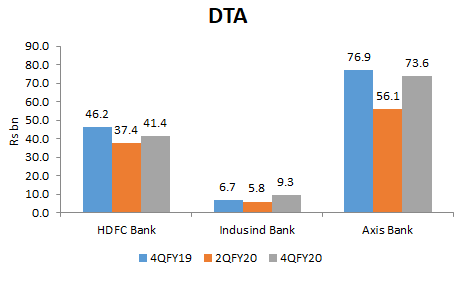

EXECUTIVE SUMMARY. In the case of all the three prominent private sector banks (HDFC Bank, Indusind Bank and Axis Bank) that have declared 4QFY2020 results, sell-side analysts and the business media have chosen to ignore the role of deferred tax assets (DTA) in inflating 2HFY2020 net profits. Even though...

The author acknowledges the contribution of Aspects of India’s Economy (RUPE) for this article

EXECUTIVE SUMMARY. There was a sharp rise in corporate India’s external commercial borrowings (ECB) during the past financial year. Outstanding ECBs for December 2019 rose $ 29 bn y-o-y, to $ 223 bn, or 40% of...

EXECUTIVE SUMMARY. At a time when the economic environment is very volatile, and HDFC Bank’s share price has seen an unexpected slump, comes news of another bizarre corporate governance episode. Once more this paints a sorry picture of the board of India’s number 1 bank by market capitalisation, and...

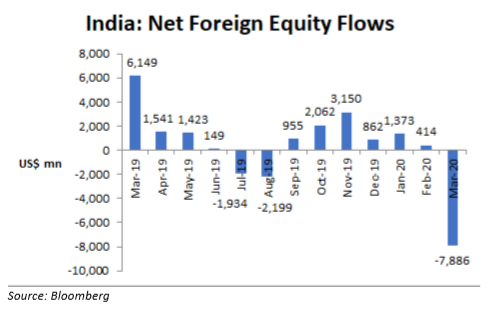

EXECUTIVE SUMMARY. The sharp fall in index heavyweights as a result of foreign equity outflows resulted in panic amongst investors. Prominent sell-side firms arranged many conference calls with blue-chip and market favourite banks like HDFC Bank in March 2020. Unfortunately, apart from informing the stock exchanges, neither the bank...

EXECUTIVE SUMMARY. April 1, 2020, All Fools Day, the first day of FY2021, was an eventful day for Kotak Mahindra Bank (KMB) shareholders, as the share price fell an alarming 9% as compared with a NIFTY-50 decline of 4% and the NIFTY Bank fall of 5%. What should be...

Indusind-Bank-Fiasco-and-the-Sleeping-Sentinels-1Download

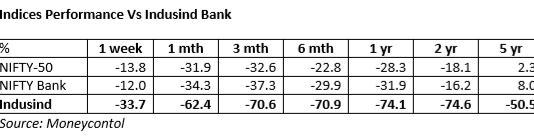

EXECUTIVE SUMMARY. The savage mauling of Indusind Bank’s share price in the last year, and especially in the last month, is a reflection of the unravelling of the bank’s high-risk asset and fee growth strategy. A bank which use to trade at 5x P/BV is currently reduced to being...

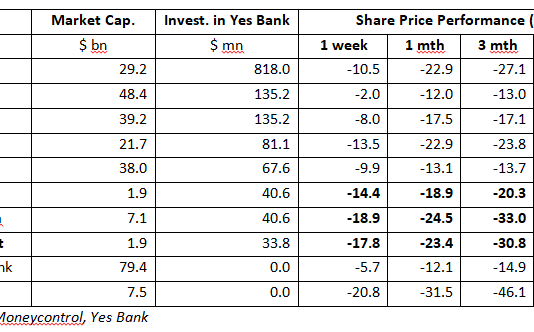

EXECUTIVE SUMMARY. In the SBI-led bail-out of Yes Bank assisted by private sector entities, HDFC Bank, the largest private sector bank, is notably absent, as is Indusind Bank. Stranger still, much smaller banks like Bandhan Bank, Federal Bank and IDFC First have decided to come to the rescue of...

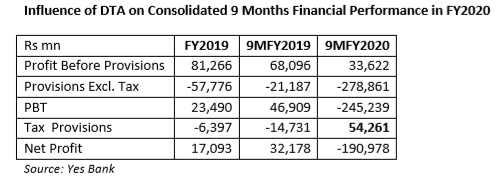

EXECUTIVE SUMMARY. Yes Bank reported a staggering consolidated net loss of Rs 191 bn ($2.6 bn) for the 9 month period ended December 31, 2019 (for 3Q FY2020 the net loss was Rs 185.6 bn). However, even this is understated on account of the huge increase in the deferred...

In light of the moratorium on Yes Bank on March 6, 2020, Smartkarma compiled my research notes from May 15, 2017 where I had consistently highlighted my concerns on the bank to create this ebook.

Special-Report-How-Independent-Research-Found-a-Fatal-Flaw-with-Yes-BankDownload