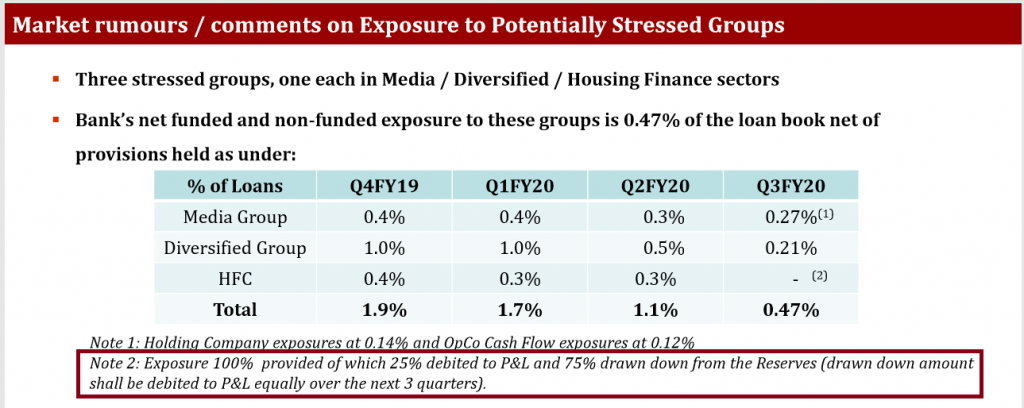

EXECUTIVE SUMMARY. In a stunning non-disclosure, Indusind Bank conveniently neglected to reveal, in its 3QFY2020 results, that it had reduced shareholder funds by around Rs 6.7 bn as a charge for frauds without charging it to profits. The bank reported a consolidated net profit of Rs 13.09 bn (Rs 14.01 bn in 2QFY2020); had the fraud amount been charged to profits, it would have reported only Rs 6.4 bn as net profit. While the Reserve Bank of India (RBI) permits this practice in case of frauds (banks are permitted to spread the provision over 4 quarters by reversing the debit to shareholder funds), the banking regulator also states that suitable disclosures have to be made pertaining to the amount of fraud and quantum of provision for it. As the bank did not disclose this amount of direct reduction from shareholder funds, it was the duty of Purushottam Nyati, partner, Haribhakhti & Co., the audit firm, to highlight it, which he, sadly, failed to do.

The charge of Rs 6.7 bn was only revealed by Indusind Bank in the results conference call when analysts enquired about the disparity between the shareholder funds and the net profits reported, and a vague disclosure in the analyst results presentation. Responding to this writer’s queries on the lack of disclosure, Indusind Bank said that the explanation in fine print on the analyst presentation was “self explanatory.” Unfortunately, this lack of transparency, which the RBI needs to investigate, adds to the litany of issues that this writer has been highlighting pertaining to the leadership of Romesh Sobti, CEO, Indusind Bank. These include untrustworthy financial accounts in FY2016 and FY2017, reckless lending to the insolvent IL&FS and other stressed groups, and the use of deferred taxes to inflate profits. With Sobti’s retirement by March 2020, there will be a change in leadership at Indusind Bank, and shareholders should be extremely cautious regarding what else might emerge from the murky depths of this once fancied bank.