EXECUTIVE SUMMARY. Nearly a year after Axis Bank truncated the responsibilities of its Chief Risk Officer (CRO) by transferring corporate credit risk to the...

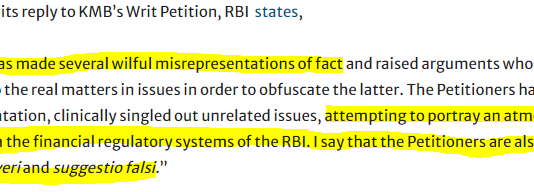

On December 14, 2020, Kotak Mahindra Bank (KMB) informed the exchanges that the Reserve Bank of India (RBI) had approved the appointment of Prakash...

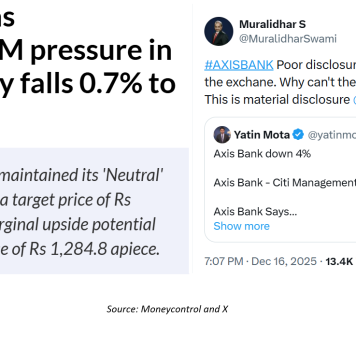

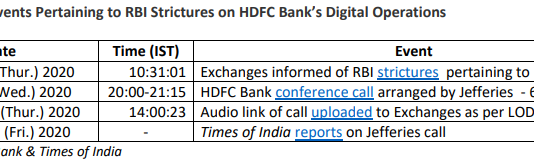

EXECUTIVE SUMMARY. It was unfortunate that HDFC Bank decided to provide selective disclosure at a conference call hosted by Jefferies. Only 63 institutional investors...

EXECUTIVE SUMMARY. The Reserve Bank of India’s (RBI) decision to temporarily put a halt to all digital launches of HDFC Bank’s financial products and...

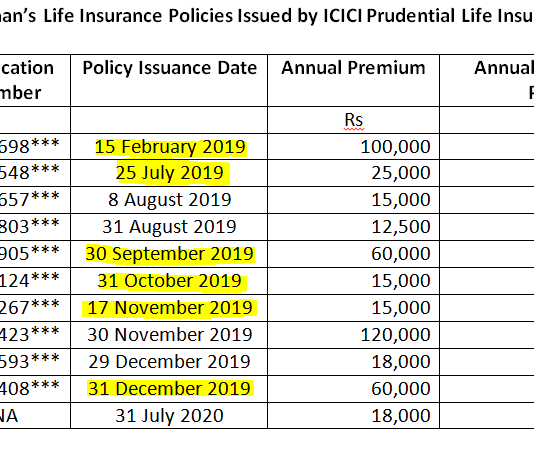

EXECUTIVE SUMMARY. Despite ICICI Prudential Life Insurance (IPru Life) reporting improvement in long-term persistency ratios, there are worrying examples of brazen mis-selling of life...

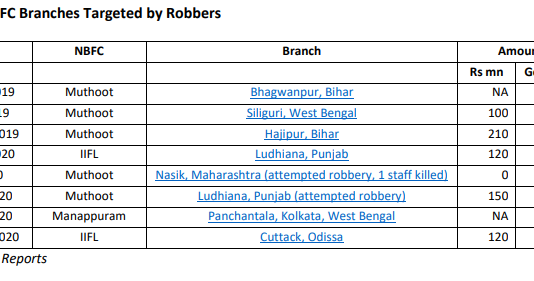

EXECUTIVE SUMMARY. Even though non-bank finance companies (NBFCs) dedicated to providing loans against gold ornaments are highly profitable and enjoy significant net interest margins...

EXECUTIVE SUMMARY.

“What is the robbing of a bank compared to the founding of one?” – Bertolt Brecht

An internal working group (IWG) of the...

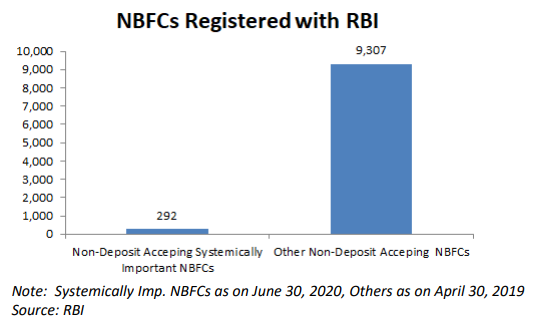

EXECUTIVE SUMMARY. A newly-appointed (on October 9, 2020) deputy governor of the Reserve Bank of India (RBI) has proposed, for discussion, that large systemically-important...

EXECUTIVE SUMMARY. Aditya Puri, the iconic first CEO of HDFC Bank, will finally step down on October 26, 2020 after 26 years at the...

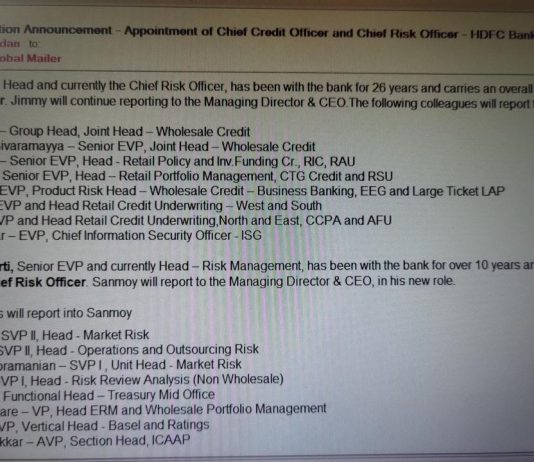

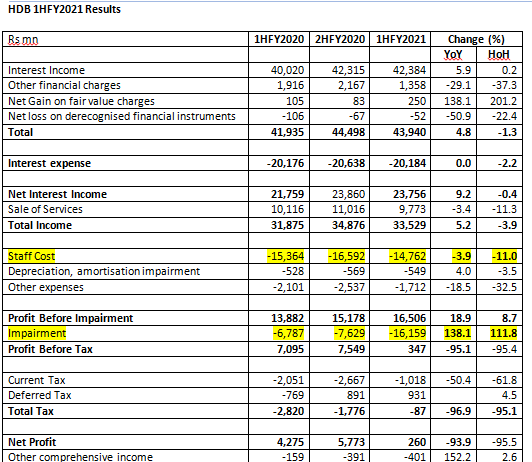

EXECUTIVE SUMMARY. HDFC Bank’s 1HFY2021 results is a study in contrasts to its non-bank finance company (NBFC) subsidiary, HDB Financial Services (HDB). While the...