EXECUTIVE SUMMARY

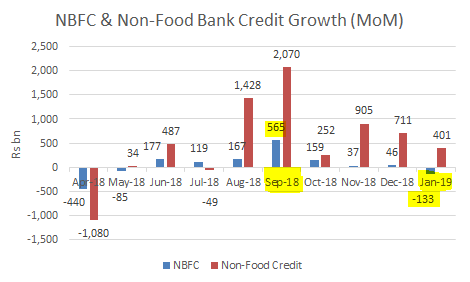

For the beleaguered non-bank finance company (NBFC) sector, banks are the single largest component of external funding. This source peaked at the end of September 2018, in the aftermath of the default of IL&FS, a private unlisted infrastructure developer and financer. However, in the beginning of the last quarter of the financial year ended March 31, 2019 (4QFY2019), when bank credit in the economy normally peaks, bank credit to NBFCs (as on January 18, 2019) has declined as compared with the previous month. The sharp spurt in bank credit at end-September probably indicates that NBFCs utilised their sanctioned limits with the banks, and top-rated NBFCs took on excessive bank loans to tide over their asset-liability mis-matches in that period. Subsequently, by early January 2019, banks may not have renewed or rolled over the NBFC bank limits, which led to a drawing down of bank credit. It therefore appears that bank finance will continue to remain tight for NBFCs in the last quarter of FY2019, as they sell their assets to banks and restrict asset growth in order to remain liquid.