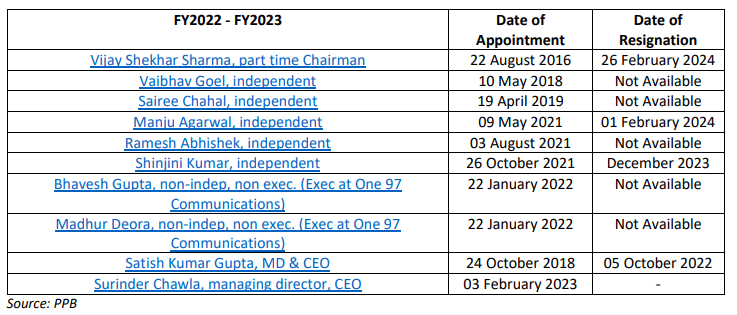

Three new developments herald a possible new beginning for Paytm Payments Bank (PPB): The reconstitution of its board of directors, apparently due to pressure from the Reserve Bank of India (RBI); the stepping down of Vijay Shekhar Sharma (51% shareholder of PPB) as part-time chairman and the induction of former government bankers and a former government bureaucrat as independent directors (IDs). The reconstitution of the board, and the withdrawal of the nominee directors of One 97 Communication (49% shareholder in PPB), were likely necessary to prevent the interference of shareholders in the operations of the bank as well as their influence on IDs.

The Reserve Bank of India’s (RBI) earlier curbing of operations of PPB highlights how IDs, who are meant to protect the interests of customers and the general public, instead align themselves with promoter interests when there is a dominant shareholder on the board. A positive outcome is that IDs who remained silent and declined to either rectify the deficiencies highlighted by the regulator, or resign at the appropriate stage, can no longer go unpunished. Proxy advisory firms are right to consider them unfit to serve on a corporate board of directors.

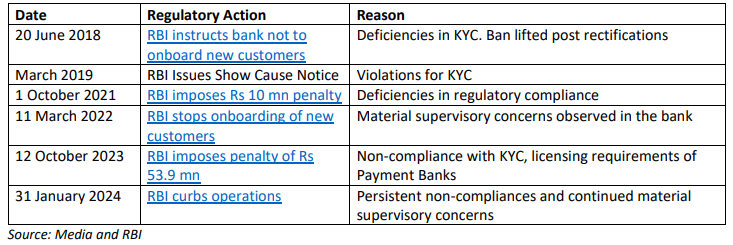

History of Regulatory Action against Paytm Payments Bank

PPB had a history of RBI censures for violations pertaining to on boarding of customers, and especially in the all-important Know Your Customer (KYC) guidelines. As per media reports, RBI detected hundreds of customer accounts were on boarded without proper documentation and reportedly more than 1,000 customers were linked to a single Permanent Account Number (PAN). Such violations suggest either poor operational practices to facilitate business growth or more ominously a business strategy of money laundering. Globally, KYC has become the bedrock of banking, as banks must have comprehensive knowledge of their customers, depositors and borrowers from a risk management as well as an Anti-Money Laundering (AML) perspective. Therefore, when the banking regulator serves notice for violations, penalises and even takes the extreme step of stopping on boarding of new customers (as the RBI did with PPB on March 11, 2022), the board of directors must take notice and immediately address the concerns to the regulator’s satisfaction. PPB’s independent directors, however, managed to sleep soundly through all the noise.

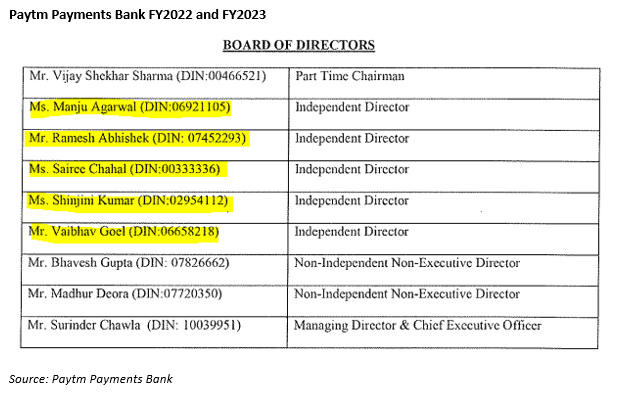

Paytm Payments Bank Board of Directors – FY2022–FY2023

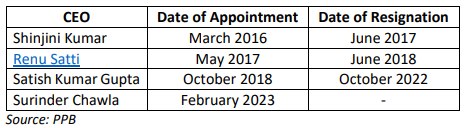

In FY2022 and FY2023, the independent directors of PPB were Vaibhav Goel (Chartered Accountant), Sairee Chahal (entrepreneur), Manju Agarwal (former State Bank of India Deputy Managing Director), Ramesh Abhishek (former Indian Administrative Service) and Shinjini Kumar (ex RBI, former CEO PPB and entrepreneur). All the IDs in this period had the necessary expertise and experience of corporate boards and the role of IDs. When a bank has a history of regulatory displeasure and a high turnover of Chief Executive Officers (CEOs) – 4 in 8 years – IDs have to be more vigilant in overseeing the executive and demanding compliance reports.

PPB CEOs Since 2016

Indeed, Schedule IV Section 149(8) of the Companies Act, 2013 dealing with the code of conduct for IDs states[1],

II. Role and functions:

The independent directors shall: (1) help in bringing an independent judgment to bear on the Board’s deliberations especially on issues of strategy, performance, risk management, resources, key appointments and standards of conduct; (2) bring an objective view in the evaluation of the performance of board and management; (3) scrutinise the performance of management in meeting agreed goals and objectives and monitor the reporting of performance; (4) satisfy themselves on the integrity of financial information and that financial controls and the systems of risk management are robust and defensible;

III. Duties:

(6) where they have concerns about the running of the company or a proposed action, ensure that these are addressed by the Board and, to the extent that they are not resolved, insist that their concerns are recorded in the minutes of the Board meeting;

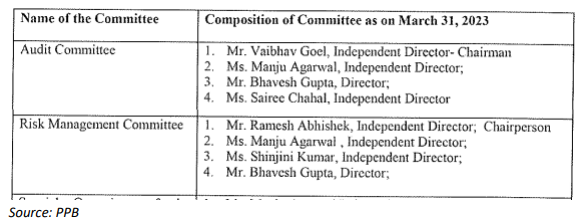

When the RBI documents various violations and penalises a bank, it should be taken extremely seriously by the board of directors. Typically, the Audit Committee (in which Vaibhav Goel, Manju Agarwal and Sairee Chahal were present as ID members) and sometimes the Risk Management Committee (with Ramesh Abhishek, Manju Agarwal and Shinjini Kumar as ID members) will examine the issues raised by RBI more closely. The board appoints a compliance officer to ensure that the issues highlighted by the regulator are addressed. A time-bound compliance report has to be first submitted to the board, notifying it that the bank has complied with the RBI’s directive and addressed its concerns. This report is thereafter sent to the RBI.

Audit and Risk Management Committee of PPB in FY2023

This is supervisory action on a regulated entity for persistent non-compliance…Such actions are invariably preceded by months and at times years of bilateral engagement where we not only point out deficiencies but provide more than adequate time to take corrective action.

On February 8, 2024, Shaktikanta Das, governor RBI said,

Sufficient time is given to non-compliant entities but action is taken when bilateral talks don’t yield action.

What is shocking is that on the board of PPB were two experienced bankers; Shinjini Kumar, a former RBI official and also ex-Chief Executive Officer of PPB, and Manju Agarwal, a former senior executive of State Bank of India. Both these individuals would have been familiar with RBI’s regulatory and supervisory procedures, as well as KYC norms for banks. Yet, despite their presence, PPB was unable to satisfy the regulator’s concerns.

Apart from their expertise and experience, many independent directors are selected for their lack of spine in protecting non-promoter interests. Promoters, and in the absence of founders, professional management prefer individuals who do not grill the management, and quietly acquiesce to decisions which may be adverse to minority/public interests. Such conduct by IDs ensures that not only are their terms extended with the support of the promoter/management, but they become eminently qualified to serve on the boards of other companies. Normally IDs consist of chartered accountants and lawyers whose business interests are intertwined with the corporate world, former bureaucrats, ex-bankers and retired company executives who require additional income or prestige with being associated with the corporate world. As technology is playing a vital role in business, boards also require specialists in IT. To date, IDs/public interest directors have not suffered from presiding over and being complicit in poor governance in Yes Bank, IL&FS, or the National Stock Exchange, and in the massive siphoning of funds from companies which wind up defaulting. Mute spectator IDs avoid annoying corporates by standing up for minority/public rights, and thereby ensure that they will be invited to more sleeping boards. They are rewarded for being silent and complicit in misgovernance. What’s not to like?

But the environment is changing, with the coming of age of proxy advisory firms which recommend to their institutional clients on how to vote on resolutions, including the appointment and re-appointment of directors. Both Stakeholders Empowerment Services (SES) and Institutional Investor Advisory Services (IiAS) have recommended not to support Manju Agarwal’s re-appointment as an independent director in CMS Info Systems, on account of her poor track record on the board of PPB. The SES report in particular is scathing on her performance at PPB – commenting on her performance in the light of the prior regulatory issues, the report says,

…the question is what did she do? Did she use her experience in resolving the issue? Answer is No as the problems persisted and culminated in death warrant for PPBL. Were her suggestions ignored? Possible, but if she can resign now [link] she could have done it long back, thus bringing fault lines of PPBL in open and would have saved not only problems faced by stakeholders but for herself, as SES views this as loss of reputation for her after a chequered career at premier bank. Thus, SES concludes that she did not adhere to code of conduct as envisaged and failed in protecting the institution.

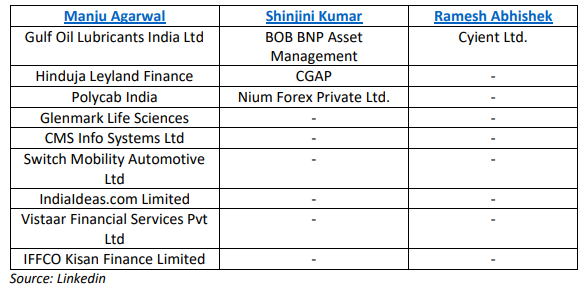

The same fate will rightly befall all the other IDs at PPB during FY2023 when their terms come up for re-appointment or if they are mistakenly selected for their “expertise and experience” as directors in other companies. There are consequences for IDs who sit on boards while turning a blind eye to repeated regulatory lapses and sending their resignations immediately prior or post stringent regulatory action to possibly save their reputation.

Other Directorships Held by Individuals who were Independent Directors of PPB in FY2022 and FY2023

[1] Highlighted in SES Proxy Advisory Report of CMS Info Systems Ltd.

Note: On March 1, 2024 Manju Agarwal resigned as an independent director from CMS Info Systems just prior to the postal ballot on her reappointment being concluded.

This article was also published in The Wire.in and can be read here.

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I have no exposure to Paytm Payments Bank or to One 97 Communications. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: