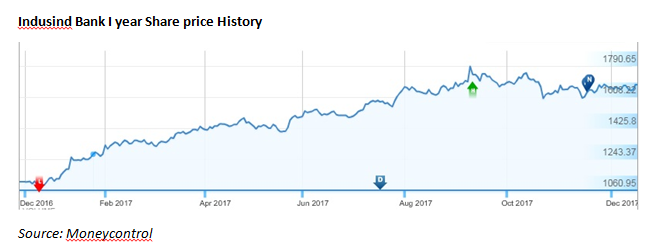

Retail-focused new private sector banks, the darlings of the capital market, are facing the ire of the banking regulator. Nearly two months after the Reserve Bank of India (RBI) compelled HDFC Bank to classify a large account as non-performing, thus qualifying the blue-blooded bank for ‘divergence’ (from RBI findings), comes news that the regulator has fined Indusind Bank for misreporting its results and contravention of regulatory restrictions pertaining to non-fund based facilities for the year ended March 31, 2016. Although Indusind Bank in its latest annual report disclosed significant RBI NPA divergence, the business media and sell-side research conveniently ignored the disclosure, as they are overwhelmingly bullish on the bank. The misreporting of accounts and the penalty by the RBI, though, reflects poorly on the bank and its senior management and should be a warning signal for investors. On December 18, 2017, Indusind Bank will be included in the prestigious Bombay Stock Exchange Sensex index of 30 companies, it is ironic that such a historic event is preceded by a penalty for its accounts not depicting a true and fair view.

On December 13, 2017, in a surprising development, the RBI, the banking regulator penalised Indusind Bank, Rs 30 mn (US$ 0.5 mn)

“for non-compliance with the directions issued by RBI on Income Recognition and Asset Classification (IRAC) norms and contravention of regulatory restrictions pertaining to non-fund based (NFB) facilities.”

On April 18, 2017, a RBI notification instructed banks to disclose the divergence in their reported NPAs as detected by the regulator for the year ended March 31, 2016, in a prescribed format if it exceeded a certain threshold. A day later, when Indusind Bank declared its 4QFY2017/FY2017 results, an analyst asked Romesh Sobti, Chief Executive Officer (CEO), Indusind Bank whether the bank would report RBI divergence. To which Sobti replied,

“All banks will disclose, we will also disclose. There is no skipping that…It should not be a large number.”

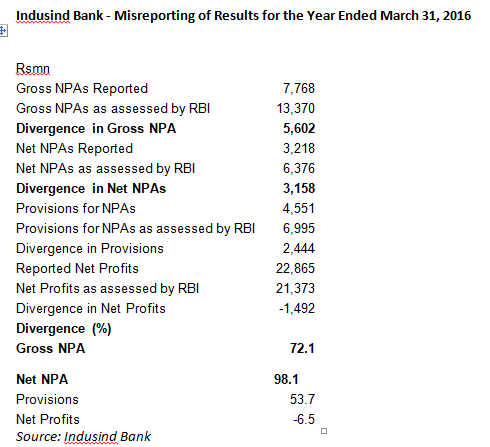

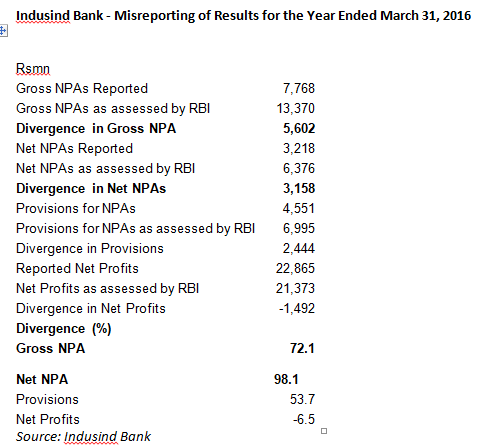

Nearly a month later, when the bank’s annual report for the year ended March 31, 2017 (FY2017) was released, it disclosed that the bank’s gross NPAs divergence for FY2016 was an alarming 72%, far exceeding the RBI’s threshold limit of 15%; its net NPAs, as determined by the RBI, were nearly twice its reported and audited number. And, in contrast to Sobti’s statement that the divergence was universal, prominent banks like the State Bank of India (SBI), HDFC Bank, Bank of Baroda, Bank of India, Union Bank of India and Kotak Mahindra Bank did not report RBI divergence for FY2016.

