The gap between Axis Bank’s own portrayal of customer experience and the reality of customer complaints recalls Robert Louis Stevenson’s classic tale of Dr. Jekyll and Mr. Hyde.

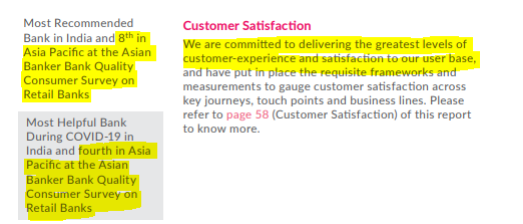

Let us begin with Dr Jekyll. The bank claims, in its FY2022 Sustainability Report, that “we are committed to delivering the greatest levels of customer-experience and satisfaction to our user base…” The bank’s commitment to reaching the “greatest” heights of customer experience would appear to be borne out by awards: the bank ranked 8th among the ‘Most Recommended Banks’ in the Asia Pacific region in the Asian Banker Quality Consumer Survey on Retail Banks, and ranked 4th among ‘Most Helpful Banks’ during Covid-19 in the same survey.

Extract from Axis Bank FY 2022 Sustainability Report on Customer Satisfaction

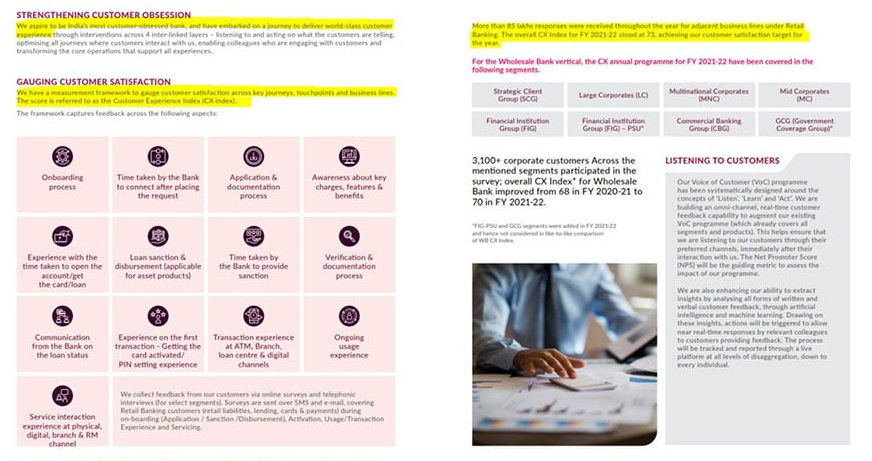

The report goes on to state that Axis Bank aspires to be “India’s most customer obsessed bank.”

The dark character of Mr. Hyde emerges, however, in a Reserve Bank of India (RBI) committee on customer service, whose report was released to the public on June 5, 2023. The report documents customer complaints of each bank from FY2020 till FY2022.

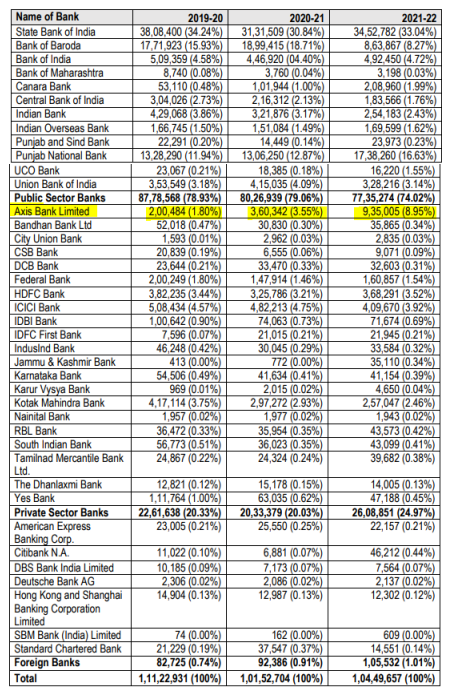

In complete contrast to the impression conveyed in Axis Bank’s Sustainability Report, the data reveal that customer complaints for Axis Bank rose by 80% in FY2021 to 360,342, second only to ICICI Bank’s 482,213 in the private sector. In FY2022, it ousted the much larger ICICI Bank to become the undisputed private sector market leader with an astounding 935,005 complaints, constituting a 9% industry (private, government and foreign banks) market share.

Customer Complaints in the Banking Industry

Source: Report of the Committee for Review of Customer Service Standards in RBI Regulated Entities p. 40-41

The data carries a caveat, which states that Axis Bank is the only bank in the industry whose FY2022 data are not comparable with FY2021, as the bank had tightened the tagging norms since FY2021. Since the annual growth in customer complaints in FY2022 was a staggering 159% this analyst sought greater clarity from Axis Bank on the tightening norms it had introduced, which resulted in the dubious distinction of achieving the status of private sector market leader.

