An account of K.R. Shenoy’s life gives us glimpses of a significant phase of Indian banking, one which had far more dynamism than it usually gets credit for.

The laterite soil of the district of Dakshina Kannada – or ‘south Canara’ as it was referred to before Independence – is poor for crop cultivation.

Instead, in the 20th century, its enterprising communities grew a remarkable crop of banks and bankers: Canara Bank (established in 1906 at Mangaluru), the erstwhile Corporation Bank (1906, Udupi), Karnataka Bank (1924, Mangaluru), the erstwhile Syndicate Bank (1929, Manipal) and the erstwhile Vijaya Bank (1931, Mangaluru).

Each bank was initially set up by entrepreneurs to serve their own castes: the Bants (like Shetty, Hegde, Alva), Goud Saraswat Brahmins or ‘GSBs’ (Shenoy, Kamath, Pai) and the Kannadiga/Tulu Brahmins (Bhat, Rao). However, they eventually developed into full-fledged banks, serving the general public.

Corporation Bank, however, was founded by Haji Abdulla but after his exit, the GSBs played a pivotal role. As a result, Dakshina Kannada – along with the district of Udupi, which was carved out of it in 1997 – became known as the “cradle of Indian banking”.

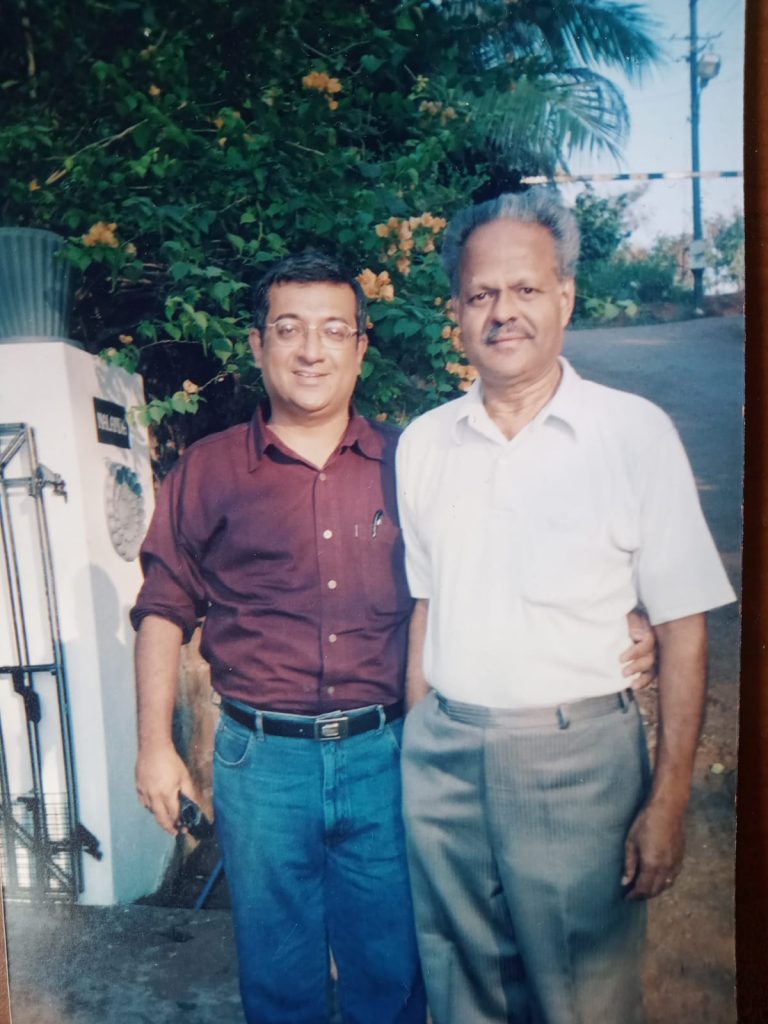

Katapadi Raghunath Shenoy, one of that remarkable crop of bankers, died on January 8, 2022 in Mangaluru after a brief illness. Shenoy had risen to be executive director (1992-1997) of the erstwhile Corporation Bank and then chairman and managing director (1997-2002) of the erstwhile Lakshmi Vilas Bank.

An account of his life gives us glimpses of a significant phase of Indian banking, one which had far more dynamism than it usually gets credit for.

