Leadership is

unravelling at Yes Bank and the stock is tanking. In the dark hours of November

14, the bank announced the immediate resignations of Ashok...

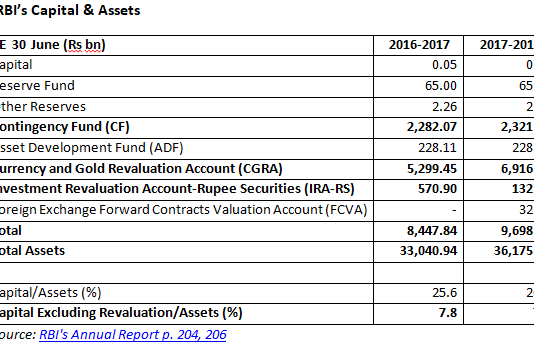

The unseemly public jostling between India’s central bank and the government of India casts a poor light on both institutions. Adhering to unrealistic fiscal...

Romesh Sobti, CEO, Indusind Bank, is a veteran banker with 43 years’ experience. He recently went on record to defend the bank’s substantial bridge...

Indusind Bank, one of the stock market darlings and foreign investor

favourites, startled the capital market with a mere 5% rise in net earnings.

Earnings rose...

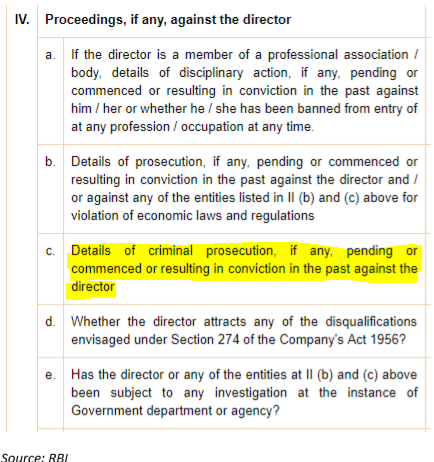

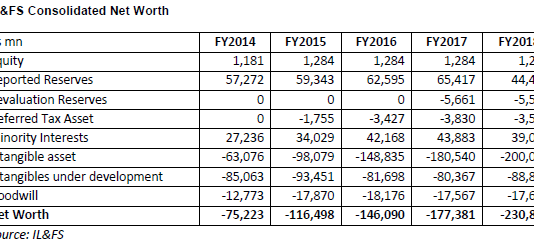

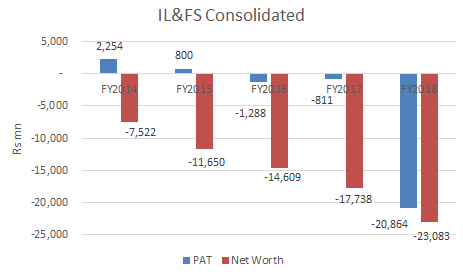

The quality and intellectual calibre of the former directors of insolvent IL&FS was revealed to all when an anonymous former director and ex-member of...

Sunlight is said to be

the best disinfectant; it is also considered fatal for vampires. Whatever be

the reason, the ICICI Bank board has decided to...

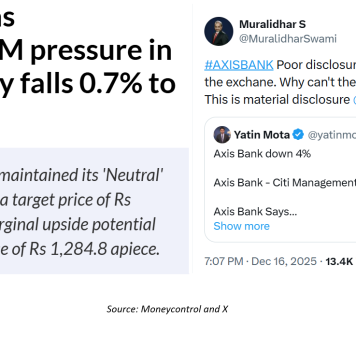

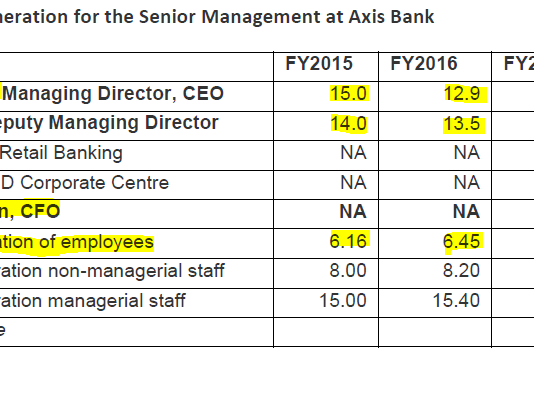

Axis Bank is back in the spotlight for rewarding senior management for a disastrous performance. It was a year in which profits and profitability...

One might think that the ICICI Bank board, worried at the beating its image has taken in recent months, might try to restore public...

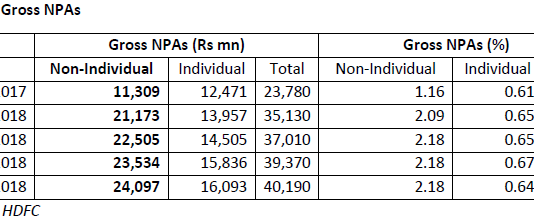

In an earlier insight, More Transparency Was Expected From HDFC Regarding Its Reliance Naval Exposure, on April 19, 2018, this writer had cautioned that...

It seems miracles

do happen. The lame walk, the dying return to life, the blind see – well, maybe

not the last, if they are sell-side...