In the corporate sector it is extremely rare to find a whistleblower who consistently puts out internal information on malpractices and confidential internal communication, some of it within days of its release, which highlight either malpractices or dissent within the senior ranks. Such information should be a goldmine for the media and sell-side analysts, as it provides valuable insights which the senior management declines to reveal.

‘Madanlal Dahariya’, a pseudonymous Twitter account, has been doing sterling work on highlighting malpractices within HDFC Bank, such as the gross mis-selling of over-priced Global Positioning System (GPS) to the automobile loan customers of the bank; the abrupt departure of three senior and long serving officials namely, Abhay Aima (Head-Private Banking), Ashok Khanna (Head-Automobile Loans) and Munish Mittal (Chief Information Officer); and other irregularities in the bank. All these stories the bank had declined to disclose prior to his tweets. Based on Dahariya’s whistleblowing, Bloomberg broke the story on HDFC Bank’s mis-selling of GPS to automobile loan customers, and the RBI commenced an investigation to look into the same.

Normally one expects independent directors who are active on social media to closely monitor such an individual’s tweets, as they provide leads which they can pursue and verify. They can then present their findings to the board of directors and demand an explanation from the executive management. Independent directors, unlike executive directors on the board, have limited access to information on the company, and hence such whistleblowing can be useful to them.

Similarly to the media, whistleblowers provide alternative insights into the company. Of course, these need to be verified independently, but if they are confirmed by independent enquiries, the media can publish the information. This is what Bloomberg appears to have done in HDFC Bank’s automobile loan story. Indeed, this writer has published many articles on HDFC Bank based on the tweets of ‘Madanlal Dahariya’.

As it is rare to find a whistleblower who releases a steady stream of information on a prominent, large cap bank with significant foreign institutional ownership, banking journalists should be paying close attention to his tweets. All the more so when it relates to India’s number 1 bank by market capitalisation.

Instead what we find is the exact opposite. Sandeep Parekh, independent director, HDFC Bank, a lawyer and former Executive Director, Securities and Exchange Board of India (the capital markets regulator) blocked ‘Madanlal Dahariya’ on Twitter from around September 6, 2020. Tamal Bandyopadhyay, consulting editor and columnist at Business Standard and author of two books on HDFC Bank, blocked him around August 16, 2020. Mayur Shetty, senior editor at Times of India, had blocked him more than a year ago.

This writer sent a query to all 3 of them enquiring why they had blocked ‘Madanlal Dahariya’ on Twitter. Mayur Shetty, who writes on banking, could not recall him, and said he normally does not block individuals on Twitter. Sandeep Parekh declined to respond. Tamal Bandyopadhyay, responding to my queries on why the author of 2 books on HDFC Bank had not written either on the automobile loan scam or on the abrupt exits of 3 seniors in the bank, provided the following lengthy reply.

“I have written two books on HDFC Bank in 2012 and 2019. The contexts were different.

Neither of them is sponsored by the bank. Both have been projects of the publisher as much as my other books on Bandhan Bank, shadow bank Sahara India Parivar, a collection of essays and the forthcoming book titled “Pandemoniun: The Great Indian Banking Tragedy”.

Former RBI governor YV Reddy has written the forward for the first book on HDFC Bank and Nandan Nilekani has written the foreword for the second.

Many stalwarts in Indian finance, including Deepak Parekh, KV Kamath, UK Sinha have endorsed these two books.

Former finance minister of India released the first book in Mumbai and SBI chairman and chief economic adviser to the finance ministry released the second book in mumbai and delhi.

I’m not a reporter; I’m a columnist and I believe I have the freedom and choice on what i decide to deal with in my weekly column Banker’s Trust.

Every week many things happen in the banking/finance/economy space and I take the call on what to focus on. Had I been a reporter, I would have been dealing with news and it would have been a different story.

Incidentally, I did deal with the HDFC Bank succession plan in one of my recent columns.

Isn’t fair to expect that I should decide on what should be the subject of my column? Because I have written two books on HDFC Bank am I bound to write on anything and everything that involves the bank?

