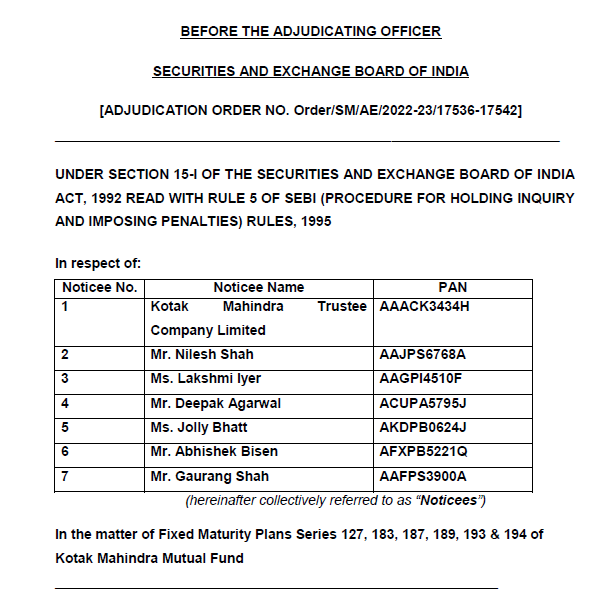

The Securities and Exchange Board of India (SEBI)’s order dated June 30, 2022 indicted not only the senior-most executives of Kotak Mahindra Mutual Fund (KMF), but also Kotak Mahindra Trustee Company (KMTC), for failing in its oversight of the asset management company. The matter related to KMF’s investment in the Zee promoter companies and the manner of its repayment to investors. The implications of the SEBI order for Kotak AMC, KMTC, Kotak Mahindra Bank (KMB) and on the financial sector need to be examined by the banking and capital market regulators and capital market participants.

The adjudicating officer of SEBI was appointed to adjudicate the various irregularities in managing the six Fixed Maturity Plan (FMP) Series which invested in debt securities of Zee founder companies and the delayed payments to investors. The modalities of the delayed payment to investors were found to be in violation of the SEBI (Mutual Funds) Regulations, 1996. An earlier SEBI order on Kotak AMC in August 2021 had exposed the incompetence of senior executives of Kotak AMC such as the Debt Investment Committee, who did not bother to know the identity of the recipient companies when they approved investing in debt securities of the Zee founder companies. The recent SEBI order has also penalised the Kotak AMC executives and KMTC for various violations.

Kotak Mahindra Fund – Debt Investment Committee in FY2017

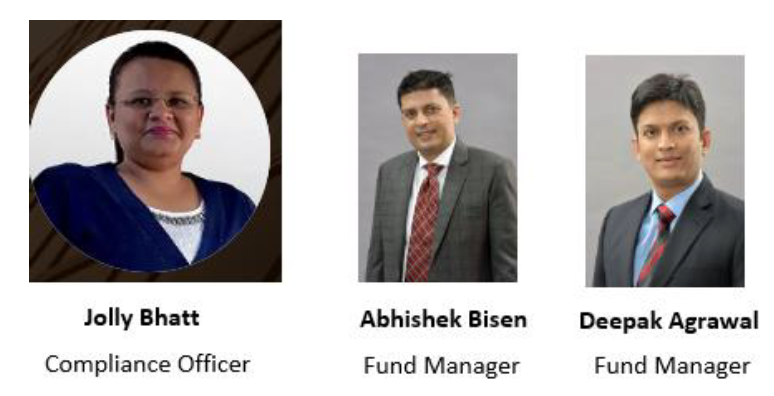

The SEBI order thoroughly exposes the role and the professional incompetence of the senior executives of Kotak AMC, namely, Nilesh Shah, managing director and Chief Executive Officer (CEO) of the AMC and member, Economic Advisory Council to the Prime Minister; Lakshmi Iyer, Chief Investment Officer-Fixed Income and Debt Products; Gaurang Shah , director; Deepak Agrawal, fund manager; Jolly Bhatt, head of compliance; and Abhishek Bisen, fund manager. Nilesh Shah, Lakshmi Iyer and Gaurang Shah were members of the Debt Investment Committee which approved the investment in the securities of the Zee founder companies.

