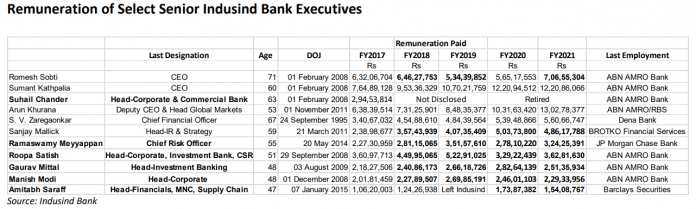

EXECUTIVE SUMMARY. Most private sector banks withhold the remuneration details of senior executives in the annual reports. However, shareholders can specifically request this disclosure from companies. The remuneration disclosure provides valuable information on the quantum of monetary compensation, revealing how senior managers have been appraised and compensated.

In Indusind Bank, the scale of remuneration reveals how Ramaswamy Meyyappan (Chief Risk Officer) and the corporate credit team (initially led by Suhail Chander and subsequently by Roopa Satish) were handsomely rewarded (FY2017-FY2019) for doing high-risk, poor quality loans to companies like CG Middle East (US$ 40 mn in FY2018; the loan is being investigated by the Securities and Exchange Board of India), Sprit Infrapower (Rs 5 bn loan to unlisted company of founders of Zee media in FY2019) and IL&FS (Rs 20 bn bridge loan in FY2019). Thereafter their remuneration declined in FY2020, and for some it recovered in FY2021.

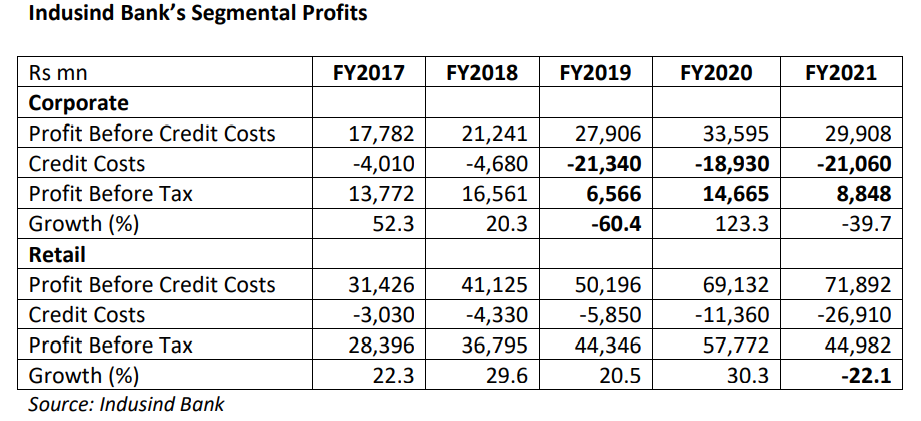

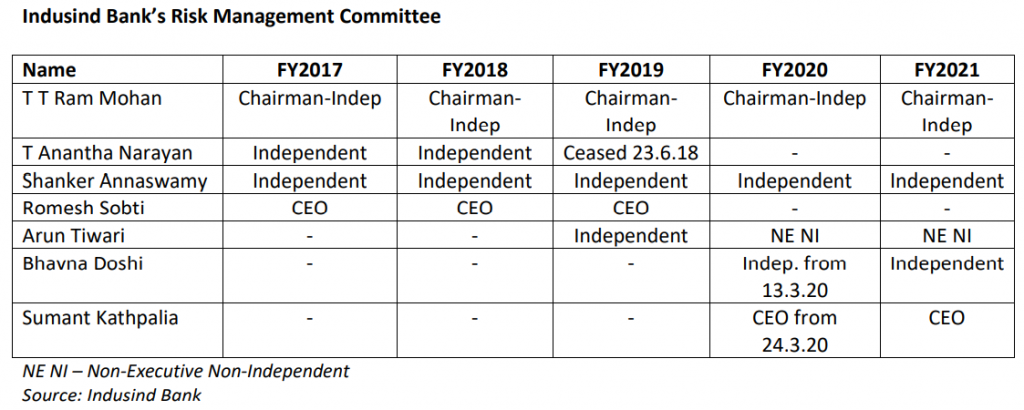

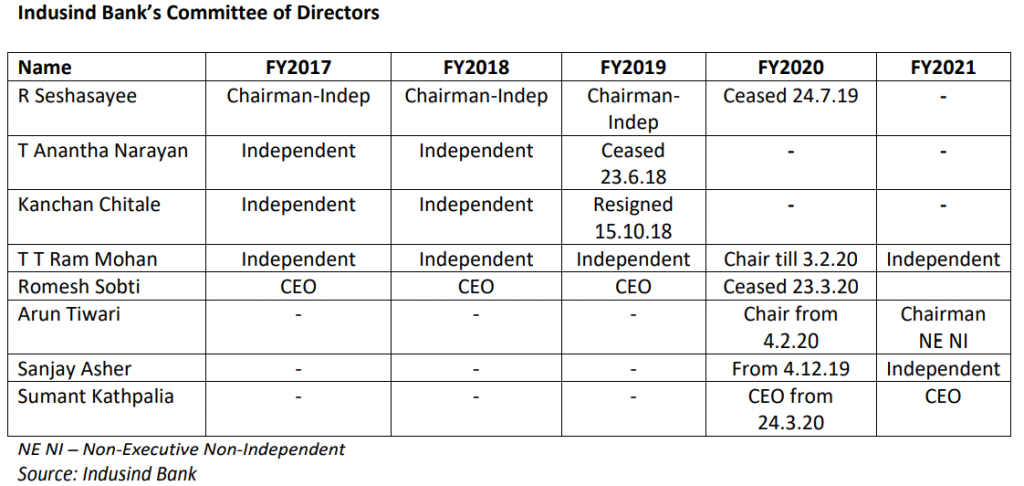

Indusind Bank has declined to provide any clarity on the reasons for the increase and decrease in individual remuneration. When corporate banking’s credit costs in FY2019 shot up by 4.6x and Profit Before Tax (PBT) of the division declined by 60% to Rs 6.6 bn, Roopa Satish, the Country Head – Corporate, Institutions and Investment Banking, remuneration increased by 16% to Rs 52.3 mn. In FY2020 her remuneration declined by 37% to Rs 32.9 mn. More importantly, despite the significant financial and reputational loss to the bank from dodgy corporate loans, none of the concerned executives was sacked; the only apparent punishment was a reduction in their already inflated remuneration. These events demonstrate poor oversight by the important sub-committees of the board of directors such as Committee of Directors (CoD), Risk Management and the Nomination and Remuneration (NRC). The coterie, consisting of mainly former ABN AMRO Bank colleagues, are well protected from getting the axe.

The lesson to stakeholders is that, when times are good, senior executives will be richly rewarded, and when times turn sour on account of their incompetence and/or complicity, they will still retain their jobs. The only punishment will be a reduction in their remuneration. As long as such individuals are blessed by the CEO, their jobs are secure, and there is negligible accountability for their disastrous acts which result in losses to the bank and to shareholders.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in Indusind Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.