K.R. Shenoy. Source: KR Shenoy Family Photo Collection

K.R. Shenoy was born in 1943 at Udupi, in what was then known as South Canara district. He started his career as a central banker and was deputed to the then private sector Corporation Bank, headquartered in Mangalore, which he subsequently joined, rising to the number two slot after its nationalisation.

Following the completion of his first five-year term, the government, sadly, failed to renew or elevate him. He then reverted to the private sector, where he was appointed Chairman and Managing Director (CMD) at the Karur-based Lakshmi Vilas Bank (LVB).

After a successful term at LVB, he declined another term to be with his family in Mangaluru. He served as non-executive chairman at the Ahmedabad-headquartered Astral Ltd. from 2006 till August 2020 and was also associated with the non-government organisation, Myrada.

He was a gentleman-banker of the old school, whom this author had the privilege of interacting with over the last 25 years. Beneath his courteous demeanour and soft-spoken, measured tone was a thoroughbred professional endowed with a sharp analytical mind. While he had the conservatism expected of a banker, he also had an acute sense of the need to exploit business opportunities, nurture young talent and inspire general staff to achieve objectives.

Unlike many corporate honchos, he believed in maintaining a low media profile, and throughout his career he remained in the shadows. He was respectful to his seniors as well as his juniors, and he had the rare quality of providing the latitude to his juniors to voice contrarian views; once convinced, he would incorporate their suggestions.

In the early 1990s this author, fresh from a Master of Arts in international studies, was studying how to analyse corporate annual reports, under the mentorship of the late N.L. Hingorani who was former professor of Udaipur University and former director of the National Institute of Bank Management. I was learning how managements disguise facts and massage financial accounts to cloak their actual performance.

Also read: What Should the Future of Indian Banking Look Like?

In those days, predating the introduction of the Income Recognition and Asset Classification (IRAC) norms by the Reserve Bank of India, analysing bank annual accounts was a Herculean challenge, as there were no disclosures on non-performing loans, or provisions for bad debts, investments and income tax. Hence, reported profits could not be taken seriously, as it was left to management’s discretion to make the necessary bad debt provisions prior to the reporting of interest income on loans.

Of the government banks, only the State Bank of India was listed, but it was prior to their domestic issue, and hence there was negligible trading; the same was the case with the few listed old private sector banks. While studying many bank accounts, Corporation Bank’s superior performance and profitability stood out. Having a healthy distrust of banks’ financial accounts, this author decided to investigate.

Being Mangaluru-headquartered, the senior management of Corporation Bank was relatively inaccessible to a Mumbai-based analyst. Fortunately, I was introduced to Premanand Kamath, a government securities dealer in the bank’s treasury division in Mumbai. He, in turn, opened the doors and provided much needed access to the senior management, especially the amazing smoothly-coordinating duo of K.R. Ramamoorthy, CMD, and K.R. Shenoy, the executive director or ED of the bank. In a difficult environment, when there were doubts about the bank’s independent existence, and rumours of a merger with a larger government bank, this duo successfully transformed a small Mangaluru-headquartered bank and put it on a firm footing.

K.R. Ramamoorthy. Photo: Video screengrab

In nationalised banks, it was common for the CMD and the ED to come from different banks, with no prior experience of either working with each other or with the staff of the bank. There were instances of the CMD and ED working at cross purposes to the detriment of the bank’s progress.

Fortunately, both Shenoy and Ramamoorthy were Corporation Bank officers, and had worked together prior to their respective elevation to CMD and ED. They were secure in their positions and had confidence in each other’s capabilities. When Ramamoorthy was appointed as CMD and Shenoy was elevated as ED, the latter made it clear that he would function as a loyal number two in a chief operating officer role, where he would focus on the internal functions of the bank. Both of them were ably assisted by K.R. Mallya, the general manager. The trio were referred to as the ‘three KRs’.

It speaks volumes of the leadership in the 1970s of the then private sector Corporation Bank that its chairman and managing director, N.N. Pai, selected Ramamoorthy, then working at Lipton, as the bank’s company secretary in 1975. He was later carefully groomed by Pai and subsequently by Y.S. Hegde for the leadership position.

Similarly, Shenoy was an RBI officer who went on deputation to Corporation Bank in 1973, and in October 1978 left the RBI to join the bank. Shenoy became Pai’s executive assistant, as he shifted his career from central banking to commercial banking. When Ramamoorthy and Shenoy ascended the commanding heights of Corporation Bank, they were equipped to work smoothly with one another.

