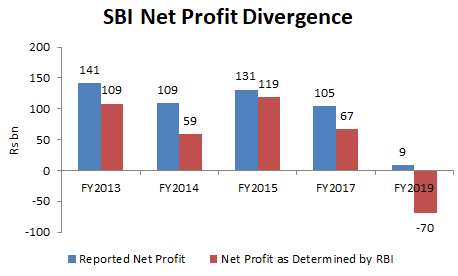

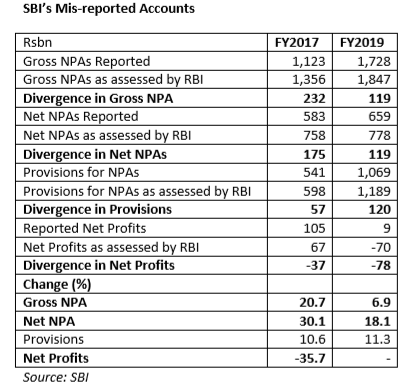

EXECUTIVE SUMMARY. For the second time, State Bank of India (SBI), the government’s premier bank, and India’s largest by assets, has been publicly shamed by the banking regulator for fraudulent accounts. Stakeholders are now aware that the bank’s standalone meagre profit of Rs 8.62 bn for the year ended March 31, 2019 was actually a loss of Rs 69.7 bn. The difference was on account of under-reporting of non-performing loans and credit costs. The Reserve Bank of India (RBI) had publicly hauled up the bank earlier in FY2017, and, thanks to the Right of Information Act, 2005 (RTI), the public is aware that the bank’s accounts for FY2013, FY2014 and FY2015 were also untrustworthy.

It is extremely disturbing to find that a bank is a repeat offender on grounds of fudged accounts. In SBI’s case it reflects poorly on Rajnish Kumar, the executive chairman, Prashant Kumar, CFO, Girish K Ahuja, Head, Audit Committee, and the bank’s 14 auditors. These are the individuals who are directly accountable for the financial accounts. The integrity of the accounts is of paramount importance, as the bank’s valuation is dependent on it.

From a regulatory perspective, the auditors are the first line of defence, as bank accounts are prepared in accordance with the guidelines determined by the RBI, with which bank auditors are well versed. Hence, if the regulator has detected mis-reported accounts, the auditors have to be held responsible and need to be penalised.

As banks hold unsecured deposits from the public, are highly leveraged, and play a critical role in payments in the economy, they have to maintain the highest ethical standards. Indeed, by their very nature, banks are meant to stand for integrity and trust. It is therefore a matter of grave concern when any bank is hauled up repeatedly by the regulator for fudged accounts.

It is on account of the critical role of banks as a repository of trust that the Banking Regulation Act, 1949 regards wilful misinformation by banks to be a criminal offence punishable with a jail term. Sadly, in India, the RBI has been reluctant to enforce this section, and as a result it appears that banks treat fudged accounts as a minor infringement to be overlooked.

In FY2017, too, when Anshula Kant was the bank’s CFO, SBI had mis-reported its accounts. Ironically, she was promoted to the post of managing director and member of SBI’s board, and thereafter she was selected as CFO and managing director of the World Bank. Arundhati Bhattacharya was the executive chairman, SBI from FY2014 till mid FY2018. Despite the bank inflating profits in FY2014, FY2015 and FY2017, the government gave her a one year extension as chairman in 2016. After RBI disclosed that the bank’s accounts were mis-reported under her chairmanship in FY2017, Business Standard, a prominent business paper, awarded her ‘Banker of the Year, 2016-2017.’ In SBI, it appears that individuals responsible for the accounts lack accountability, and are instead rewarded for certifying misleading accounts, even as the banking regulator remains a mute spectator. It is therefore no surprise that the bank has proved to be a repeat offender.