In a note to the disclosure, the bank stated that of the gross NPA divergence of Rs 5.6bn, Rs 3.56 bn was repaid as of March 31, 2017. Such an explanation is irrelevant as the accounts as on FY2016 were misleading. The entire amount should have been classified as NPA, and when the amount was recovered it could have been reclassified as standard in FY2017. Furthermore, the RBI threshold for reporting divergence at 15% is liberal, as Indian asset classification is rule-based and hence a bank should have marginal difference at best between its reported NPAs and the assessment by the regulator.

Despite the disclosure being present in Indusind Bank’s annual report, sell-side analysts and the media strangely chose not to highlight this critical development. Such an omission was indeed perplexing, as there were no concerns regarding the bank’s asset quality, and the bank was trading at a price to book value multiple of nearly 5x; hence such a development should have been immediately highlighted, as it was price sensitive information.

The only explanation for the omission by the sell-side to broadcast Indusind Bank’s misreporting of its FY2016 results is that the consensus view was bullish on the bank – in end-April 2017, according to Bloomberg, 52 analysts covered the bank and 87% had a “Buy” recommendation. Typically, when the consensus view is bullish and the share price is also rising, sell-side analysts are reluctant to highlight any negative analysis on a stock which is a market favourite, as such companies are prize candidates for corporate access for brokerages. In internal appraisals of sell-side research, corporate access has significant weightage, as analysts arrange meetings with the companies they cover for institutional clients, apart from inviting them for conferences and non-deal roadshows. In such a compromised environment, published research eschews critical analysis of prominent companies. Critical commentary on companies, if at all undertaken by the sell-side is disbursed through non-public communication; whispers, emails, phone calls and one-to-one meetings. The public standing of most sell-side research is to be non-controversial on their coverage and be flag bearers of the companies they cover.

It is also no surprise that even after the RBI imposed a penalty on Indusind Bank for misreporting its FY2016 results, sell-side research has chosen to ignore the development by not publishing any updates and analysis of the regulator’s displeasure. When the gross NPA divergence exceeds 15% of the reported amount and the regulator imposes a penalty, it is a serious offence, as there exists a high possibility of the bank evergreening its bad loans and its entire reported asset quality lacking credibility, and hence sell-side research and the business media should extensively cover the development and further investigate the bank. But even two days after the penalty, this writer is unable to find any sell-side analysis nor any further investigative reporting by the media on this development.

The RBI penalty of Rs 30 mn was imposed on Indusind Bank for two issues: NPA divergence and contravention of regulatory restrictions pertaining to non-fund based (NFB) facilities. In many cases, regulatory action on banks’ NFB facilities pertains to evergreening of loans as banks replace fund-based poor quality loans with guarantees and letters of credit thereby classifying the asset as standard. Replying to a questionnaire, sent by this writer, Indusind Bank said,

“the second count relates to a ‘procedural aspect’ of non fund business which has nothing to do with asset quality issues of such non fund customer.”

Hence it is possible that the regulator fined the bank for not taking permission from the consortium of bankers when it provided corporate(s) with NFB facilities. Such practices are widespread. However, earlier RBI cautioned banks, but did not penalize them when such instances were detected.

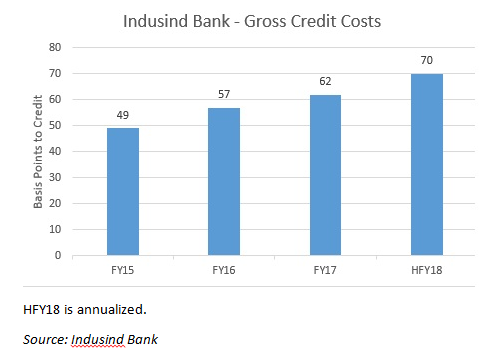

Despite Indusind Bank’s low gross NPA of 1.08% and 26% yoy growth in net profits for the half year ended September 30, 2017 (1HFY2018), annualized gross credit costs have increased. And it is not a healthy sign for a bank to report divergence and be penalised by the statutory regulator for mis-reporting of its accounts. Such an issue casts poor light on the bank’s CEO, audit committee and the auditor, and even though, thankfully, the divergence was not repeated in FY2017, investors need to be vigilant regarding Indusind Bank. On December 18, 2017, Indusind Bank will be included in the prestigious Bombay Stock Exchange Sensex index of 30 companies. It is ironic that such a historic event is preceded by a penalty for its accounts not depicting a true and fair view.