Corporation Bank headquarters in Mangaluru.

The secret of Corporation Bank’s performance in the period FY1991 till FY1997 was a tight control on loan quality, while focusing on the relative safety of investing and trading in government securities, corporate bonds and commercial paper, to the extent that in FY1994 and FY1995, interest income from investments was more than interest income from loans. Herein lies the story of how Ramamoorthy and Shenoy were early movers in the Indian banking industry in domestic treasury operations.

Following the submission of the Chakravarty Committee to review the working of the monetary sytem in April 1985, the government and RBI began implementing some of its recommendations. Around 1989, Shenoy selected Mohan Shenoi (former president and chief operating officer, Kotak Mahindra Bank) to attend a one and half-year post graduate course at the NIBM. In his thesis he recommended that the bank should set up a treasury and investment division. On the completion of his course Mohan Shenoi was posted at the HQ in Mangaluru, reporting directly to K.R. Shenoy, and the bank was considering his proposal.

One day he was called to meet K.R. Shenoy but was made to wait outside his office for an inordinate period of time. When he was finally ushered in the young Shenoi brashly remarked to the elder Shenoy, “This is not how the future treasury based in Bombay can operate, waiting unnecessarily from orders from higher authorities in Mangalore.” Shenoy heard him patiently and ended the meeting. Shenoi returned home wondering whether his impertinence had cost him his job.

Two days later, Shenoi was summoned for another meeting with K.R. Shenoy and this time he was ushered promptly into the latter’s cabin. The elder Shenoy handed his protégé two tickets to Bombay, with instructions to set up the bank’s domestic treasury operations and choose a suitable location.

Mohan Shenoi set up Corporation Bank’s domestic treasury with the full authority to conduct day-to-day transactions without interference from the head office. Though adequate controls were put in place to monitor operations, the objective was clear: the bank had to actively trade in government securities. Treasury operations became a major profit centre for the bank. This was radical thinking for a government bank, as most banks bought securities to maintain their statutory liquidity ratio and held them to maturity. Subsequently, Corporation Bank’s domestic treasury branched out into investing in corporate debentures and bonds, and the bank built a sizeable commercial paper book for a bank of its size.

Another interesting feature in Corporation Bank in the early 1990s was its significant fee income. To an outside analyst like this author, it defied explanation that a small bank based in Mangaluru with limited corporate exposure could be reporting such high fee income. In those days, prior to the entry of the new private sector banks, the practice of reporting part of interest income on loans and front-loading it as fees was non-existent. The tale of its fees lies in the unexciting back office function of inter-branch reconciliation of accounts, where Shenoy played a critical role.

Also read: As RBI and Kotak Smoke Peace Pipe, What Does it Say About the State of Banking Regulation?

In 1973, when the RBI sent K.R. Shenoy on deputation to Corporation Bank, one of his mandates was to set up robust internal systems, and the bank gave tremendous importance to inter-branch reconciliation of accounts. As accounts were manually reconciled, many banks had huge inter-branch non-reconciliation issues, but Corporation Bank did not suffer from such problems. When Citibank started offering cash management services to Indian companies, it tied up with Corporation Bank on account of its excellent back office systems, apart from its branch network. K.R. Mallya took charge of cash management, and also commenced directly approaching companies. It was account of this service that the bank booked handsome fees.

File Photo: Pedestrians walk past the facade of a Citibank building in New York July 14, 2014. REUTERS/Lucas Jackson//File Photo

Being a small bank, Corporation Bank was unable to lend to large companies; but by offering cash management services, not only could the bank enhance its fees, but also gain access to blue chip companies. The cash management services, combined with an active domestic treasury which invested and traded in corporate securities, enabled the bank to cement its commercial relationship with corporate India. To achieve these objectives took a vision, identifying key staff and providing them with the required training and exposure to be successful in these endeavours. Being a government bank, Corporation Bank faced severe restrictions in acquiring outside talent. The credit should go to the leadership of the banks in the 1970s, who identified individuals like Ramamoorthy and Shenoy to join the bank; they in turn groomed their juniors as future leaders for the Indian banking industry.

