An ordinary meeting of Axis Bank on December 15, 2025 with institutional investors had an extraordinary outcome, one which may need to be probed by the Securities and Exchange Board of India (SEBI). Listed companies regularly meet institutional investors to enable the capital market to get a better understanding of the business. However, in such meetings, companies are very careful not to divulge price sensitive information, as such sensitive information is meant to be reported publicly at the time of quarterly results or through a release to the stock exchanges, not disclosed to select audiences.

Source: Axis Bank

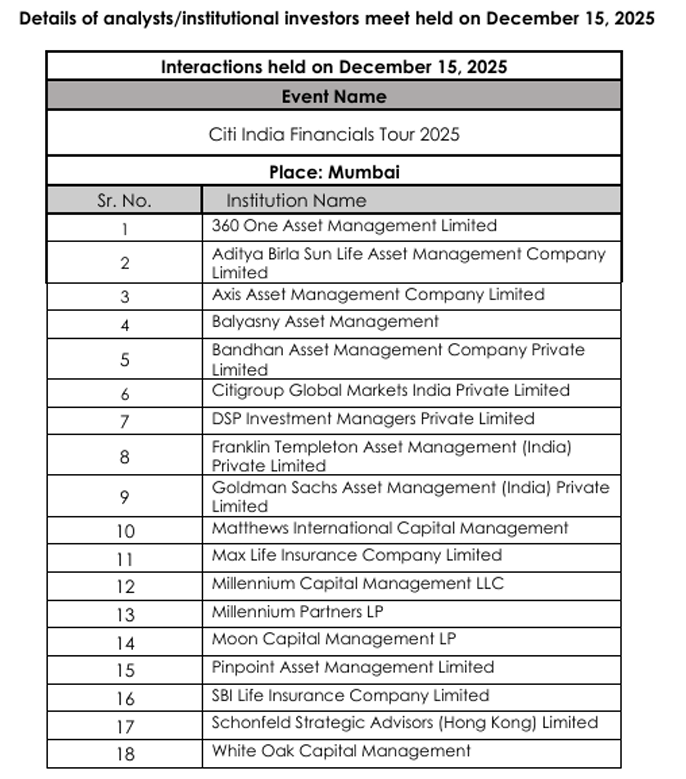

The Axis Bank meeting was organised by Citi India, and was attended by 18 institutional participants. The link provided by the bank regarding the subject of the discussion pertains to presentations made at time of the 1QFY2026 and 2QFY2026 results. Since the 2QFY2026 results had been declared on October 15, 2025, the capital market did not expect to be informed of anything of importance at this meeting. At any rate SEBI’s Listing Obligation and Disclosure Requirements, 2015 (LODR) 30 requirements prohibit the disclosure of unpublished price sensitive information to select audiences.

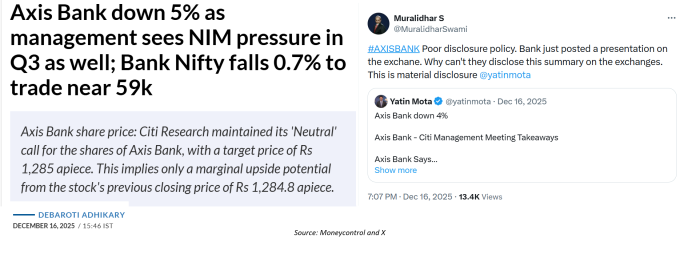

It was shocking, therefore, when the Axis Bank share price fell by 5% the day after the meeting, with Moneycontrol reporting: “Axis Bank down 5% as management sees NIM pressure in Q3 as well…” Citing a Citibank report, Moneycontrol said:

“Citi added that Axis Bank now expects NIMs to bottom out in either Q4 FY26 (January-March, 2026) or Q1 FY27 (April-June, 2026), instead of the ongoing Q3 FY26 (October-December, 2025). “Management now forecasts [emphasis ours] a shallow, ‘C’-shaped NIM trajectory towards a targeted 3.8% over the next 15-18 months,” it said.”

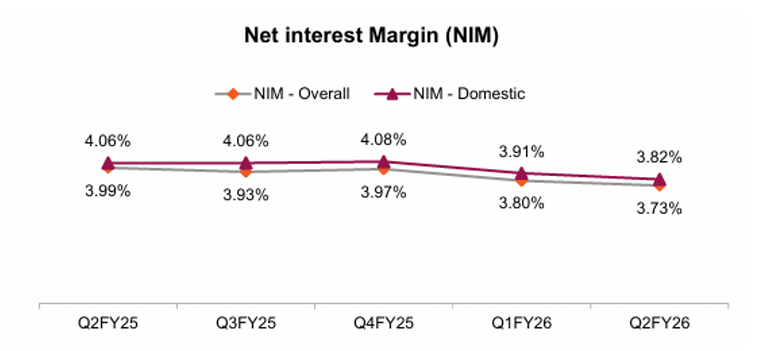

What is especially damaging in the news story is a direct quote from the Citibank report, which attributes the Axis Bank’s net interest margin (NIM) recovery from 4QFY2026 to 1QFY2027 to the bank’s management commentary shared at the meeting. At the 2QFY2026 results meet the bank management had guided that it expected the bottoming of the NIM by 3QFY2026.