And extending the same logic, should it be my responsibility to track every development in Bandhan bank and Sahara?

Also should those who have written foreword for the two books and endorsed them and released them talk/ write on the bank in response to all developments in the bank?

Why have I blocked Mr Madanlal Dhariya on Twitter? If I’m not mistaken, I have blocked you too.

I guess I have as much freedom to block any one on my Twitter as the reputed banking analysts and others have to raise questions on my integrity and speculate how compromised I am for writing two books on HDFC Bank.

Should I be interested in knowing what’s happening in the bank? The insider story? Isn’t that my prerogative and do I need to tell the world how I am tracking them?

I have been tracking the industry for 25 years (not 20 years) and have been writing a weekly column since 2000 — first in BS [Business Standard] on every Thursday (an oped) and then In Mint (every Monday) and back to BS in late 2018. I decide the subject of my column and will continue to do so.”

Tamal Bandyopadhyay, as the back leaf of his first book on HDFC Bank, Bank for the Buck, says “is one of the most respected business journalists in India”. To write his first glowing account on HDFC Bank he was given unrestricted access to the senior management of the bank, and Aditya Puri (HDFC Bank CEO) and the author jointly marketed the book. In his reply commenting on why he had not written on any of the negative developments at HDFC Bank, he makes a perplexing comparison, and extends the logic to those who have written the foreword and endorsed his two books on HDFC Bank as having the same responsibility as the author to comment on all developments at the bank.

As a consulting editor and columnist, Tamal Bandyopadhyay certainly has the freedom to choose what he comments on. Nevertheless, one seeks in vain to locate any comment by him when HDFC Bank’s digital operations collapsed in early December 2019 (incidentally Bandyopadhyay’s second book on HDFC Bank was titled HDFC Bank 2.0: From Dawn to Digital), or the GPS automobile loan scam in June-July 2020 and the abrupt departures of three senior officials (one of whom he had interviewed for his first book) in FY2020 and early FY2021. When an experienced banking journalist publishes not one, but two highly favourable books on a single bank, and thereafter declines to comment on some of the recent major negative developments, it does raise the issue of credibility.

To date, ‘Madanlal Dahariya’ is the sole HDFC Bank whistleblower in the public domain regularly exposing the official commentary put forth by the bank. For an HDFC Bank independent director and two experienced banking journalists working at prestigious newspapers to block him on Twitter indicates either that they are already aware of this information, which is unknown to the public, or that they don’t want to know of any negative developments beyond what is released officially by the bank. Sadly, the latter approach is followed by most sell-side analysts and many in media.

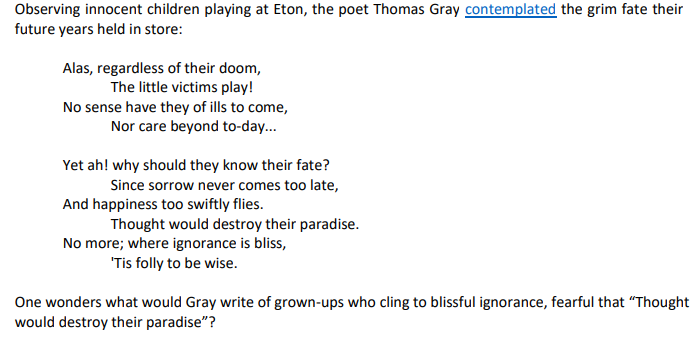

Observing innocent children playing at Eton, the poet Thomas Gray contemplated the grim fate their future years held in store:

Alas, regardless of their doom,

The little victims play!

No sense have they of ills to come,

Nor care beyond to-day…

Yet ah! why should they know their fate?

Since sorrow never comes too late,

And happiness too swiftly flies.

Thought would destroy their paradise.

No more; where ignorance is bliss,

‘Tis folly to be wise.

One wonders what would Gray write of grown-ups who cling to blissful ignorance, fearful that “Thought would destroy their paradise”?

DISCLOSURE

I, Hemindra Hazari, am a commentator on Indian banks, economy and the capital markets. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. I own equity shares in HDFC Bank. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.