The first Corporation Bank cadre officer to be selected as CMD of another government bank was V. Leeladhar, who was appointed CMD of Vijaya Bank, and thereafter of Union Bank of India; he later became RBI deputy governor. He was followed by M.V. Nair as CMD first of Dena Bank and then of Union Bank of India; M.D. Mallya became CMD of Bank of Maharashtra and thereafter of Bank of Baroda; K.R. Kamath was appointed CMD of Allahabad Bank and then took charge at Punjab National Bank; M. Narendra became CMD of Indian Overseas Bank; and CVR Rajendran became CMD of Andhra Bank and is at present CEO of the private sector CSB (erstwhile Catholic Syrian Bank).

For a small bank to provide so many leaders to the industry in a short time span is a phenomenal achievement.

Despite Ramamoorthy’s and Shenoy’s impeccable integrity, professionalism and their contribution in making Corporation Bank a model bank, the irony was that the government declined to renew their tenure at Corporation Bank or elevate them to a larger bank. The issue was that, in the Harshad Mehta scam, even though Corporation Bank did not incur any losses from the transactions, a few of the Bankers’ Receipts passed through the bank. And this was pointed out in the RBI Inspection Report. The Central Vigilance Commission was unwilling to clear Shenoy’s name, even though he received and accepted the government’s appointment letter for CMD of Andhra Bank.

Also read | ‘Scam 1992’: Bulls, Bears and the Shadow World of High Finance

Although this author was in telephonic contact with Shenoy for some time, we first met at the end of his tenure at Corporation Bank on the tarmac of Mangaluru airport, as I was coming to meet the senior management of the bank while he unfortunately had a prior outstation engagement. When I enquired about his future plans, he replied, “I cannot afford to retire.”

Fortunately, the private sector recognised the talents of Ramamoorthy and Shenoy as professional bankers and turnaround experts, and with the RBI’s blessing Ramamoorthy took charge as executive chairman and CEO of Vysya Bank while Shenoy was appointed CMD of Lakshmi Vilas Bank. Both banks were difficult assignments, but they were able to stabilise operations.

Another irony was that, despite both of them laying a strong foundation for Corporation Bank which their immediate successors benefitted from and took forward, from FY2013 onwards, on account of poor leadership, the bank’s performance sharply deteriorated. Finally in April 2020 the bank lost its independent identity, and was merged with Union Bank of India. A worse fate befell Lakshmi Vilas Bank, again on account of lacklustre leadership and promoters’ interference, as it was put under a moratorium by RBI in November 2020, and finally acquired by DBS.

Shenoy was a team player, who did not covet media attention and was a solid number two to Ramamoorthy in Corporation Bank. He demonstrated the qualities of a leader when he stabilised the operations at LVB. Indeed, his professional life as a banker reaffirms that commercial banking is a team effort, and while the leader puts forth the strategy, it requires a smoothly functioning team to implement it, while nurturing young talent and keeping the customers’ as well as the general staff’s interest, a lesson that some of the new private sector banks seem to have forgotten.

In today’s environment, the contribution of government banks to the development of India’s economy is largely forgotten. They are derided for ‘phone banking’, while the new private sector banks and their larger than life ‘iconic’ CEOs are glorified in the media through ‘exclusive’ interviews and ‘Best Banker’ awards.

When it comes to prominent private sector banks, the media deliberately fails to highlight mismanagement until it becomes a crisis, and ignores the high employee attrition, which is an indicator of staff harassment and discontent. Government banks and bankers of the past had some failings, but the public and the media would do well to recognise the seminal contribution of certain government banks and bankers such as K.R. Shenoy, who combined conservatism in lending with dynamism in developing new profit centres and nurturing the general staff and their customers.

Their exploits may remain unsung but their deeds will not be forgotten.

A fitting tribute to my dear friend and former colleague late K R Shenoy. KRS was always quite analytical, calm and composed and measured in his response. We had mutual trust and our relationship was more collegial.

KRS grew with CorpBank Team on a routine basis, though he was from RBI. We could find a no nonsense friend and a Professional Guide who mingled in all circles. I remember his seeking feedback on Corpbank Officers Salary Revision based on Pillai Committee model. He was foresighted when he advised me to refund portfolio management fund of St. Johns predicting market fluctuations.

