EXECUTIVE SUMMARY. The succession fiasco at HDFC Bank reveals how the banking regulator has allowed a promoter with a minority stake to have a stranglehold on the selection of the chief executive officer (CEO) and the chairman of the bank. Strangely, the board of the bank has to date been unable to choose a successor to the present CEO, Aditya Puri.

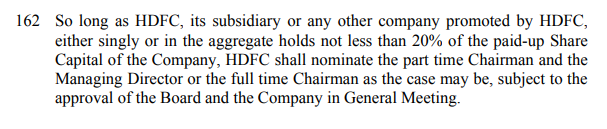

Article 162 in HDFC Bank’s Memorandum and Articles of Association permits HDFC, mortgage financier and promoter of HDFC Bank, to nominate the bank’s non-executive chairman and CEO (subject to the approval of the board, shareholders and the regulator), as long as HDFC or the HDFC group holds a minimum of 20% equity stake in the bank. Such a clause in the memorandum of association granting a minority shareholder the power to nominate critical board members not only goes against basic corporate governance principles, but also defies the banking regulator’s objective of lowering promoter holding in banks so as to reduce their influence in executive management. While such a clause may have been understandable in the first 5 years of a bank’s existence, the regulator needs to reconsider its decision to allow the promoter to control the management in perpetuity.

In Indian banks, promoters are normally minority shareholders, and it is the responsibility of the regulator to ensure that promoters do not interfere in management. For the Reserve Bank of India (RBI) to permit the HDFC group to nominate the chairperson and CEO in HDFC Bank stands at stark variance with its own policy of compelling bank promoters to reduce their stake to 15%.

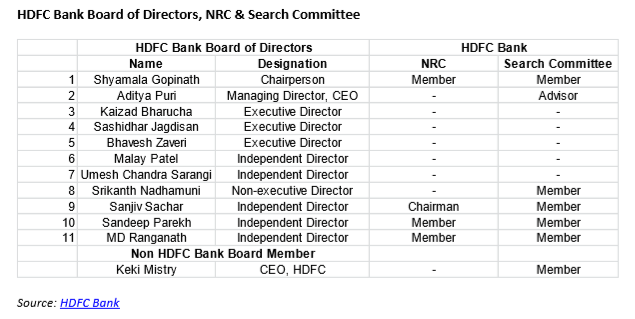

In private sector banks, the nomination and remuneration committee (NRC) of each bank board recommends candidates for directorship to be approved by the board, shareholders and the regulator. Hence nominee directors of the promoters can be part of the NRC, and it should be the sole responsibility of the NRC to recommend new board members and evaluate the performance of the executive directors. By allowing HDFC to nominate the chairperson and CEO in HDFC Bank reduces the importance of the bank’s NRC.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I own 10 HDFC Bank equity shares. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any nonpublic, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.