Kotak Mahindra Mutual Fund Compliance Head and Debt Fund Managers Penalised by SEBI

What should be alarming is that all levels in Kotak AMC – the fund managers, the Debt Investment Committee, the compliance officer and the board of directors – were willing to violate SEBI’s mutual fund regulations to facilitate the extension of the time horizon to the Zee founder companies to repay the investors. Worse, KMTC, which is an independent company which oversees the Kotak AMC, and where all the decisions taken by the AMC board of directors have to be sent for the Trustee’s information/confirmation/approval, did not object to this modified arrangement for delaying payment to investors. As soon as the transgressions in Kotak AMC had been unearthed, a professional trustee company should have demanded an audit of all the investment transactions at the AMC, especially when it was found that the Zee founder companies that the Kotak AMC had invested in were loss-making, had high debt, and had no means of refinancing the debt through future internal cash flows. It is extremely disturbing that the Investment Policy of Kotak AMC permitted such investments in dubious shell companies. It is obvious from the SEBI order that Kotak AMC and the Trustee on this issue were acting as a single entity and the Trustee apparently abandoned its primary responsibility of protecting the investors.

Directors (Trustees) of Kotak Trustee Company in FY2016 and FY2017

Monetary Penalties Levied by SEBI on Kotak AMC & KMTC

| Name | Monetary Penalty | SEBI Order Dated | |

| 1 | Kotak AMC | Rs 5 mn | August 27, 2021 |

| 2 | Kotak Mahindra Trustee Company Ltd. | Rs 4 mn | June 30, 2022 |

| 3 | Nilesh Shah – Managing Director, Kotak AMC | Rs 3 mn | June 30, 2022 |

| 4 | Lakshmi Iyer – Chief Investment Officer, Kotak AMC | Rs 2.5 mn | June 30, 2022 |

| 5 | Deepak Agrawal – Fund Manager, Vice-President Kotak AMC | Rs 2 mn | June 30, 2022 |

| 6 | Jolly Bhatt – Compliance Officer, Kotak AMC | Rs 1 mn | June 30, 2022 |

| 7 | Abhishek Bisen – Fund Manager, Kotak AMC | Rs 1.5 mn | June 30, 2022 |

| 8 | Gaurang Shah – Director, Kotak AMC | Rs 2 mn | June 30, 2022 |

Source: SEBI

The fact that the investors ultimately received their funds from the FMP’s investments in the Zee founder companies, albeit with a delay, should not absolve the conduct of Kotak AMC. There is a fundamental difference between a bank and an AMC, which unfortunately neither the board of directors of Kotak AMC nor the trustees of KMTC comprehend, namely, banks can undertake loan restructuring of their customers without seeking consent from depositors, while an AMC requires the prior consent of its investors for making any modification to the original terms of the mutual fund scheme. That no senior executives at Kotak AMC, including its compliance head and the trustees, objected to the restructuring indicates the calibre of professionalism in both companies.

Investors of the select FMP schemes of Kotak AMC became aware of problems from April 2019, when they were informed just before the maturity of the schemes, and SEBI’s order in August 2021 highlighted the poor professional conduct of the senior executives of Kotak AMC in appraising and approving the loans to Zee founder companies in 2016. Since these announcements, there has been no disciplinary action (in the public domain) taken against the concerned executives by their companies. The only action has been regulatory censure and monetary penalties, as the board of directors of the AMC and the trustees endorsed their actions.

Incidentally, Uday Kotak is chairman of the Kotak AMC, and he is the founder-CEO of KMB, which is the parent company of the AMC and KMTC. In October 2017, Uday Kotak, as chairman of the SEBI-appointed Committee on Corporate Governance said,

“By and large most leading corporates in India follow rules and regulations, and if their governance practices are put to test, they will likely stand scrutiny of the law. However, if one delves deeper, one could find that while the letter of the law may have been complied with, the spirit of regulations has not necessarily been embraced wholeheartedly.”

