In June 2024, Yes Bank sacked at least 500 junior staff, mainly in its retail division (as reported by The Economic Times on June 25, 2024). Nearly a year later, as reported by Mint, it has followed up by removing 4 senior executives, three of whom were in its retail division. Thus the sackings are slowly working their way up the bank’s hierarchy. But will they reach the real culprits at the top? Who will sack the sackers?

In fact, responsibility for the bank’s disastrous retail strategy lies at the pinnacle of the organisation: the board of directors, who were either ignorant or were uninterested to ask pertinent questions; the Chief Executive Officer (CEO); the Executive Director in-charge of retail; the Chief Financial Officer (CFO); and the Chief Credit Risk Officer (CCRO). These individuals oversaw and implemented an ill-conceived, poorly executed retail strategy marked by out-of-control overheads, excess retail staff and dependence on Direct Sales Agents (DSAs) who sourced low-yield poor quality retail loans, which resulted in rising retail losses for the bank. The retail losses were bailed out by profits from the bank’s successfully revived corporate division. Retail losses were under-reported, in the form of significant unallocated expenses which prudently should have been allocated to the retail division (for more details and early warnings of its retail strategy see here and here).

The irony of the situation is that the bank’s retail division was supposed to have been the main profit engine to turn the bank around from the meltdown of its corporate loans, which had ultimately led to a moratorium being imposed in March 2020. Instead, 5 years later, the retail division has resulted in a high-cost sourced retail asset portfolio of Rs 1,286 bn (30% of assets and 41% of loans as on 3QFY2025) characterised by low-yield and deteriorating quality, which requires a bail-out by the bank’s corporate and treasury divisions.

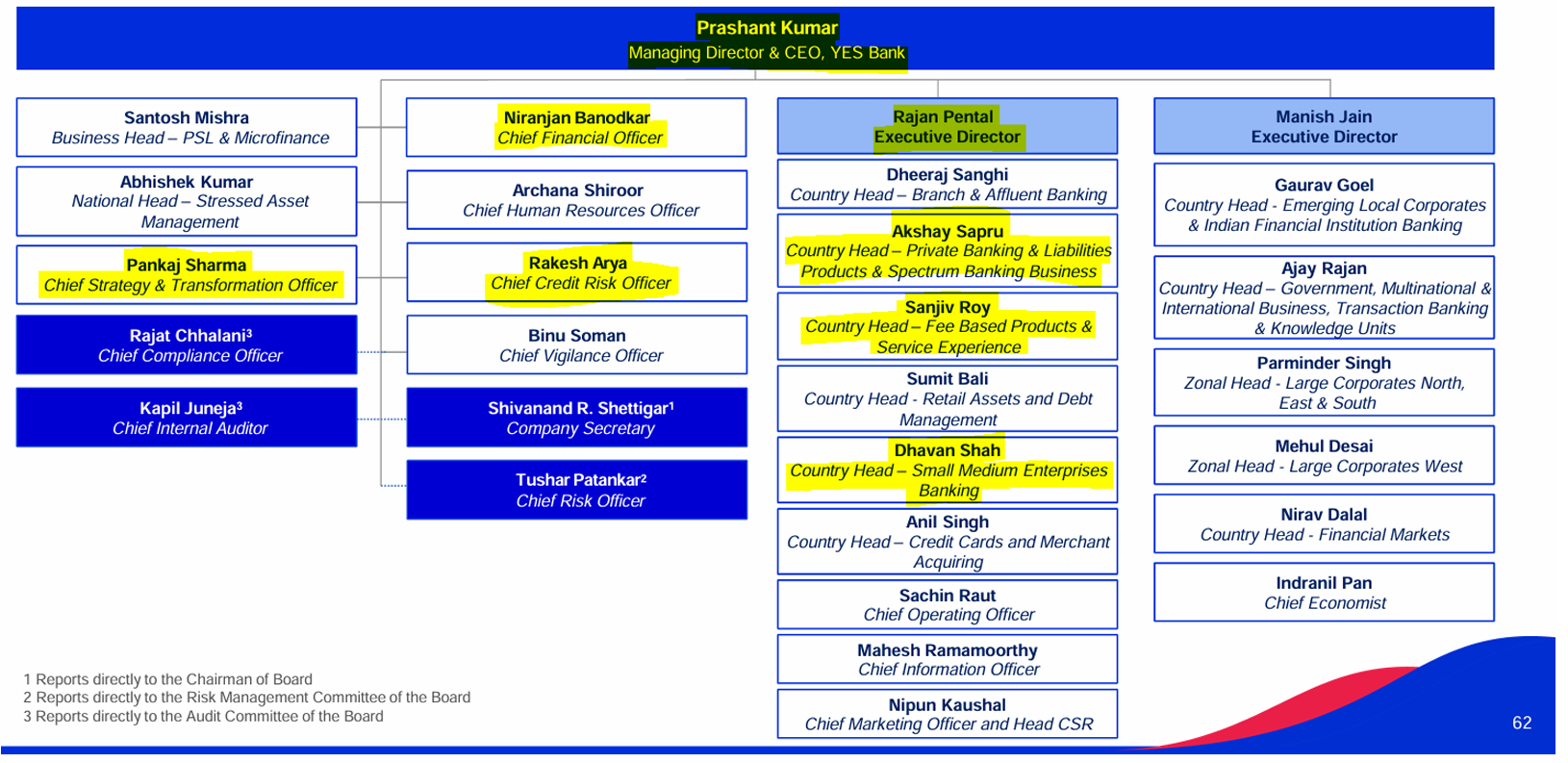

The Mint story, citing an internal email from the CEO to the Yes Bank staff, implies that the 3 senior executives in retail are to be held responsible, although the wording is coached in terms of restructuring the organisation to a more branch-centric organisation, and eliminating redundancy in roles. It is odd that all 3 senior retail executives reported directly to Rajan Pental, the Executive Director and in-charge of retail, even as he appears to have been left unscathed in this restructuring exercise. Although the main responsibility for Yes Bank’s retail fiasco lies at the door of Rajan Pental, there are other senior executives who too cannot escape responsibility.

Yes Bank’s Senior Executives Organisational Chart

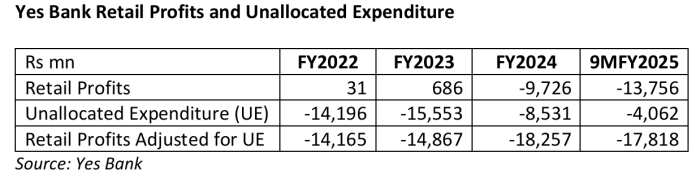

From the bank’s own public information, it was apparent that it had been struggling with its retail strategy since FY2022. The bank reported meagre retail profits in FY2022 and FY2023, while unallocated expenditure was significant as compared with peer banks. As wholesale/corporate division and treasury overheads are easily identified and normally banks have internal time tested measurements for allocating cost of funds for these two divisions, the unallocated expenditure, according to this analyst, was associated with the bank’s retail operations. It was therefore the duty of the bank’s CFO to inform the CEO and the board of the real cost of their retail strategy, as it was bleeding since FY2022.

Yes Bank Retail Profits and Unallocated Expenditure

| Rs mn | FY2022 | FY2023 | FY2024 | 9MFY2025 |

| Retail Profits | 31 | 686 | -9,726 | -13,756 |

| Unallocated Expenditure (UE) | -14,196 | -15,553 | -8,531 | -4,062 |

| Retail Profits Adj. for UE | -14,165 | -14,867 | -18,257 | -17,818 |

Source: Yes Bank

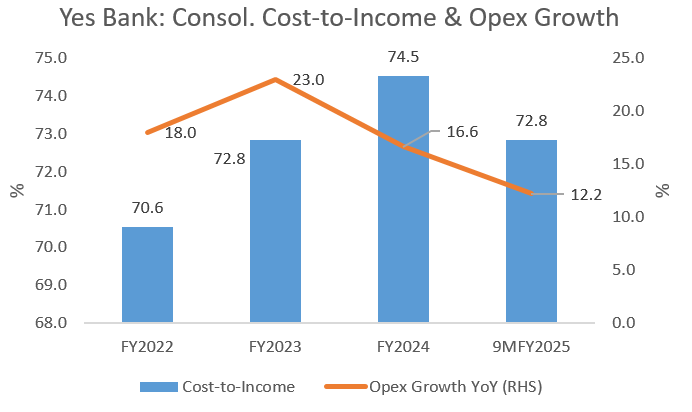

Managing the operating cost for the bank was crucial, on account of the bank’s slender net interest margin (around 2.5%). However, the senior executives responsible for the bank’s retail strategy and its oversight believed that the increase in operating cost was justified in order to build a retail business from its infancy. The bank’s consolidated cost-to-income increased from 70.6% in FY2022 to 74.5% in FY2024, and reduced to 72.8% for the 9 month period ended December 31, 2024. Here again, it was the duty of the CFO to closely monitor costs and impose reasonable cost controls when the bank was expanding its retail franchise, but it appears the retail division was given full liberty to increase costs even as it failed to provide any evidence of generating sustainable profits.

Yes Bank has a high dependence on DSAs. In FY2023, 63% of retail loans were sourced through this channel, which was brought down to 50% in 9MFY2025. Financial intermediaries which have high dependence on DSAs and third party vendors should be extremely vigilant, as unsavoury practices are associated with such vendors. Executives take advantage of these, resulting in higher costs to the organisation. In Yes Bank it was the responsibility of the CFO to judiciously implement cost controls and discipline the retail bank’s overall costs, especially costs associated with DSAs and third party vendors for its retail operations.

Instead, the CEO, the CFO and the board of directors permitted the retail bank to be managed like an e-commerce start-up which could burn cash so as to make a profit at some future distant date. Sadly, this was a luxury that a bank which had just emerged out of a moratorium could ill afford.

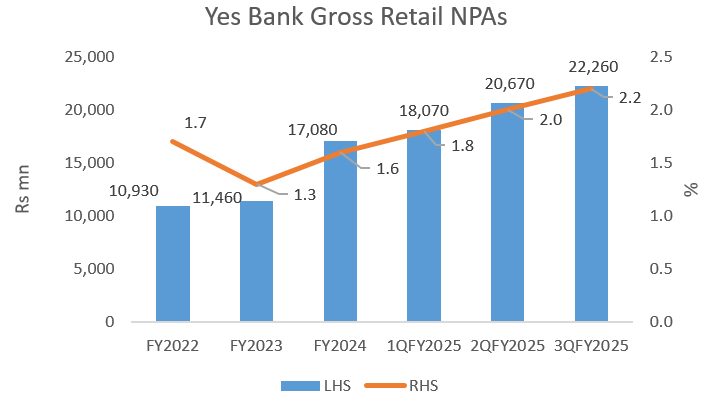

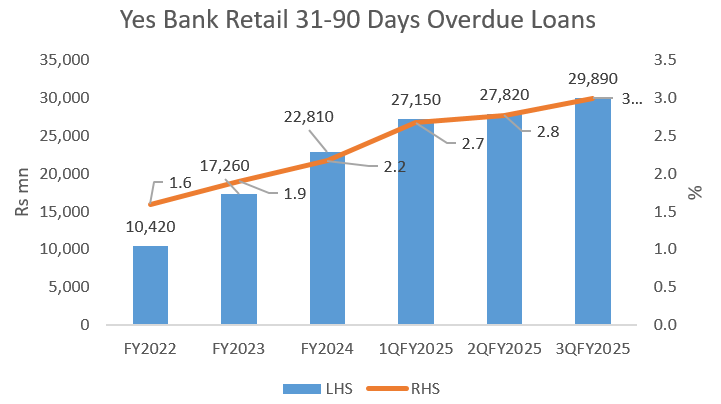

When a bank has a slender net interest margin and a high cost-to-income ratio, it is vital to keep asset quality in check. It is the duty of the bank’s Chief Credit Risk Officer to evaluate and monitor the asset quality. This is especially important when the bulk of retail loans are being sourced from third party vendors. The major issue with Yes Bank’s retail loans is that they are of low yield and poor quality: retail NPAs and overdue loans started rising at an early stage. The rise in the bank’s 31-90 days overdue retail loans indicates a future rise in retail NPAs. As the entire banking industry is expected to have worsening retail asset quality, Yes Bank’s retail portfolio is particularly vulnerable. The low yield on retail loans should have normally resulted in high quality, but the bank has got the worst of both worlds, which reflects extremely poorly on its sourcing and credit risk management.

