By Niha Masih

January 28, 2023 at 4:57 p.m. EST

Article can be read here

2 min read. Updated: 04 Aug 2020, 10:52 PM IST Shayan Ghosh

It remains to be seen how Jagdishan steers HDFC Bank's Massive loan book of over ₹10 trillion

MUMBAI : With the Reserve Bank of India (RBI) clearing his appointment as the next chief executive of HDFC Bank, Sashidhar Jagdishan, has reached the...

Former ICICI Bank CEO Chanda Kochhar has been indicted by the Justice BN Srikrishna panel for violating the bank’s code of conduct. Following this,

the bank has decided to consider her resignation submitted on October 4, 2018 as a ‘termination’ and recover the bonuses paid to her since April 2009,

which...

Sitharaman's decision to merge 10 banks into four may be riddled with leadership and decision-making challenges

BY SALIL PANCHAL, Forbes India Staff 3 min read PUBLISHED: Sep 10, 2019 11:04:29 AM IST UPDATED: Sep 10, 2019 11:12:56 AM IST

Finance minister Nirmala Sitharaman’s mega bank-merger plan, if successful, will see 10 government-owned banks being...

Former economic affairs secretary Shaktikanta Das has been appointed as the new Governor of the Reserve Bank of India, an order from the Department of Personnel & Training said on Tuesday evening.

Das is a 1980 batch IAS officer of Tamil Nadu cadre and will hold the post for three-year term. He...

3 min read. Updated: 16 Dec 2019, 12:38 AM ISTShayan Ghosh

As many as 10 banks disclosed they had under-reported NPAs of close to ₹24,000 crore in the year ended 31 MarchThe country’s largest lender, SBI, reported the largest bad loan divergence so far this year, under-reporting gross NPAs of ₹11,932 crore

Topics...

An independent banking analyst Hemindra Hazari wrote a report questioning the corporate governance practices of companies which have employed her.

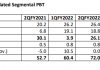

“Q1 FY20 is expected to be poor on account of stressed loans slipping to NPAs,” says Hazari.

THE NEWS SCROLL 17 FEBRUARY 2020 Last Updated at 8:56 PM | SOURCE: IANS

''RBI relaxation led to Uday Kotak gaining over Rs 23,000 cr''

New Delhi, Feb 17 (IANS) The relaxation in norms for private sector banks have resulted in a staggering windfall gain of Rs 23,300 crore to Uday Kotak,...