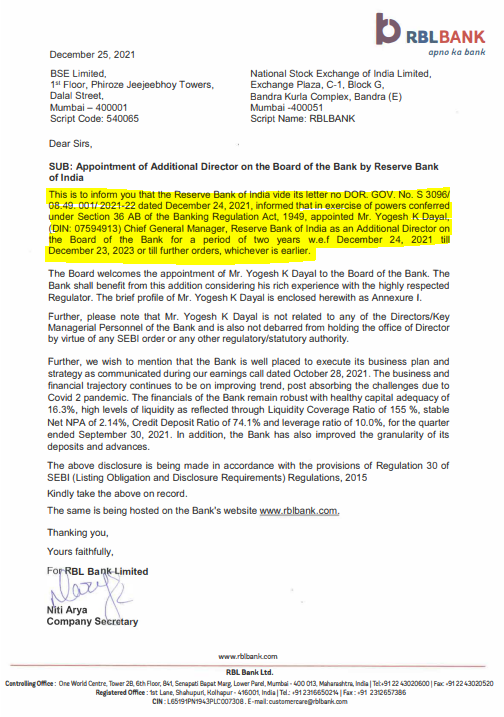

EXECUTIVE SUMMARY. Xmas festivities were disrupted when RBL Bank dropped a bombshell on the stock exchanges. It informed the public that the Reserve Bank of India (RBI), under Section 36AB of the Banking Regulation Act, 1949, had appointed Yogesh K Dayal (Chief General Manager, RBI) as an additional director. Four and a half hours after this announcement came even more worrying news: the board had accepted the request of Vishwavir Ahuja (CEO since June 30, 2010) to proceed on leave with immediate effect, and had appointed Rajeev Ahuja (currently Executive Director) as the interim CEO.

RBL Bank’s conference call with analysts on the evening of December 26, 2021 did not provide the much needed clarity on why the banking regulator had taken such a severe action, or why Vishwavir Ahuja had proceeded on leave with immediate effect following the appointment of the RBI director.

While the analysts naturally were looking for the reason behind the move, the bank was trying to manage the fallout of this fait accompli by assuring the public and investors that the financials of the bank were sound. Herein lies the predicament: the analysts wanted the bank to provide the reason why the RBI took the decision which led to the departure of their longstanding CEO, while the bank naturally could not publicly comment on the RBI’s decision. It feared that this was a confidential communication between the regulator and the regulated, and that it would earn the further ire of the regulator.

In such a situation, to prevent rumour mongering, the RBI should issue a press release explaining the rationale for its decision as, in the light of the disasters at IL&FS, Punjab Maharastra Co-operative Bank, Yes Bank, DHFL and the erstwhile Lakshmi Vilas Bank, depositors are naturally concerned about their life savings in private sector/co-operative banks and non-bank finance companies (NBFCs).

In RBL Bank’s case it is possible that the regulator felt the need to decisively act as the succession planning was not achieving the concerned milestones in the time span given. It may also be that the financials are indeed sound, as the management has been keen to project. But if this is truly the case, the regulator has overreacted by appointing its director to facilitate succession planning; or it believes the board of directors (which includes two former RBI officials) is incapable of undertaking the regular task of succession planning; or there is a huge problem deeply buried in the bank’s innards, in which case both depositors and shareholders should flee the bank.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I have no equity exposure to RBL Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.