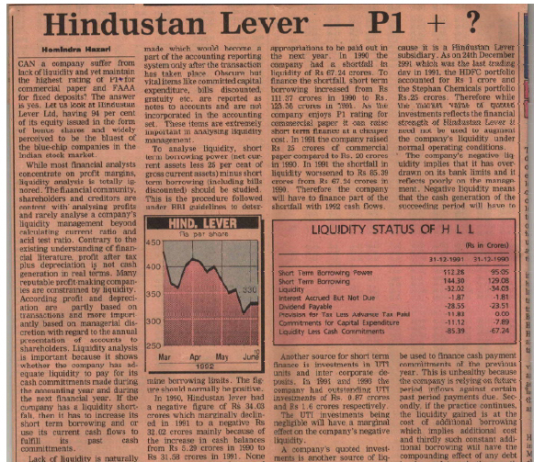

Debate with CRISIL on providing the highest rating of P1+ to Hindustan Lever

HLL-3Download

Hemindra Hazari

The Economic Survey is the flagship document of the Ministry of Finance, presented by the finance minister to parliament on a day prior to the release of the Union Budget. This prestigious economic document is the responsibility of the chief economic adviser to the Indian government and is widely...

EXECUTIVE SUMMARY

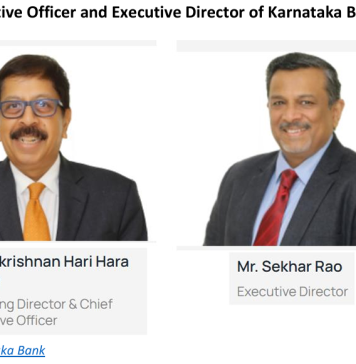

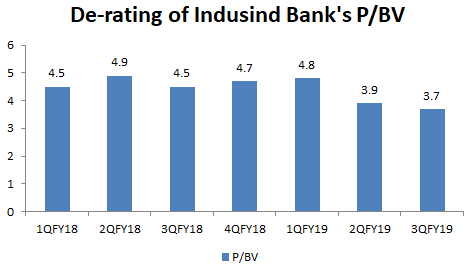

Indusind Bank’s reckless decision to provide a Rs 20 bn (8% of the bank’s capital) unsecured bridge loan to IL&FS, an insolvent infrastructure company has led to a significant de-rating of its valuation multiple. In the 3QFY2019 results call, Ramesh Sobti, the bank’s CEO believes that the bank...

The ICICI Bank Board recently staged a ringing defence of its Chief Executive Officer (CEO), Chanda Kochhar with a categorical press statement reposing trust in her. Now that statement has blown up in the board’s face. A new exposé has revealed the smoking gun: Kochhar and her family were...

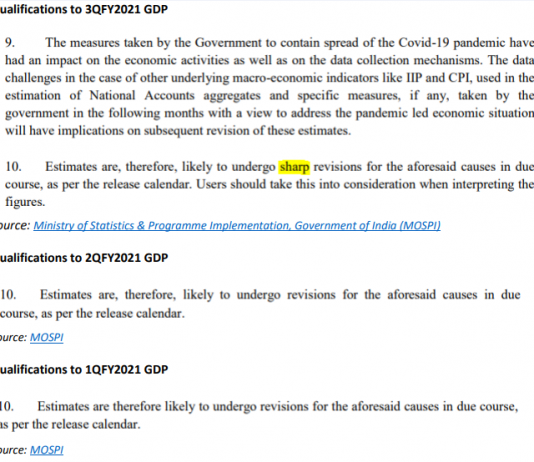

EXECUTIVE SUMMARY. A noteworthy feature in the 3QFYGDP estimate is its dubious credibility, as indirectly admitted by the official statistical agency itself. In the 1QFYGDP and 2QFYGDP, while the National Statistical Office (NSO) had acknowledged that, on account of the lockdown, the estimates are “likely to undergo revisions” the...

EXECUTIVE SUMMARY

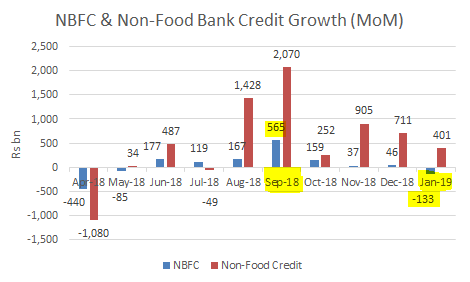

For the beleaguered non-bank finance company (NBFC) sector, banks are the single largest component of external funding. This source peaked at the end of September 2018, in the aftermath of the default of IL&FS, a private unlisted infrastructure developer and financer. However, in the beginning of the last...

State Bank of India (SBI), India’s largest bank, became even larger with the merger of its five commercial banking subsidiaries on April 1, 2017.

Leading up to the All Fool’s Day merger, in mid-February 2017, finance minister Arun Jaitley was confident the step would make the bank a global player; a month...

Hemindra Hazari 27 March 2017

Can half the workforce of rural India be considered “marginal to the economy”? That, it appears, is what Lord Meghnad Desai, eminent economist, Gujarat-born and UK-naturalised Labour life peer and Indian Express columnist, believes.

Desai has had a notable academic career, earning his doctorate at the University of...