Leadership is unravelling at Yes Bank and the stock is tanking. In the dark hours of November 14, the bank announced the immediate resignations of Ashok Chawla, its non-executive, independent chairman, and Vasant Gujarathi, an independent director and head of its important audit committee. The directors of Yes Bank appear to have joined the ranks of endangered species. In June 2015, the Mumbai High Court revoked the appointment of 3 executive directors in Yes Bank; on September 19, 2018, the regulator had disallowed the continuance of founder-CEO Rana Kapoor from February 1, 2019; and director heads continue to roll at this beleaguered bank.

As investors lose hope, the bank must hurriedly appoint competent, independent-minded bankers in the board who can restore the regulator’s confidence and withstand the incessant pressure from the founders. The abrupt resignation of an external expert on November 15, to select a new CEO further muddies the water. The immediate appointment of Uttam Prakash Agarwal, a former president of the Institute of Chartered Accountants, as an independent director and probable future head of the bank’s audit committee may not be the most appropriate choice. The concerned individual has dabbled in politics and failed to be elected from a suburb of Mumbai in a 2014 Maharashtra state election as a representative of a political party. Appointing chartered accountants-cum-politicians may not be the best way to restore confidence in the bank at such a critical stage.

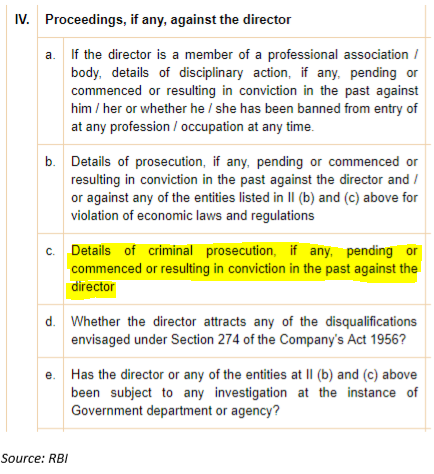

On November 14, 2018 at 8:21 pm, Yes Bank informed the stock exchanges that its chairman, Ashok Chawla, had submitted his resignation with immediate effect. Chawla’s resignation was inevitable, since he was named in a chargesheet filed by the Central Bureau of Investigation (CBI), India’s premier federal investigation police, on July 19, 2018. The criminal investigation pertained to the time when Chawla was the Secretary of Economic Affairs in the Ministry of Finance. The moment he was charge sheeted by the CBI, his days as a director on Yes Bank were numbered, as RBI’s ‘Fit and Proper’ Criteria for Directors on the Boards of Banks, IV b disqualified him as a director on any bank. In fact, Chawla should have resigned immediately when the CBI filed the charge sheet, but, sadly, he waited nearly 4 months to take this decision.

Yes Bank also announced the immediate resignation of Vasant Gujarathi, independent director and head of the audit committee of the board, who was appointed on April 23, 2014 to the board. Although his resignation was attributed to “personal commitments”, Gujarathi was a member of the audit committee since his appointment on the board, and was the chairman of the audit committee since April 27, 2016. It appears that his belated resignation may be on account of the regulator pulling up the bank for fudged accounts for the years ended March 31, 2016 and March 31, 2017. In a strange anomaly, Rajat Monga, the Chief Financial Officer who certified those years of fudged accounts, was rewarded with a board seat, subject to RBI approval.

Yes Bank simultaneously announced the appointment, with immediate effect, of Uttam Prakash Agarwal as an independent director for a term of 5 years, subject to shareholder approval. The bank’s press release on his appointment as a replacement for Gujarathi focused on his professional experience as a chartered accountant and the “the youngest President of ICAI [Institute of Chartered Accountants of India] 2009-10”. Strangely, and perhaps intentionally, the bank omitted to mention that Agarwal had contested the Maharashtra state elections in 2014 for the assembly seat of Borivali, a suburb of Mumbai, as a candidate of the Shiv Sena party, but had lost the elections. Interestingly, during that election, media had documented that,

“Some students [below 18 years of age] of a local school in school uniform and during school hours were seen holding up placards and Shiv Sena flags, urging people to elect Agarwal.”

Although the said article quoted Agarwal as stating that the party had not asked any student to campaign for him, it also quoted an election official stating that election laws in India prohibit the participation of students in election campaigns.

While it is commonplace for corporate chiefs to cultivate the ruling party, it is not the normal practice for private sector banks, or private corporate sector entities in general, to nominate politicians as directors, as this adds an additional dimension of political risk. Investors should be cautious regarding Agarwal, a chartered accountant-cum-politician, replacing Gujarathi on the audit committee. Indeed, Agarwal may be even be appointed as the chairman of this important sub-committee of the board.

On November 15, 2018 at 7:58 pm Yes Bank announced the resignation with immediate effect of O.P. Bhatt as an external expert of the ‘Search and Selection Committee’ for appointing a new CEO of the bank. This committee worked along with the bank’s nominations and remuneration committee to select a new CEO and it is strange that Bhatt should resign at this stage citing “potential conflict of interest”. All these departures in such a short time frame do not bode well for the bank.

Reacting to the resignations of the bank’s chairman and the head of its audit committee, Yes Bank’s stock tanked by 7% to Rs 206 on November 15, 2018 and is currently down a further 7% during market hours on November 16. The bank is now plunging into the new year without a chairman, and with its promoter-CEO being forced by the regulator to step down as CEO on January 31, 2019. The status of the appointments of its executive directors also remains uncertain as it requires the approval of the successors of Ashok Kapur as joint founders and the approval of the RBI, both of whom have had reservations pertaining to the choices of Rana Kapoor.

Yes Bank’s stock has halved since August 20, 2018 on leadership concerns, and the nominations by the board of new appointees such as Rajat Monga, the former CFO who signed off on two successive years of fudged accounts, and now Uttam Prakash Agarwal, do not inspire confidence regarding the quality of leadership at this troubled bank.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I have no position in any of the securities referenced in this Insight. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.