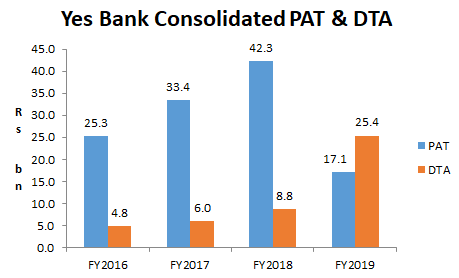

EXECUTIVE SUMMARY. Yes Bank’s loss in 4QFY19 would have been much higher, by Rs 16.6 bn, and its annual profit significantly lower, had it not been for the increase in the net deferred tax asset (DTA) of the same amount. The huge increase in the DTA partly offset the large provision the bank made for standard and non-performing assets. Although such accounting is permissible under regulatory norms, it inflates current profits, and depresses future profits. In the opinion of this writer, it is not a prudent practice. The management probably were of the view that reporting a larger loss than what they reported in the 4QFY19 would unnerve shareholders and depositors; as it is the stock market immediately reacted to the results with a 29% fall in the share price. The bank, though, has merely deferred the negative impact, and shareholders should be enlightened about the accounting treatment. The saving grace is that the new CEO is cleaning up the bank and its bad assets will become more transparent than in the past.

Recent Posts

Most Popular

IndusInd Bank Board Protects Senior Executives Responsible for Fraud

One of the most shocking episodes in the history of Indian banking was revealed by The Wire.in in a recent exclusive: namely, that the...

Tata’s Outside CEO Battles Multiple Crisis After Bad Year

“For the future growth of the Tata group, Chandra has to find new businesses which can replace TCS’s cash generation which at this time...

Not a Private Matter: Did Axis Bank Share Price Sensitive Information to a Select...

An ordinary meeting of Axis Bank on December 15, 2025 with institutional investors had an extraordinary outcome, one which may need to be probed...

Does the IndusInd Board Run the Bank? Or Is There a Centre of Power...

Ashok Hinduja, chairman, IndusInd International Holding, told the press recently:

"Could you have as a promoter taken steps to avert the crisis at IndusInd Bank?

Money...

Cobrapost Expose on Cholamandalam & Murugappa Group | Cobrapost Press Conference Live Lootwallahas 2

https://www.youtube.com/live/JjL1S77TQXA

Venue: Press Club of India, New Delhi.

My commentary starts from 30:00 mins.

First HDFCBANK, now YESBANK, is this another instance of both these banks following the same trajectory or is this a pre-cursor to an accepted practice in the private sector banks?

Banks resort to this to inflate profits, it is the role of the analysts & media to point out that it results in merely deferring the problem.

Banks resort to this to inflate profits, it is the role of the analysts & media to point out that it results in merely deferring the problem.