One might think that the ICICI Bank board, worried at the beating its image has taken in recent months, might try to restore public confidence by selecting an impeccable stand-in for its CEO-under-investigation. But, true to form, the board has selected a gentleman in whose tenure as CEO, ICICI...

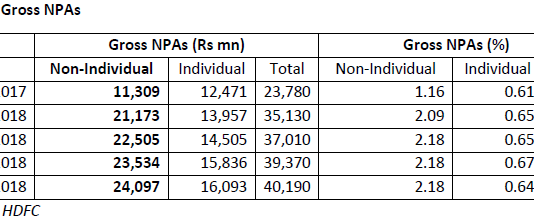

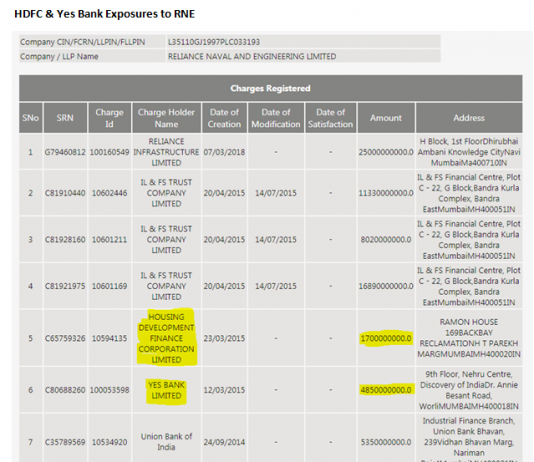

In an earlier insight, More Transparency Was Expected From HDFC Regarding Its Reliance Naval Exposure, on April 19, 2018, this writer had cautioned that RNE was a problem account in the industry and that most banks in the consortium would be classifying the account as a NPA.

On April...

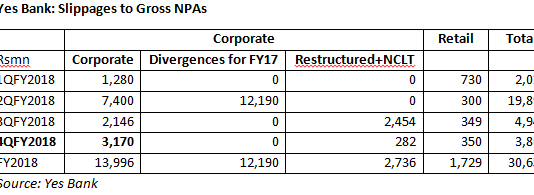

It seems miracles

do happen. The lame walk, the dying return to life, the blind see – well, maybe

not the last, if they are sell-side analysts and the business media, in which

case they keep their eyes closed for life. Had they attempted a close analysis

of Yes Bank’s 4QFY2018 results, they...

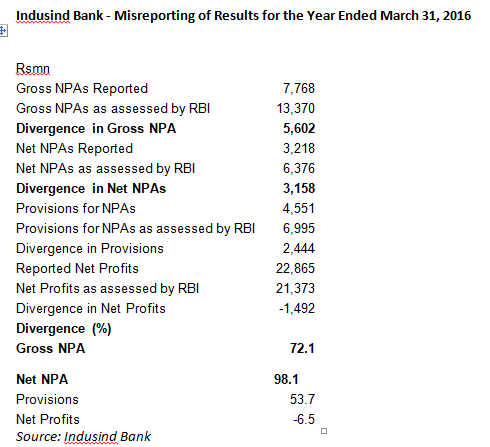

In a stunning blow to the credibility of Indusind Bank, its board of directors, Ramesh Sobti, chief executive officer and Russell I Parera, auditor and partner, Price Waterhouse, the bank reported that it had mis-reported its accounts for the year ended March 31, 2017. This was its second consecutive...

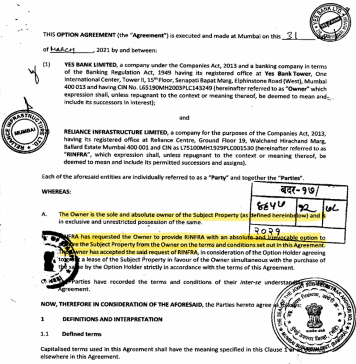

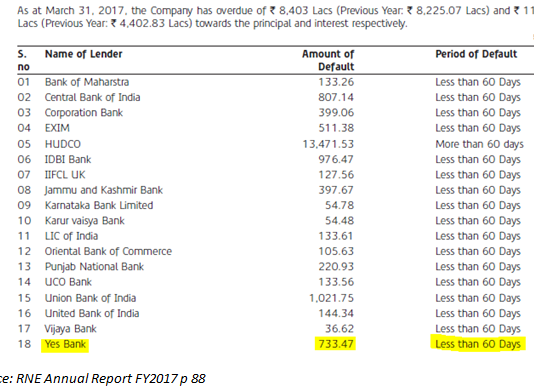

Reliance Naval Engineering (RNE) will in all

likelihood be classified as non-performing by all the concerned banks in the

consortium for the quarter ended March 31, 2018. Long facing difficulty meeting

its financial obligations, the company finally fell short in the December

quarter. In the March quarter, banks in the consortium were unable...

Reliance

Naval Engineering (RNE) will in all likelihood be classified as non-performing

by all the concerned banks in the consortium for the quarter ended March 31,

2018. Long facing difficulty meeting its financial obligations, the company

finally fell short in the December quarter. In the March quarter, banks in the

consortium were unable to...

The ICICI Bank Board recently staged a ringing defence of its Chief Executive Officer (CEO), Chanda Kochhar with a categorical press statement reposing trust in her. Now that statement has blown up in the board’s face. A new exposé has revealed the smoking gun: Kochhar and her family were...

After the Reserve Bank of India (RBI) made clear to the board of Axis Bank that it should reconsider its decision to grant the present Chief Executive Officer (CEO) a fourth term, one would have expected the board to have seen the light. But no, shockingly, the board has...

The shimmering lustre of India’s crown jewel of banking, HDFC Bank, is attributed to its chief executive officer (CEO), Aditya Puri. In a span of nearly 24 years he has taken its market capitalisation to US$ 74.4 bn, easily surpassing State Bank of India, the banking behemoth. The secular...

Retail-focused

new private sector banks, the darlings of the capital market, are facing the

ire of the banking regulator. Nearly two months after the Reserve Bank of India

(RBI) compelled HDFC Bank to classify a large account as non-performing, thus

qualifying the blue-blooded bank for ‘divergence’ (from RBI findings), comes

news that the regulator...