Source: Axis Bank 2QFY2026 Analyst Transcript p. 11

At that time the Axis Bank management had also provided a caveat that the bottoming of the NIM was subject to there being no further interest rate cuts by the Reserve Bank of India (RBI). On December 5, 2025, the RBI cut the repo rate by 25 basis points (bps) to 5.25%, and hence it was possible that the NIM would continue to be under pressure for the banking sector. But for the Axis Bank management to explicitly state that the bank’s NIM would continue to be under pressure to a select audience of institutional investors, and not release the same statement to the exchanges, was a violation of SEBI LODR, 2015 (LODR) 30.

Pertinently, even after the media reported this development and alluded that price sensitive information had been shared by Axis Bank to a select audience, the bank declined this analyst’s request to disclose the webcast/transcript of this important meeting to the stock exchanges.

Normally, in any listed company, the Chief Executive Officer (CEO), Chief Financial Officer (CFO) and the Investor Relations (IR) head are extremely cautious about making any forward-looking statements to analysts and the media. They normally highlight only numbers in the latest quarterly results presentations, which are in the public domain. Authorised company spokespersons, when interacting with analysts/investors, are trained to restrict their commentary to either past numbers or the past guidance the company may have given to the stock exchanges. They cannot unilaterally provide new guidance to a select audience without any prior disclosure to the stock exchanges.

A bank’s NIM is its most critical parameter to forecast profits and profitability, and hence NIM guidance is highly price sensitive information. Axis Bank’s NIM has been under consistent pressure since 4QFY2025, and analysts had been constantly asking the bank when the NIM would bounce back. Hence the information that following the RBI repo rate cut on December 5, 2025, the bottoming of Axis Bank’s NIM would get further extended should have been released to the stock exchanges, and not so selectively.

Source: Axis Bank 2QFY2026 Results Presentation p. 9

Global sell-side research is also aware of the requirement of not disclosing non-public information, as it is a violation of insider information rules. Normally research is vetted by the internal compliance department prior to public release. In this case it is also strange that Citi’s compliance department cleared the note for release when it contained non-public and price sensitive information attributed to senior Axis Bank executives. Indeed a standard disclaimer in all stock market research is that the information contained in the research report is not based on any non-public material information. Even when sell-side analysts interact with the buy-side (institutional investors), the interaction is audio recorded to document any sharing of insider information. Globally, and especially in developed markets, there are severe penalties for the violation of insider information regulations.

Axis Bank Share Price Performance on December 16/15, 2025 Vs Major Indices

| 15 December 2025 | 16 December 2025 | Change (%) | |

| Axis Bank (Rs) | 1,285 | 1,225 | -4.7 |

| NIFTY-50 | 26,027 | 25,860 | -0.6 |

| Bank NIFTY | 59,462 | 59,035 | -0.7 |

Source: National Stock Exchange

That the information shared by Axis Bank at the December 15, 2025 meeting with select institutional investors was material and price sensitive was borne out by media reports citing the Citibank research report and the stock price performance of Axis Bank versus the major indices on December 16, 2025. What is equally surprising is that despite all this information being in the media, nobody (notable exception of Muralidhar S on social media) has made an issue of the fact that a prominent bank shared such information to select institutional investors. Worse, even after these media reports, Axis Bank did not feel the need to disclose to the stock exchanges the transcript of the discussions it had with these institutional investors. Even this analyst’s request to the bank to publicly release the information fell on deaf ears.

The reason why global capital market regulators have stringent regulation and punitive penalties pertaining to the selective release of price sensitive information by listed companies is clear: on the basis of such information, investors can make huge illicit gains. Thus such selective disclosure compromises market integrity. Axis Bank is a prominent Indian bank, 5th largest bank by market capitalisation, and a constituent of the prestigious BSE-30 and NIFTY-50 national stock market indices. In this particular case, SEBI needs to investigate Axis Bank’s December 15, 2025 meeting with institutional investors, and determine whether price sensitive unpublished material information was shared by the bank. This is necessary for maintaining the integrity of the Indian stock market. It is not a private matter.

This article was also published in The Wire and can be read here.

_________________________________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594), BSE Enlistment No. 5036. Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in Axis Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

www.hemindrahazari.com

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: