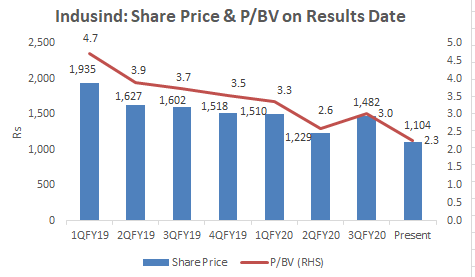

EXECUTIVE SUMMARY. On February 27, 2020 the Reserve Bank of India finally approved Sumant Kathpalia as the CEO who will succeed Romesh Sobti when the latter retires on March 23, 2020. Kathpalia, who has a background in consumer finance and wealth management, will be taking charge of a bank which is facing stiff headwinds due to ill-advised corporate loans. These have resulted in a steady decline in its share price since August 2018 and a massive de-rating in its all-important P/BV multiple.

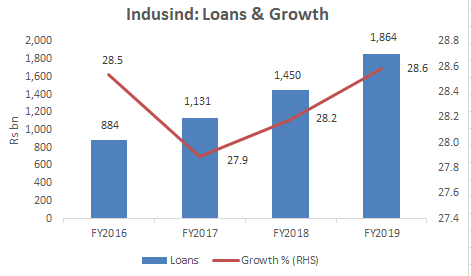

Unfortunately for Kathpalia, the severity of the economic slowdown, which is likely to continue, will dictate the business strategy of Indusind Bank. He should be cautious on providing guidance on future profitability and aggressive asset growth. Axis Bank in early 2019, under the newly joined CEO, Amitabh Chaudhry, projected an optimistic future scenario. This initially resulted in an upsurge in the share price, but Axis has thereafter lost most of its gains as the bank struggles to achieve those rosy projections. The market has concerns regarding Indusind Bank’s high-risk appetite. This has resulted in its troublesome telecom and real estate exposures, which may take time to resolve. This writer has been concerned about the bank’s risk management and accounting integrity for some time, and Kathpalia will have to reassure the market that these critical areas have been addressed.

It may be more prudent for Kathpalia to not grow loans and instead focus on recovery, as acquiring quality assets in a deteriorating economy will be extremely difficult. No doubt, such a strategy may not be initially welcomed by the stock market, which normally tends to be growth focused. The strategy that this acolyte of Sobti should follow is to reverse the high growth strategy of his mentor, which has caused so much grief recently to shareholders. If Kathpalia implements a conservative strategy where the assets and top line remain constant, profits can increase in the medium term through lower credit costs, thus rewarding shareholders and regaining part of the bank’s earlier glory.