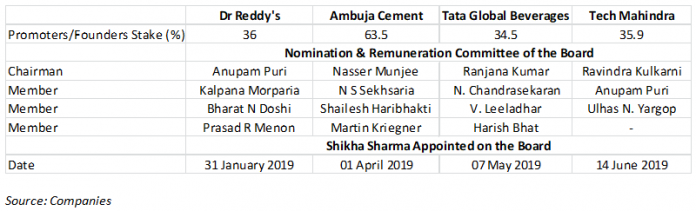

EXECUTIVE SUMMARY. On June 14, 2019, Tech Mahindra joined the ranks of Tata Global Beverages, Ambuja Cement and Dr Reddy’s in appointing Shikha Sharma as an independent director. Private equity firm KKR had also appointed Sharma as an adviser for their alternative investments. The irony of publicly-owned and listed blue-chip companies eagerly seeking Sharma for the prestigious position of independent director on their boards is that she had a poor track record and an unceremonious exit as chief executive officer (CEO) of Axis Bank. On her watch in Axis Bank, senior management personnel were rewarded for epic mismanagement, poor operational risk controls led to staff being arrested for money laundering, whistle-blowers were persecuted, and accounts for two consecutive years were fudged, which finally led to the banking regulator effectively booting her out as CEO. Any one of these issues should have disqualified her for any prominent position in publicly-owned and listed companies. Indeed, with such an embarrassing exit, the private corporate sector should have boycotted her, but instead she has been welcomed with open arms to join their boards of directors. Her appointments on prestigious boards lays bare how corporate governance is actually practised in India, where a candidate with such a dismal track record is eagerly sought after to grace boards.

Recent Posts

Most Popular

IndusInd Bank Board Protects Senior Executives Responsible for Fraud

One of the most shocking episodes in the history of Indian banking was revealed by The Wire.in in a recent exclusive: namely, that the...

Tata’s Outside CEO Battles Multiple Crisis After Bad Year

“For the future growth of the Tata group, Chandra has to find new businesses which can replace TCS’s cash generation which at this time...

Not a Private Matter: Did Axis Bank Share Price Sensitive Information to a Select...

An ordinary meeting of Axis Bank on December 15, 2025 with institutional investors had an extraordinary outcome, one which may need to be probed...

Does the IndusInd Board Run the Bank? Or Is There a Centre of Power...

Ashok Hinduja, chairman, IndusInd International Holding, told the press recently:

"Could you have as a promoter taken steps to avert the crisis at IndusInd Bank?

Money...

Cobrapost Expose on Cholamandalam & Murugappa Group | Cobrapost Press Conference Live Lootwallahas 2

https://www.youtube.com/live/JjL1S77TQXA

Venue: Press Club of India, New Delhi.

My commentary starts from 30:00 mins.