A strange picture of India’s financial system is being drawn, where privatisation is being pushed even as critical analysis and reporting on private sector entities is slowly being discouraged.

Hemindra HazariBANKING29/DEC/2017

As we bid farewell to 2017, The Wire looks back at some of the markers of disruption that affected different spheres, from politics and economics to technology and films.

Sometimes a denial is revealing. On December 22, the Reserve Bank of India (RBI) and the Union secretary for financial services felt it necessary to clarify that there were no plans afoot to close down some public sector banks. This development followed the RBI’s decision to initiate Prompt Corrective Action (PCA) on Bank of India (BoI), a large and prominent government bank, on December 20.

BoI joined the ranks of nine other government banks whose operations were restricted in the last ten months.

Whether or not there were plans to close down select government banks is not the question here. The question is, why have such rumours acquired so much force that the central bank and the Centre feel it necessary to issue an official denial? Behind the susceptibility to rumours lies a series of policy measures by the two authorities in recent years. After nearly five decades of relative stability and security following bank nationalisation, these measures have injected a new uncertainty and growing sense of panic into India’s financial system.

In 2008-09, India, and particularly its central bank, won praise worldwide for having protected the country’s financial system against the types of excesses which elsewhere had engendered a global financial crisis. However, since then, in the name of economic reforms and to stimulate private sector investment in the economy, the government, with implicit RBI approval, has followed a reckless course.

Firstly, it pushed government banks to lend to private-public partnerships (PPPs) in infrastructure with their eyes closed. In doing this, it ignored the red flags of unrealistic PPP bids (often marked by moral hazard, gold plating etc), to the extent that India became a global leader in PPPs.

When this bubble finally burst, the Indian government did not resolve non-performing assets (NPAs) decisively with aggressive recovery and recapitalisation. The government also left several public banks headless for long periods, with the newly-formed Bank Board Bureau rendered more or less irrelevant.

A recapitalisation of banks was belatedly announced in October, but since then there has been little clarity on how it will be implemented, and how much capital the government will allocate for specific banks.

In the last year, the government’s disastrous demonetisation, followed by a poorly implemented Goods and Services Tax (GST) regime, created a sense among people that the NDA government is capable of implementing illogical decisions with devastating effects on the general public. What adds to this no doubt are the regular, semi-official ‘leaks’ to the media on ‘consolidation’ of government banks – i.e, takeovers or mergers. This generates insecurity among existing clients of the banks targeted for consolidation.

This insecurity has also been greatly heightened by the bail-in clause of the Financial Resolution and Deposit Insurance Bill, whereby creditors’ money, including that of depositors will be used to recapitalise distressed banks.

What is particularly confusing is that even after the Centre announced a bank recapitalisation plan, which should have addressed the capital requirements of the banks, the RBI has now initiated a PCA on a large government bank.

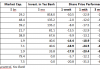

Nifty PSU Bank Index – 1 Year Performance

Source: Moneycontrol

All these measures by the government, with the full support of the central bank-cum-banking regulator, have created a sense of disquiet among depositors and investors, notwithstanding the surge in share prices post the government’s announcement of a recap on October 24. The belated manner in which the government has addressed the NPA issue, the huge provisions banks had to provide upfront for cases referred to the National Company Law Tribunal and the lack of specific details on the recapitalisation have cumulatively had a significant negative impact on the financial position of government banks. With 10 out of a total of 21 government banks under the PCA regime, and with stressed (NPA plus restructured) loans for all of them at 16.2% as on September 30, government banks’ market share is declining, while that of private sector banks has been increasing.

Also Read: Auditor Extraordinaire: The Curious Case Of NPA Underreporting In India

Whether this is a deliberate strategy by the government under the influence of the International Monetary Fund and the World Bank to forcibly contract government banks’ market share and allow private banks to increase theirs, or is mere bungling by the government, remains uncertain.

Air India, the government-owned airline, is an example of how the government deliberately undermined a state-owned entity. It withdrew from profitable routes and handed these over to private airlines; under-invested for a long period while private sector airlines were expanding; then suddenly took on huge debt to finance a wild excess of aircraft acquisition; forced an ill-planned merger with the erstwhile Indian Airline and eventually used the results of this mismanagement to justify the privatisation of India’s national carrier. Whether a similar fate awaits government banks remains to be seen.

NIFTY Private Banks Index – 1 Year Performance

Source: Moneycontrol

Are private sector banks really any more prudent, as the secular rise in the Nifty Private Bank Index would seem to suggest? Despite not having the handicap of being dictated to by the government, the new private sector banks like ICICI Bank and Axis Bank have been imprudent, with stressed loans at 8.8% and 7.7% respectively as on September 30.

Worse, most of them (Yes, Axis, ICICI, Indusind and even HDFC Bank) have been caught by the regulator trying to deceive the public, by significantly under-reporting their NPAs. Yes Bank and Axis Bank reported NPA divergence for two consecutive years, revealing systemic issues at both the banks. The sheer scale of the under-reporting of NPAs by the new private sector banks should have resulted in stringent action by the board of directors on the banks’ chief executive officers (CEOs) and chief financial officers (CFO), who bear the final responsibility along with the audit committees and the auditors for the integrity of the accounts. In contrast, in IDBI Bank, which also reported NPA divergence for FY 2016, the government, as the majority owner, acted swiftly, and prior to the declaration of the bank’s 4Q FY 2017 results removed the bank’s CEO and transferred him to another smaller bank. But bizarrely, Yes, Axis, Indusind and ICICI Bank, not only retained their same CEO and CFO who had certified FY 2016 accounts but also rewarded them with increments, bonuses and additional stock options. To date, the RBI has nominally fined some of the new private sector banks for fudging their accounts and no stringent action against the senior management or their auditors has been undertaken.

Misreporting of accounts is a serious offense, as the credibility of the entire accounts is at stake. Yet this has not created a crisis of confidence in the private sector banks, because of the near-unanimous media plus analysts saying all is well. The refusal of analysts and the media to highlight negative developments in banks that are the market favourites is not surprising. Analysts’ remuneration is influenced by arranging meetings with their companies under coverage for their institutional clients and hence any critical analysis of companies will entail the concerned corporate blocking access to that analyst.

Similarly, India’s business media is dependent on corporates for exclusive interviews with CEOs and CFOs and hereto critical reporting will result in a denial of corporate access. The business model of media is also dependent on corporate advertising. As a result, when it comes to prominent and large companies, the media and sell-side research, instead of being watchdogs, have become lapdogs. Thus, critical analysis and reporting is deliberately ignored.

The public’s confidence in government banks has undergone a sea change from the past. In FY 1996 when Indian Bank reported a huge loss of Rs 1,727 crores rendering the bank insolvent, retail depositors did not panic as they had faith in the government that their deposits were safe. However, ICICI Bank, under the leadership of K.V. Kamath had not one but to two runs on its deposits in 2003and 2008 revealing the public’s perception, despite the bank reporting profits and being the largest private sector bank by assets.

A strange picture of India’s financial system is being drawn. Where there should be no crisis because of sovereign ownership, a crisis is emerging on account of government bungling, or a plan to eventually push through privatisation and assist private sector banks increase their market share. And where there is a problem of serious misreporting of accounts there is no panic as there appears to be a cover-up with negligible publicity and mild regulatory disapproval.

Hemindra Hazari is an independent market analyst.