It is ironical that while the committee was meant to lay down the standards of corporate governance for the Indian corporate sector, Kotak’s own companies were being hauled up nearly 5 years later by the same regulator which had appointed him as chairman of a prestigious committee. In the above Kotak-related cases SEBI did not even have to delve deeper to detect whether the spirit of the regulation was transgressed, since the regulation itself had been violated.

The fact that SEBI has imposed monetary penalties on a trustee company and on an AMC which are 100% subsidiaries of a prominent bank has implications for financial stability.

SEBI fined KMTC Rs 4 mn (US$ 50,653) for not protecting the interests of the investors in those schemes which held the investments of Zee promoter companies. Although the monetary penalty imposed by SEBI is a slight rap on the knuckles for KMTC, it raises the critical issue of whether trustee companies which are mandated to set-up asset management companies (AMCs) hold adequate capital for the risks they manage.

Unlike AMCs, which require a minimum equity capital of Rs 500mn (US$ 6.3 mn), SEBI has not stipulated a minimum equity capital requirement for trustee companies which set up AMCs. Trustee companies which set up AMCs have minimal capital. For example, KMTC was established in July 1994 with a paid-up equity of Rs 500,000, and as on March 31, 2021 the company’s net worth was Rs 2.7 bn (US$ 36.8 mn). As trustee companies which set up AMC have minimal expenses, since they have negligible staff and marginal operating expenses, their founders prefer minimal equity capitalisation. However, if, on account of mismanagement, as is seen in KMTC, the regulator penalises such companies in excess of their equity, the shareholders of the trust have to recapitalise the company. Therefore, although in this case KMTC can comfortably pay the monetary penalty, SEBI must insist on a minimum equity capital for trustees which are setting up AMCs, as the mutual fund industry is managing a vast pool of investor savings.

Both KMPT and Kotak AMC are 100% subsidiaries of KMB. In August 2021, SEBI had imposed a monetary penalty on Kotak AMC of Rs 5 mn (US$ 68,092) and other penalties, which were partly stayed by the Securities Appellate Tribunal on October 2021, for the investments in the Zee founder companies. In this case too the monetary fine was a pittance, and the company could easily pay it – in FY2021 Kotak AMC had a net worth of Rs 10.9 bn (US$ 149 mn). If the regulatory penalty had been more than the equity capital of the AMC, the parent company, which is KMB, would have had to recapitalise the AMC.

Moreover, when a regulator penalises a subsidiary of a bank for mismanagement of investors’ savings, it heightens concerns of reputational risk for the parent bank. At present, in banks, there are no separate capital adequacy norms for providing for such risks in the subsidiaries. On January 4, 2022 the Reserve Bank of India (RBI) had issued guidelines for domestic systemically important banks (D-SIB), which included only State Bank of India, HDFC Bank and ICICI Bank, to hold additional Common Equity Capital Tier I (CET1), ranging from 0.2%-1%, of risk weighted assets as a buffer. As non D-SIBs like KMB have subsidiaries managing various risks in the financial system, the banking regulator must ensure in its capital adequacy guidelines for banks that additional equity capital is separately determined for subsidiaries for ensuring that such risks are provided for in the interests of financial stability.

The Kotak Mahindra group of companies is a prominent player in India’s financial sector, and KMB is the apex umbrella entity which owns all the subsidiary companies. Any transgressions and violations of the law in its group companies impact the bank’s reputational risk, and may impose an additional charge on the bank’s equity capital. It is time the Reserve Bank of India (RBI) examines these issues and undertakes measures for banks to provide for additional equity capital to manage such risks in its subsidiaries.

An edited version of the article was published by The Wire.in here.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in Kotak Mahindra Bank, SBI, HDFC Bank and ICICI Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.