He never mixed friendship and professionalism, though that was disadvantageous to me at times. His success is mainly due to his respect for knowledge and his watchword “thus far…and no further” keeping people to accept his timely words unbiased. As I was associated with him since 1977, I could always look to him for resolutions with trust and confidence in all matters. He continued his friendship even as he joined LVB, Karur. Appeared as tough, KRS was very jovial and outspoken irrespective of cadre bias. Corpbank had its ascent only due to the best combination of CEO Mr. KRR and COE Mr. KRS, those decades.

Well written eulogy Mr. Hazari.

Corporation Bank was the first public sector bank to shift its Treasury from its Headquarters in Mangalore to Mumbai , where all the market action was. Later on many banks followed this example.

Along with Mr. Mohan Shenoi, I was fortunate to be part of the team, that set up the treasury in Mumbai.

Mr.Ramamoorthy and Mr. K.R.Shenoy used to spend time in the Treasury during their visits to Mumbai, taking direct inputs from the dealers, to get a feel of the market pulse. The treasury was close to their hearts.

Both of them have succeded in grooming a talent pool within the bank. A lot of Corpbankers have headed banks as EDs/CMDs, in senior positions in Private Sector Banks, in Regulators such as SEBI, IRDAI. One ended up as Deputy Governor in RBI. Speaks highly of their mentoring.

May K.R Shenoy’s soul rest in peace.

I finished reading the complete article sometime back which has come up really well. The author has truly done justice to this article by covering various facets of dear Shenoy Mam’s towering personality, unique qualities, his strengths and his contribution to CorpBank in particular and banking sector in general.

Having seen him and worked with him closely, I always used to hold him in high esteem. Happy and proud to read the article which has already gone viral in Banking Circles.

Befitting tribute to dear Shenoy Mam who will always be in our hearts. Om Shanthi 🙏🙏🙏

A fitting tribute to a gentleman banker. He was an able foil to Mr KRR in their efforts to resuscitate the Bank and restore it to its pristine health and glory.

Mr KR Shenoy worked shoulder to shoulder with the Chairman. Mr Hazari must be complimented for chronicling the evolution of Corporation Bank -genesis-growth, senescence, decay and finally death by merger of an institution which provided a number of leaders to the financial sector in general and banking sector in particular.

Good bye Mr K R Shenoy ! You will live in the heart and mind of several generations of corpbankers for your simplicity, humility, integrity, empathy,leadership and guidance! God bless! Om Shanti

Best regards to Udaya and his daughter and may God give them the courage to bear this tragic personal loss.

Thanks Mr Hazari for such a wonderful tribute to Mr KR Shenoy. I met him in Mangalore for my PhD work on history of banking in South Canara district. I called him to seek an appointment. He not just welcomed me at his Mangalore home but also asked me to join him for high evening tea. He also asked me the topics I wished to discuss so that he could read and be ready! It was a humbling lesson that someone who has spent so much time on banking also needs to prepare for discussing the sector. I spent a very nice evening with Mr Shenoy who patiently told me about his experiences in the banking sector. Much to my delight, he also gave me some books which were out of print and difficult to find elsewhere. Mrs Shenoy also welcomed me and was a very warm host.

I was shattered to hear of the news. The last few years have been very harsh and continues to take away some very fine people. I pray that the Gods give Shenoy family all the courage to bear and overcome this loss. He left a lasting legacy which deserves to be celebrated. The Indian banking sector which moves from one crisis to another should learn some lessons from the lives of bankers such as KR Shenoy.

A well captured journey of CorpBank in general, and the role played by Mr K R Shenoy (KRS) in it in particular. My Compliments to Mr. Hemindra Hazari.

The article made me to relive my CorpBank days. I had a lot of learnings from KRS. The first was time management. Every time he addressed us, he will always end up saying that I was allowed so much time and I am finishing well within the time. The second thing was the clarity of thought and the crisp and clear comments he used to make on the Notes. The greatest lesson was about the role of the Executive Director in complimenting and supplementing the efforts of the CMD in building the organisation, while remaining within the “Lakshmana Rekha”

It was a great learning experience in CorpBank under the collegial leadership of KRR and KRS which prepared me to handle the higher responsibilities which came in my way later on.

The news of his passing away created a feeling of loss of someone close in life. KRS will always be remembered by his colleagues in CorpBank.