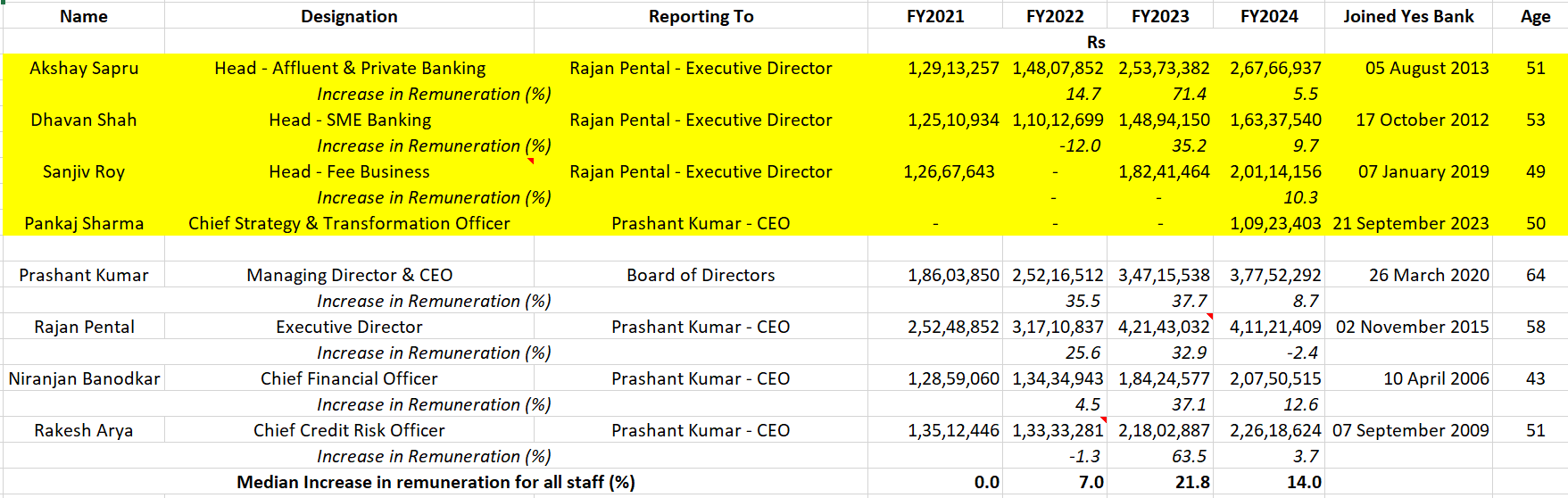

While Yes Bank was rapidly increasing its high operating expenses, low yield, and doubtful quality retail assets, the senior executives associated with the high retail asset growth were being well rewarded by the bank. Rajan Pental, who headed retail, was promoted to the board as an executive director in February 2023. All the concerned senior executives received hefty increases to their remuneration in FY2023, as the board of directors and the senior executive management believed they had put in a sterling performance despite no genuine profits in the retail bank.

Remuneration of Senior Executives with Retail and General Oversight

Yet a year later, Yes Bank fired at least 500 junior staff in retail, and nearly two years later, it sacked four senior executives, three of whom were in retail. The bank may claim the sacking of senior executives to be part of a revised retail strategy, emphasising decentralisation, where the branches will be centric to the future growth, entailing the redundancy in their roles. However, the fact that the bank has to sack so many junior staff and some key retail senior executives, and drastically change the retail strategy within five years of its implementation, as well as the lack of retail profits, reveal the failure of Yes Bank’s strategy.

The present CEO’s term ends in October 2025. The board of directors is expected to short-list individuals and send the selected candidates for the Reserve Bank of India’s approval. With the mess in retail it appears unlikely that the board would recommend another term for the existing CEO or select anyone associated with the retail bank. It may prefer to select outside candidates or the corporate head to succeed the present CEO.

If the successor is from outside the bank or its corporate banking head, it is extremely important that all the senior executives who were responsible for allowing the retail strategy to be a drain on the bank be replaced, as their performance has been found wanting. The recently announced sacking of only four senior executives will not rectify the problem, as it extends further up the chain of command. Indeed, one of the strategic mistakes of the existing CEO when he took charge after the moratorium was to retain and depend upon many of the senior staff who were associated with the founder-CEO, Rana Kapoor and the culture of high growth at any cost, inflated salaries and poor work ethic. It is these individuals, along with the present CEO, who are responsible for the retail fiasco.

Even for a new CEO, the assignment would be difficult, as the bank is stuck with 30% of its assets being non-remunerative, and there would be no takers in the market to dispose of low yield and poor quality retail assets. The bank will have to wait for the existing retail assets to run down as they get repaid or written off, while simultaneously acquiring quality corporate and retail loans – in an economic environment which is rapidly deteriorating.

The performance of the board of directors, and especially the nominee directors of State Bank of India, is particularly disappointing. They should have been more vigilant, demanding reasons for the retail division not breaking even despite so many quarters of retail losses (adjusted for the unallocated expenditure). The board of directors, it seems, woke up very late. This despite having former experienced bankers from India’s largest bank, independent directors with retail banking expertise, nominees from private equity (whose sole objective is profit maximisation), and a former banking regulator as the chairman of the board.

Yes Bank’s Board of Directors

It is unfortunate that Yes Bank’s recovery in the post moratorium period has been again stalled by mismanagement of its own making. Here was a bank which not only had India’s largest bank as a key shareholder, but other banks and prominent private equity firms as equity holders, and had been recapitalised adequately for growth (CET 1 ratio of 13.1% in 3QFY2025). All it had to do was implement a profitable retail strategy which could contribute to the bank’s overall profitability, instead of being a drain on it. In contrast, many Non-Bank Finance Companies (NBFCs) in the last 5 years in a competitive environment, strengthened their retail presence and rewarded shareholders like Bajaj Finance, Cholamandalam Investment and Finance, Shriram Finance and Muthoot Finance. Yes Bank’s retail misadventure should be a case study on how not to conceive and implement a retail strategy dependent on DSAs, characterised by high operating expense, poor credit risk management, improper pricing of assets, absence of genuine profits and presided over by a board of directors who slept while retail losses were piling up.

This article was also subsequently published in The Wire and can be read here.

_____________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). BSE Enlistment No. 5036. Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in Yes Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

www.hemindrahazari.com

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: