As HDFC Bank awaits the lifting of its credit card ban, it is strengthening its technology architecture. But will it be able to recover lost ground?

BY SALIL PANCHAL, Forbes India Staff INFOGRAPHICS BY PRADEEP BELHE PUBLISHED: Jul 2, 2021 06:34:49 PM IST UPDATED: Jul 2, 2021 07:26:15 PM IST

When Sashidhar Jagdishan, the managing director and CEO of HDFC Bank, publicly and upfront apologised to shareholders in their integrated annual FY21 report released in June—about issues relating to technology outages the bank had been facing and a ban imposed on it to issue new credit cards—the move was rare and commendable. It is extremely unusual for a corporate leader, more so of a mega bank, to use the words ‘sorry’, ‘justifiably’ and ‘fix the problem’ in a message to investors. Consider the fact that in the past several years, public sector banks (PSBs) have, in the case of glaring divergences in reporting non-performing assets (NPAs), mentioned these only in the notes to accounts to the financial statements, as mandated. There were no regrets, explanations or concerns.

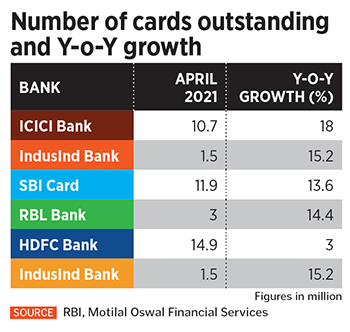

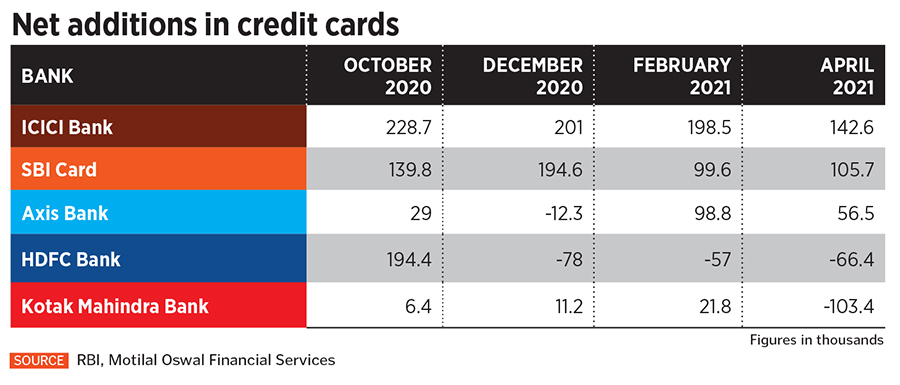

For HDFC Bank, India’s largest private lender by assets, internal crisis—in the form of inquiries, penalties and bans imposed by the regulator Reserve Bank of India—is unfamiliar territory. It has not only caused embarrassment for the bank but has also enabled ICICI Bank—one of its rivals in retail banking—to gain market share in the credit card market alongside SBI Card since December 2020, at the expense of HDFC Bank (see table). Despite a strong set of earnings through healthy revenue growth and steady asset quality, valuations for HDFC Bank have dipped over the past year while those for ICICI Bank have risen in the same period. Improved quarterly earnings have boosted investor sentiment for ICICI Bank; the stock has outperformed the Nifty Bank index, gaining 21.4 percent in 2021 against just 10.9 percent for the index and only 3.8 percent for the HDFC Bank stock in 2021.

While it is quite likely that HDFC Bank will climb back to normalcy in the credit card business when the ban is lifted, the longer it is out of the market the more it will hurt the bank. As of now, the ban is yet to be lifted, with HDFC Bank awaiting communication from the RBI. HDFC Bank, with a 24 percent market share, was the market leader in issuances of new cards, which ranged between 1.5 to 2 lakh cards every month, prior to the ban.

The hard rap on knuckles

In the space of the past two years, HDFC Bank has suffered three large outages at its data centre: First on November 27, 2018, when its next-generation mobile banking application crashed due to a massive surge of customers; the second during the first few days of December 2019, when net banking and mobile banking applications suffered problems and then again in November 2020.

In the fallout, the RBI in December last year issued an order which temporarily banned HDFC Bank from launching its digital business-generating activities planned under its programme Digital 2.0, including issuing new credit cards.

In another embarrassing development, the RBI in May this year penalised HDFC Bank Rs 10 crore for wrongfully selling third-party non-financial products (GPS devices) to its auto loan customers between 2015 and 2019. This contravened the provisions of the Banking Regulation Act 1949. The RBI action came after HDFC Bank probed into the matter based on a whistleblower’s complaint to the RBI regarding the irregularities.

The bank had taken remedial action against six employees for improper lending in the auto loans division, while the one-year extension for its departmental head Ashok Khanna was not approved and he retired in March 2020. “For many years we had been bundling the financing of GPS systems and cars. The teams believed this was a routine lending activity,” Jagdishan said in the 2021 annual report.

Jagdishan, an HDFC Bank veteran of over 25 years and chosen, in 2019, by the bank as the ‘strategic change agent’, has usually only seen external crisis such as rising NPAs, poor credit offtake and the impact of the first wave of the pandemic. Rarely has the bank witnessed internal battles of this nature.

The fact that Jagdishan’s predecessor Aditya Puri, over a 26-year period, built a bank that commands a market capitalisation of $109 billion (as of July 1), meant that he always had huge shoes to fill. Jagdishan’s doubters say after the RBI actions he had little choice but to admit to the problems the bank faced and try and start afresh.

This is probably what gave rise to HDFC Bank’s ‘Project Future–Ready” which Jagdishan announced in April this year, in an effort to create the necessary strategic and execution agility for the bank to serve its customers. It includes redoubling its focus on verticals such as retail, corporate, private banking and increasing its focus on commercial banking, particularly the micro- and small and medium enterprise vertical. HDFC Bank’s MSME loan book has grown 30 percent year-on-year to touch Rs 2.02 lakh crore as of December end.

The bank has also identified four delivery channels: branch banking, tele-service/sales (including virtual relationship manager channel), sales channels aligned with the business verticals, and digital marketing.

There is a certain amount of humbleness in the new regime. In an analyst call hosted by Morgan Stanley India on June 9, Jagdishan had said: “I must thank the regulator for rapping us in December 2020 as it has made us run faster and think ahead of time.” In several other analysts’ calls, he has reiterated that while technology outages will continue to take place [in the system], the critical factor is how resilient one is to withstand it and how swift the recovery time is.

Global data on tech outages at banks from a Goldman Sachs May report shows such incidences are higher in overseas banks. Between June 2020 and May 2021, HDFC Bank had 16 outages, compared to 24 for National Australia Bank, 39 for Wells Fargo, 40 for Citi, 52 for Bank of America and 73 for SBI, based on Downdetector data. But outages appear to last longer for banks in India compared to the overseas ones. HDFC Bank has the highest—4.1 hours—duration of outage and SBI 4 hours, compared to 2 hours for National Australia Bank, 1.7 hours for Wells Fargo, 2.7 hours for Citi and 2.5 hours for Bank of America.

Doing things right

This shows that the agility to deal with technological problems is weak in Indian banks. While HDFC Bank waits for guidance from the regulator on the findings of the third-party audit report of its IT systems, the bank has started to strengthen its existing technology architecture and make the shift towards new-age cloud-driven processes. “Banks in general had been laggard in moving from their monolithic legacy-based systems and swiftly adopting next-generation processes, which some technology giants and fintechs have been able to do faster,” says HDFC Bank’s chief information officer Ramesh Lakshminarayanan. HDFC Bank is pivoting to a factory approach through a digital factory and an enterprise factory plan, where it will roll out new digital products and services, he said.

In the next three months, HDFC Bank customers could see changes to their existing payment applications, such as PayZapp, and also a new platform for existing credit card customers. These platforms will be built on cloud-native stacks and not on conventional data centres.

The broader digital strategy for the bank will likely include collaborating and partnering with some of India’s top fintech unicorns, besides incubating some new fintech startups with a co-ownership formula and also creating and owning its own technology IPs. While declining to reveal actual technology spends, Lakshminarayanan said it will “move in line with global standards” and be funded by existing business operations.

Some of the recent digital payments data is encouraging for HDFC Bank. Unified Payments Interface (UPI) May 2021 data on digital remittances from India’s top 30 banks shows HDFC Bank to have the lowest technical decline [read as failure rate] of 0.06 percent and a debit reversal rate of 99.95 percent on a high volume of 215.12 million transactions.

ICICI Bank is equally impressive with a technical decline of just 0.08 percent and a DR of 94.5 percent on volumes of 151 million. Similarly, in beneficiary bank data both HDFC Bank and ICICI Bank have a technical decline of just 0.03 percent each, on volumes of 143.07 million and 280.54 million respectively.

HDFC Bank has also managed to maintain its market share (by volume) of UPI transactions at 8.7 percent in the three months to March 2021, compared to 8.6 percent in the previous December-ended quarter. These data points give HDFC Bank the confidence about stickiness of its customers and ensuring that glitches are limited.

