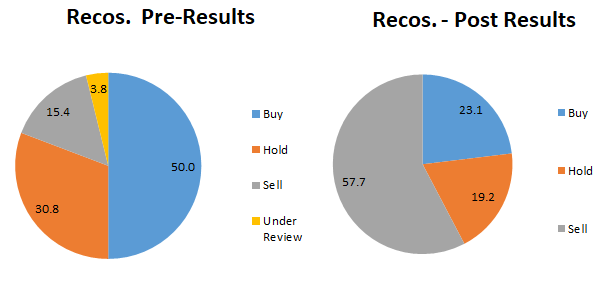

EXECUTIVE SUMMARY. After the announcement of Yes Bank’s fourth quarter results, the stock fell an astounding 29% in a single day, vaporising US$ 2.3 bn of market capitalisation. The bulk of sell-side research, those sentinels protecting shareholder wealth, supposed watchers on the wall, were bullish on the bank prior to the results. Once the bank itself released its results, these same pundits did a volte-face and turned their bubbling optimism into bleak pessimism. In their earlier published research, the sell-side, with a few exceptions, had deliberately chosen to ignore the many early warning signals. Instead they parroted the bank’s management commentary that all was well. It was only when the new CEO publicly and candidly revealed the obvious, that the bullish sell-side scurried to downgrade the bank.

The Yes Bank event, resulting in a huge loss to shareholders, has not only exposed the rot in the bank’s innards, but also exposed the sell-side research’s business model, which, for its viability, depends on corporate access and, inevitably, uncritical analysis of companies under coverage. Alas, despite the Yes Bank debacle, analysts are unlikely to discard the rose tinted lens through which they fondly peer at companies. There is a lack of accountability when bullish calls go horribly wrong. In an environment which encourages reverence towards prominent companies under coverage and a culture of corporate public relations instead of critical research, investors are abandoned to their own devices.

So true. I hold these analysts to be immature and doubt their ability to analyse the financials with due diligence, well some of them may just be paddlers of good news at the behest of the corporates they cover.