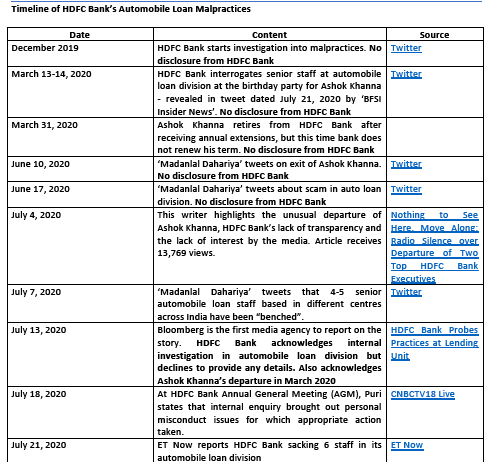

EXECUTIVE SUMMARY. With the Reserve Bank of India (RBI) imposing a penalty of Rs 100 mn (US$ 1.4 mn) on HDFC Bank, the curtain...

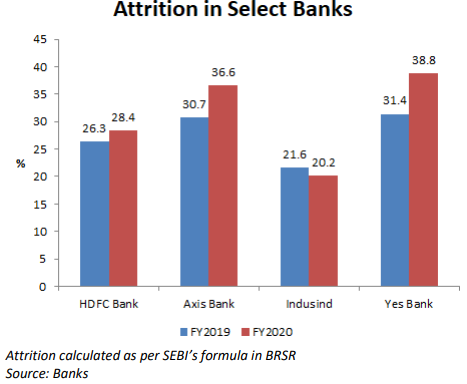

EXECUTIVE SUMMARY. While Axis Bank has recovered from its corporate non-performing asset (NPA) crisis, it seems to be in the midst of a management...

EXECUTIVE SUMMARY. In a little-publicised step, the Securities and Exchange Board of India (SEBI) has directed the first 1,000 companies by market capitalisation on...

EXECUTIVE SUMMARY. Documents of the Reserve Bank of India (RBI), like those of most central banks, are usually dry, sober statements of fact and...

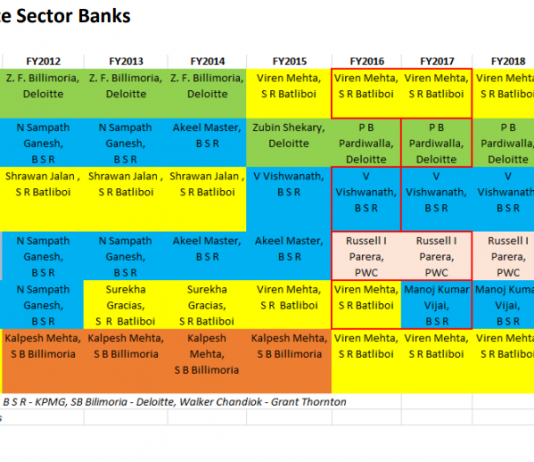

EXECUTIVE SUMMARY. The integrity of audits in private sector banks and non-bank financial companies (including housing finance) has received a major boost, while large...

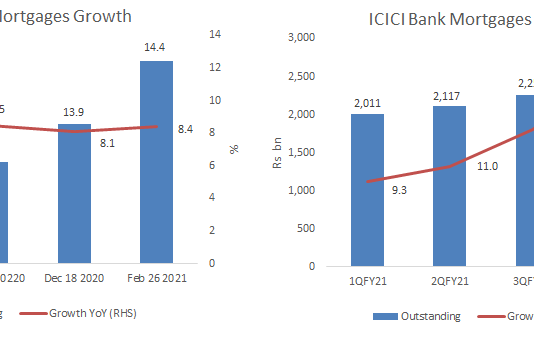

EXECUTIVE SUMMARY. ICICI Bank posted strong results for 4QFY2021 with standalone net profits up 260% yoy, but 11% down qoq to Rs 44 bn....

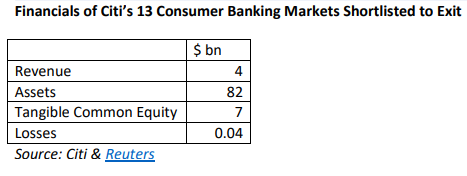

EXECUTIVE SUMMARY. Citi’s decision to withdraw from consumer banking in 13 geographies, including India, and focus instead on corporate/institutional banking, is a lesson in...

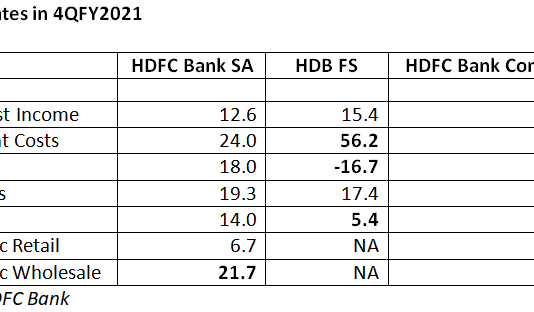

EXECUTIVE SUMMARY. There are two features worth noting in HDFC Bank’s 4QFY2021 results. The first is the continuing de-emphasis on retail loans. This was...

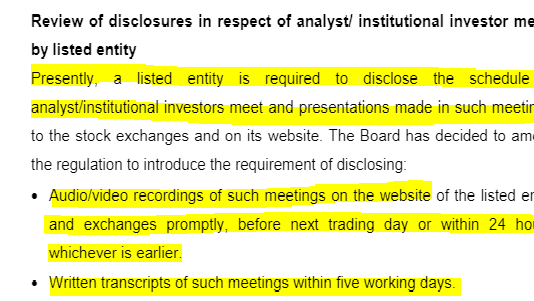

EXECUTIVE SUMMARY. In a major development, the Securities and the Exchange Board of India (SEBI) has finally instructed listed entities to disclose the audio/video...

EXECUTIVE SUMMARY. Following in the footsteps of Raghuram Rajan, who during his tenure as Reserve Bank of India (RBI) governor accepted the fifth Deutsche...