Normally, when a change in norms results in abnormal volatility in data reporting, listed companies take pains to provide greater granularity and also provide alternative data to make the year-on-year data comparable. Surprisingly, Axis Bank declined to respond to this analyst’s questionnaire seeking greater clarity on the tightening of norms for customer complaints.

On the critical issue of customer satisfaction, it reflects poorly on Axis Bank’s board of directors and senior executive management that, when they assure stakeholders of their commitment to deliver “the greatest levels of customer experience-satisfaction”, they are in reality the market leader in customer complaints in the private sector. Worse, there is a complete lack of transparency on the claimed tightening of norms for customer complaints. It is also pertinent to note that when the norms were unchanged between FY2020 and FY2021, customer complaints soared by 80% in FY2021. That is a fair indication of poor service standards even prior to the tightening of the norms.

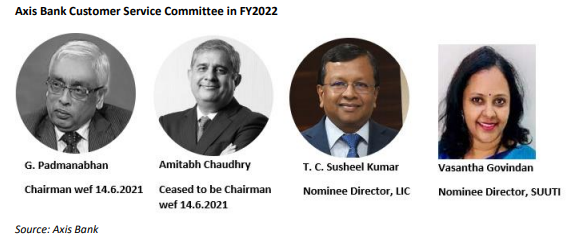

Axis Bank Customer Service Committee in FY2022

The Axis Bank’s Customer Service Committee of the board of directors, chaired by G. Padmanabhan, a former executive director of the RBI, is the highest authority within the bank for the monitoring of customer complaints. It also has nominee directors of key institutional shareholders. As a former senior executive of the banking regulator, the chairman, as well as the nominee directors, should be extremely concerned with this track record of customer service.

Axis Bank’s Grievance Redressal Policy defines a complaint “as any deficiency or gap in service delivery towards the commitment provided to the customer. Complaints could be on account of breach in committed turnaround time or non-fulfilment of the request customer has placed with the bank.” The policy does not refer to any tightening of the complaint norms.

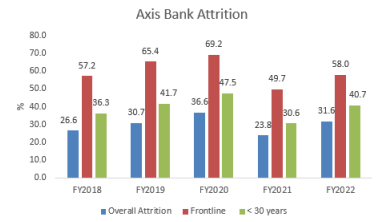

In the absence of any clarification from Axis Bank, a possible partial explanation for the poor customer service standards could be the high attrition in the bank. In FY2022, overall attrition jumped to 31.6% from 23.8% in FY2021. In the frontline and under-30 years of age category (there may be an overlap as youngsters are normally in sales/frontline) the attrition in FY2022 was a shocking 58% for frontline and 40.7% in the under-30 years category. When there is such huge attrition among the staff, especially at the entry level and in sales, customer service is bound to suffer. The board of directors and the banking regulator must probe the causes of such high attrition, as it appears to be impacting customer service.

Against the background of Axis Bank’s acquisition of Citibank India’s retail division, this private sector market leadership in customer complaints, and its lack of transparency on its ‘tightened’ norms, are a matter of concern.

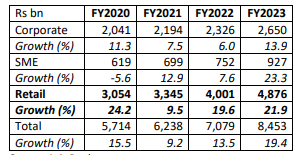

Axis Bank, like most banks, has been shifting focus from corporate loans to retail loans. Not only was it forced to take significant credit cost on its corporate loans in the past, but the current growth in corporate loans is sluggish. When the strategy shifts from corporate to retail, there are obviously more customer touch points, and hence there is a rise in customer complaints. Within retail loans, credit card loans tend to have an even higher rate of customer complaints, on account of various charges and much higher interest rates.

Axis Bank Loan Composition

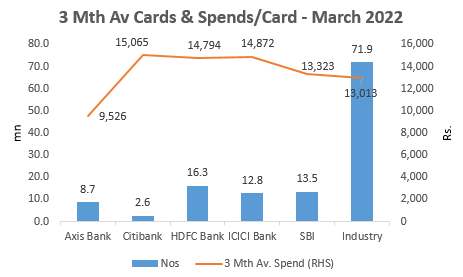

In March 2022, despite Axis Bank having a 3-month average of 8.7 mn credit cards outstanding, as compared with 16.3 mn cards for HDFC Bank and 12.8 mn for ICICI Bank, the bank reported nearly 2.5x of HDFC Bank’s customer complaints. Another aspect is that the 3-month average credit card spend for Axis Bank is not only the lowest amongst the major credit card issuers, but it is also lower than the industry’s average in March 2022. Citibank’s card spend was the highest, while Axis Bank’s was the lowest.

