury’.

Coming to the selection of Romesh Sobti as ‘banker of the year’, the turnaround in Indusind Bank and the phenomenal increase in the lender’s share price can be attributed to his leadership since taking charge in February 2008.

However, more recently, there have been two troubling incidents that have attracted little accountability.

On April 18, 2017, the Reserve Bank of India decided to publicly name and shame banks which presented an inaccurate picture of their bad loans. It released a circular directing lenders to disclose in their annual reports whenever the regulator had detected fudging of their books of accounts, called ‘divergence’.

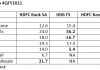

Divergence is when the regulator’s assessment of a bank’s gross non-performing assets (NPAs) is 15% higher than the bank’s audited numbers and when the net profits are found to be 15% lower than the bank’s reported net profit. Indusind Bank not only reported divergence for FY’ 2016 but also for FY’ 2017 (reported in April 2018) i.e. for two consecutive years. The RBI even fined the lender for this very reason in December 2017.

In the capital market, publishing unreliable accounts is a serious offence as market valuation and senior management compensation are based on the reported and audited financial performance of the companies. If accounts are to be found unreliable by the regulator, it casts doubt on all subsequent accounts certified by the same CEO. It is no coincidence that Shikha Sharma and Rana Kapoor, former CEOs of Axis Bank and Yes Bank, were denied another term by the regulator as both banks, like Indusind Bank, reported two consecutive years of ‘divergence’.

Credit: Reuters

What is ironic is that when former central bank official S.S. Mundra – who chaired the Business Standard jury – served as RBI deputy governor from July 31, 2014 to July 30, 2017, the department of banking supervision was under his charge. This particular department inspects banks and detects ‘divergence’. Hence, Mundra would have likely finalised the RBI’s stand on Indusind Bank’s ‘divergence’ in FY’2016. It is more than a little amusing that two years later, he decided to give the same bank’s CEO the ‘Best Banker’ award.

Then again, this practice of handing out awards to persons with less-than-perfect records is not new.

Arundhati Bhattacharya (SBI chairman, October 1, 2013 – October 6, 2017), a fellow jury member, was in-charge of SBI in FY’2017, the year in which the RBI detected that the government’s premier bank had fudged its books. Nevertheless it did not prevent both BS and FE from selecting her as the ‘Best Banker’ for FY2017 and FY2016 respectively. For two successive years, BS and FE have given ‘Best Banker’ awards to bank CEOs with a track record of unreliable accounting.

Punjab National Bank of course has trumped all others: it won two awards for “vigilance” in 2017, the same year in which the state-run lender issued nearly 300 fraudulent letters of undertaking to companies owned by diamantaire fugitive Nirav Modi.

Wheel goes round and round

Fortunately for IndusInd bank, it did not score a hat-trick, as no ‘divergence’ was detected in FY’2018. However, apart from Sobti’s history of misreported accounts, the bank undertook a high risk transaction which quickly unravelled in the quarter ended September 30, 2018 which completely exposed the credit and risk management in the bank.

On October 15, 2018, when the bank announced its quarterly results, the market became aware of an unsecured loan of Rs 2,000 crore it had provided to IL&FS sometime presumably in early FY2019 as bridge finance prior to ILFS’s equity rights issue which was unsuccessful. It appears that like the incompetent credit rating agencies, the bank’s credit and risk management either did not analyse the publicly available financials of IL&FS or, more worryingly, they analysed them without comprehending basic financial analysis.

Also read: Why the RBI-Kotak Spat Deserves Far More Attention Than It’s Getting

As a result of this ill-advised single transaction, Indusind Bank catapulted and became the fifth largest creditor of IL&FS. The IL&FS bridge loan constituted a significant 9% of the bank’s capital as on end September 2018 which in all likelihood will have to be written off, and Sobti as CEO is to be held accountable.By giving Sobti the award for FY’2018, the BS has perhaps acknowledged that he should be rewarded for not having divergence nor having any major credit risk in that year as compared with the past. On similar lines, if the business media had awarded Romesh Sobti with the “Best Banker’ award prior to FY’2016 it would have been understandable, as the bank’s performance seemed commendable.

These events unfolded and became public after FY’2016. But once having being made public, two consecutive years of mis-reported accounts and a high risk transaction putting 9% of the bank’s capital at risk are issues which should have resulted in strictures on a CEO.

Instead, two prominent business media agencies in their wisdom decided to reward such a performance with an exemplary award.

Hemindra Hazari is an independent market analyst.

Sir, Hats off to you for your incisive & more importantly fearless analysis on banking in India since last several years.Every word from you on banks is coming out prophetic in this bad market times & may be unbelievable but we tend to read & re-read the same.