Hemindra Hazari

In the run-up to the upcoming Budget, shares on the stock market have rallied, raising hopes of the long delayed revival in private sector capital expenditure and corporate earnings. But against the backdrop of an already slowing economy followed by the ill-conceived, disastrously executed demonetisation, might this be...

Hemindra Hazari

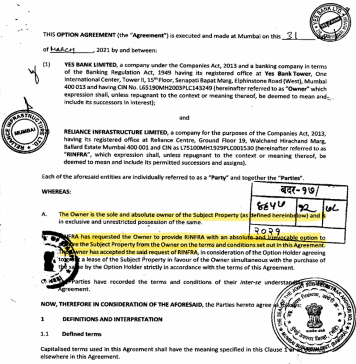

In the ongoing demonetisation saga, the credibility of India’s central bank keeps plunging to new depths.

Repeated contradictory notifications, restrictions on cash withdrawal of deposits, inadequacy of new notes to replace the withdrawn high denomination notes, and a complete lack of transparency are just a handful of examples....

Hemindra Hazari

Money laundering is not alien to Axis Bank. On July 26, 2011, an investigation by the online media firm, Cobrapost, showed officials of both private and government banks soliciting clients for laundering black money. The sting videos revealed these practices to be widespread at Axis Bank . In June...

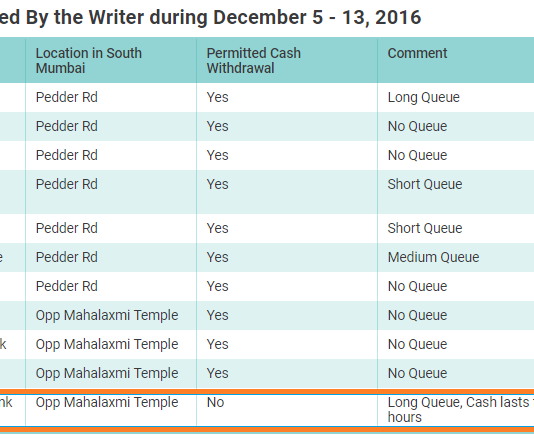

Customers of HDFC Bank, India’s most valuable and one of the most expensive banks in the world have been hard hit in the ongoing demonetisation saga in India. Depositors of HDFC Bank have been complaining about their inability to withdraw the Reserve Bank of India’s (RBI) stipulated cash withdrawal...

Hemindra Hazari

In India’s darkest economic hour, with the economy starved of cash, the prime minister extolling the people on the virtues of sacrifice and the Reserve Bank of India (RBI) governor finally emerging from his 14-day absence and silence to reassure citizens, one critical individual has gone “missing”. A...

Contrary to the expectations of life insurance deregulation, some of the large private companies have established their business model on ULIPs, a mutual fund product and in doing so sacrificed the objective of raising genuine life insurance and long-term savings for the economy. In retrospect, the liberalisation of the life insurance sector provided a license to open a casino.

Hemindra Hazari

Risk management is the control and nerve centre of a bank. The independence of control and vigilance functions like risk management and audit has to be fiercely protected by the board of directors and the banking regulator. So when a major bank starts downgrading its chief risk officer...

Hemindra Hazari

There are high hopes that Urjit Patel, the new RBI governor will act to revive bank lending and thereby do his bit for the economy. But that would require him to make the right diagnosis in the first place. The recently released RBI Annual Report at least shows no sign...

Hemindra Hazari

The government’s decision to appoint Urjit Patel, the current deputy governor of the Reserve Bank of India (RBI), to replace Raghuram Rajan as governor of the central bank was met with a chorus of approval by the media, and by captains of industry and financial capital who proclaimed...

Hemindra Hazari

The media has gone overboard on the government of India’s decision not to give Raghuram Rajan, the Reserve Bank of India (RBI) governor, a second term, and focused on how the government is unable to retain an internationally acclaimed economist. However, now that Rajan is going, we need...