The problem with having the highest customer complaints in FY2022, prior to the acquisition of Citibank’s retail business, is that the clientele of Citibank is premium: high-income, high spending and also very demanding with regard to customer service. Given the apparently poor state of Axis Bank’s customer service in FY2021 and FY2022, and assuming, in the absence of data, that it may not have significantly improved in FY2023 and FY2024, erstwhile Citibank retail customers are unlikely to experience premium service at Axis Bank staff.

While Axis Bank may continue to purvey Dr Jekyll-like commentary regarding superior customer satisfaction in its public relations literature, the customer experience of Mr. Hyde may drive out erstwhile Citibank customers, undermining the high cost (Rs 116 bn/US$ 1.41 bn) acquisition of Citibank’s erstwhile Indian operations.

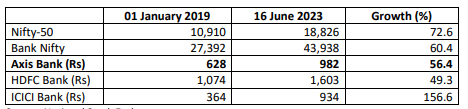

On the stock market, Axis Bank is trading close to its all-time high of Rs 990, which it reached some days ago. The surge in share price is on the market’s expectation of superior performance. However, when present CEO, Amitabh Chaudhry, took charge on January 1, 2019 there was a huge expectation of a complete turnaround in the bank. Sadly, while the stock has risen by 56% in the period, it has under-performed the Nifty-50, Bank Nifty and ICICI Bank. The only consolation has been that it has out-performed HDFC Bank.

Stock Market Performance since Amitabh Chaudhry took Charge as CEO Axis Bank

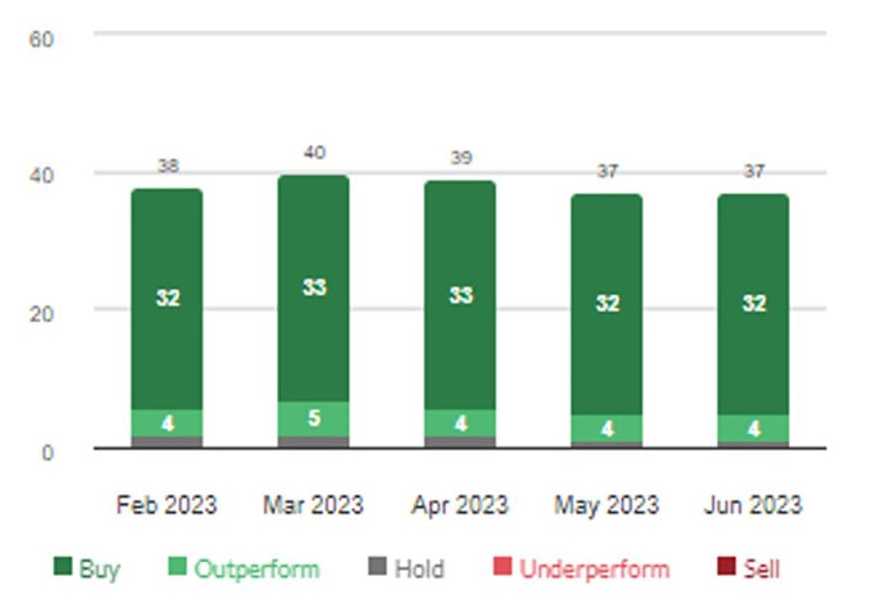

Sell-side analysts are apparently unconcerned about Axis Bank’s customer complaints, and believe it is inconsequential for the success of the Citibank India retail acquisition or for Axis Bank’s future performance. As per Moneycontrol, the overwhelming majority of analysts have a ‘Buy’ recommendation, and the fact that the share price is close to its all-time high is a testimony to their optimistic outlook.

Sell-side Recommendations on Axis Bank

While the outlook appears promising for shareholders, customers have been recording record levels of complaints against the bank atleast till FY2022. In the absence of any clarity from Axis Bank on the unprecedentedly high levels of customer complaints, the market’s only hope is that Dr. Jekyll can eventually overcome Mr. Hyde.[1]

[1] In the novel Dr. Jekyll commits suicide by consuming poison.

Note: This analyst had emailed Axis Bank with detailed queries on 6th June and also sent a reminder on 15th June that the queries remain unanswered. There has been no response from the bank.

This article was also published in Moneylife which can be read here.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in the banks mentioned in this report. HDFC Bank subscribes to this analyst’s research and a member of this analyst’s family is employed with HDFC Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

www.hemindrahazari.com

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: