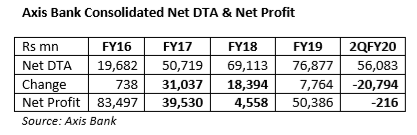

EXECUTIVE SUMMARY. The market ignored Axis Bank’s consolidated net loss of Rs 216 mn in 2QFY2020. Though sell-side analysts were not expecting this result, they nevertheless bought the bank’s explanation that this was “one-time” in this “quarter of transition”, as deferred tax assets (DTA), which are intangible assets, were restated to take advantage of the lower corporate tax regime. Axis’s result presentation kept emphasising the figure of profit adjusted for DTA. What the market has deliberately chosen to ignore is that

- When the bank was merrily inflating profits in the earlier years by creating huge net DTA, the bank’s then presentations and the sell-side conveniently ignored adjusting the inflated profit for the DTA.

- There is still an outstanding DTA of Rs 56 bn in Axis’s accounts which needs to be written-off in the immediate future.

- The only accounting mechanism to reduce the DTA is through a charge to profits.

This writer has been repeatedly exposing the rising DTA in some of the banks, but it appears that either the market has already factored it in, or it does not consider it to be of significance even when banks partly write it down, resulting in losses.

Another area of concern for the industry, and for Axis Bank in particular, is retail loans. Worryingly, the bank continues to aggressively grow its unsecured loans at a time of widespread economic distress. Surprisingly, Amitabh Chaudhry, the bank’s CEO in press interviews has acknowledged the severity of the slowdown and lack of improvement in the immediate future but has not reined in the bank’s unsecured retail loan growth. Although at present retail loans are not reporting signs of weakness, Axis’s current practice is reminiscent of the time when the bank was pushing secured corporate and infrastructure loans; at the time the asset quality of such loans, too, was reportedly sound. Even though the majority of Axis’s retail loans are being given to its own customers, the economic downturn and resultant loss of jobs and incomes can dramatically turn the tables on the quality of unsecured loans, in addition, organised retail fraud has become more sophisticated and banks should be extremely cautious.

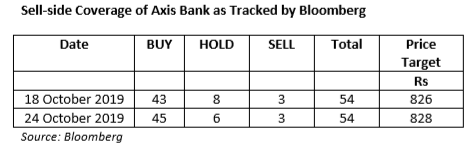

The sell-side regurgitated management commentary of the one-time DTA adjustment. In the past analysts remained silent when profits were being inflated on account of higher DTA, and after the results they rewarded Axis Bank with more “Buy” recommendations and a marginal increase in the price target. While the new management under Amitabh Chaudhry has revamped corporate credit and risk management systems, it still has to write down the residual DTA. Meanwhile the growth of retail loans may throw up some nasty surprises in the future.