HDFC Bank’s Parag Rao, group head–payments, consumer finance, digital payments and IT, is confident that the bank “will return with a bang” in the credit cards segment. His optimism stems from the fact that despite the existing ban, HDFC Bank has managed to maintain its leadership position in credit card spends at 28.5 percent, compared to 18.6 percent for SBI Card and 17.6 percent for ICICI Bank. But HDFC Bank should be concerned because ICICI Bank’s market share spend since March 2018 has risen 6.5 percentage points and SBI Card by 2 percentage points, compared to flattish growth for HDFC Bank.

“We have used the last six months to introspect, re-engineer the cards business, with our 15.5 million credit card customers. We need to get back to our pre-embargo run rate and then touch new milestones,” Rao says.

ICICI Bank gaining muscle

In HDFC Bank’s absence ICICI Bank has been a major gainer in both issuance of new credit cards and gaining market share (see table). In terms of new credit card additions, ICICI bank has seen an 18 percent growth year-on-year. “ICICI Bank has seen a 20 to 30 percent jump in its market share between December 2020 and April this year,” says Nitin Aggarwal, banking analyst at Motilal Oswal Financial Services. HDFC Bank’s credit card base has contracted by 389,424 between December 2020 and April 2021, RBI data shows.

One of the critical elements for its success in the credit cards business has been its tie-up with Amazon Pay. In October 2020, the bank said it had crossed the milestone of issuing over one million Amazon Pay ICICI Bank credit cards in just 20 months since its launch. Credit cards is the largest contributor to fee-based income for most banks.

In the pandemic, ICICI Bank also got its retail lending mix right, both in secured and unsecured lending, analysts say. Nearly half of its retail book is secured mortgages, which has seen a 21 percent growth in volume to Rs 2.43 lakh crore from levels a year ago. “ICICI Bank was trying to de-risk its book and it has managed to do it better than HDFC Bank, HDFC and Axis Bank,” Aggarwal said.

In its broad retail book, ICICI Bank reported robust personal and rural loans sequential growth of 6.4 percent and 7 percent respectively for the March-ended quarter. ICICI Bank’s entire retail book grew 19.9 percent year-on-year, which is particularly impressive coming in a pandemic year, and outperforming some of its other banking peers. HDFC Bank saw a modest 6.7 percent growth in its retail book, Axis Bank saw a 10 percent jump and Kotak Mahindra Bank’s pure retail book grew around 7 percent.

ICICI Bank’s executive director Anup Bagchi says the bank was able to capture opportunities much faster than others due to the advantages in digital banking. He said credit delivery has become more seamless and gained pace, which has led to improved market share of the non-mortgage book. Most analysts expect that unless the third pandemic wave erupts, stress formation in retail lending will be under control, provisioning will be elevated and earnings recovery will be stronger in the second half of FY22.

ICICI Bank is now trading at a multiple of around 3.2 times book value and about 2 times adjusted for subsidiaries book. HDFC Bank is trading at around 3.7 times book, having improved in recent months but having been de-rated 10 percent in the past one year, analysts say. “ICICI Bank has narrowed the valuation gap and there is more to go in ICICI Bank’s favour,” says Motilal’s analyst Aggarwal. ICICI Bank in FY21 delivered double-digit RoE (of around 12.6 percent) for the first time since FY17, and is now projected to improve to 15.2 percent in FY23E.

Jagdishan’s legacy

In the space of eight months Jagdishan has already put some things in order through the Project Future-Ready programme. In this way he has also started to create a new profile for himself which has already moved out of Aditya Puri’s long shadow. “This is probably his way of saying that I am my own person,” says business journalist Tamal Bandhopadhyay, who chronicled HDFC Bank’s digital journey in his book HDFC Bank 2.0: From Dawn to Digital. Bandhopadhyay also says that while several banks today are “extremely savvy” in their digital banking journey, Aditya Puri was well ahead of his time in terms of getting the bank onto the digital journey.

Independent banking expert Hemindra Hazari, who has studied the governance of banks in India extensively, says that he was “not surprised” that all these events have come to light in recent months, post Puri’s retirement. “Puri was so focussed on achieving targets and getting the ladoo in each business line that compliance took a backseat under his leadership,” Hazari says. Jagdishan is firmly trying to correct this while not compromising on growth. “Jagdishan is doing an honest job.’

The technology audit report’s findings notwithstanding, HDFC Bank, like most other banks, will need to see how bad loans play out in the unsecured retail lending space in coming quarters. Lakshminarayanan is, however, confident that the learnings from all these episodes will only make the bank stronger. “Companies which are awake and understand the customer pulse are the ones that will move ahead. Our customers will decide which way we go. If make this pivot quickly, customers will speak for us.”