I had the privilege of working with the late Mr K R Shenoy in the initial period (1975-1980) of my joining Corporation Bank in the Planning & Development Department. While K R Shenoy was on deputation from the Reserve Bank of India to Corporation Bank, I had the opportunity to observe his analytical mind and meticulous work. We had his guidance and wisdom whenever we approached him for help. Later he decided to stay back in Corporation Bank and rose to the level of Executive Director (ED) due to his ability and work ethic which benefitted the Bank in its growth journey.

As the author of the article has observed K R Shenoy devoted considerable effort for internal control, policy formation, integrated treasury, leadership development and provided support to field level staff. Both K R Ramamoorthy as Chairman and Managing Director and late Shri K R Shenoy as an able and efficient ED contributed to putting the institution on a strong footing for future growth.

I congratulate Mr Hemindra Hazari whom I have known for a long time and he has lucidly highlighted the qualities, skills and competence of Mr K R Shenoy. Hearing the news of K R Shenoy’s death was a great loss to all of us especially those who were the beneficiaries of his guidance, friendship and love.

The publication of an article on a great leader of the banking industry will serve as an inspiration to the current bankers. Well done Mr Hemindra Hazari.

We had a divine soul amidst us in the physical form of Shri K R Shenoy. I had the privilege of a close association with him in the 1980s/1990s in the erstwhile Corporation Bank as a member of the Investment Committee and in the Balance Sheet department, both of which he was the Head. He was having a regulator’s as well as a commercial banker’s perspective while dealing with issues. That was a great advantage for him to ensure safety of Bank (public) funds and transparency in decision making process.

My interactions with him have definitely moulded my character. He has handed over his knowledge and experience by guiding others and shared the joy on seeing them rise in the cadre. I have also seen him taking in his stride and managing the turbulent time post his “retirement” from erstwhile Corporation Bank, to provide transformational leadership to other organizations with utmost self confidence. A great personality indeed. As one of my friends told me, he is the unsung hero of Indian banking and like a fragrant flower adored and liked by everyone who came in contact with him.

I had the good fortune of working under Mr. K.R.Shenoy. The experience I gained under him immensely helped me shape my career subsequently. Mr. Shenoy maintained a low profile but beneath that was an astute banker who functioned with a perfect balance between strategy and execution. Good leadership is all about looking at the big picture without losing sight of quality of execution. K.R.Shenoy was extremely methodical in his approach to problem solving even while searching for out-of-the-box solutions. His style of risk management was through “global controls” as against “case by case controls”. This gave the hierarchy under him the flexibility to operate freely while maintaining overall controls.

He treated subordinates with great respect. He never intimidated subordinates and was approachable for everyone.

Both Mr. K.R. Ramamoorthy and K.R. Shenoy were in perfect alignment on the critical role that treasury played in the overall functioning of the Bank. It was a brilliant strategy to co-locate Industrial Finance Branch (IFB) with the treasury to exploit synergy between the two. Corporation Bank built a sizeable Commercial Paper (CP) portfolio in the 1990s to get entry into top corporates and offer them Cash Management, Non-fund based business etc.

Mr. Shenoy and Mr. K.R. Ramamoorthy gave me the opportunity to shift the Funds and Investment Department (as it was called before) from Mangalore to Mumbai and set up a modern and vibrant Treasury and Dealing Room.

Mr. Hazari has given a fitting tribute to Mr. K.R. Shenoy.

May Mr. K.R. Shenoy’s soul rest in peace. He will always be in our hearts.

It is over a month since late K R Shenoy left us for his heavenly abode but he will remain alive in our minds forever.

Thank you Mr Hemindra for chronicling the contribution of Mr K R Shenoy to Corporation Bank. Transformation of the Bank into a high quality Bank in just 7 years without any capital infusion by GOI was a script visualised by legendary CMD Mr K R Ramamoorthy and enacted to perfection by ED K R Shenoy and many of us. My contribution to the Banking Industry was the result of grooming I received from both of them during those formative years. I am very grateful to KRR and KRS.

I benefitted immensely by working closely with Mr K R Shenoy. I believe that the true tribute to Mr Shenoy is in practicing the high values he stood for. Om Shanti.

I saw this article only now, nearly eight months after its publication. Mr Shenoy was a soft spoken gentleman with whom I had occasion to work during my short stint at Corporation Bank. My heart felt condolences to his family.