February 23, 2018 by rupeindia

— Hemindra Hazari writes:

The Punjab National Bank (PNB) Nirav Modi scam has led to a clamour from certain quarters for the privatization of India’s Government banks. It was only to be expected that Assocham , the corporate sector body, saw in this development a chance to ask for the privatization of Government banks, since some of its members might be interested in buying some of them up at cut-rate prices. Arvind Subramanian, Chief Economic Adviser, who had earlier argued for the closure of Government banks in order to allow private banks to increase their market share, has renewed his argument recently by asking, “first, if not now, when? second, if not this, what?”. Shekhar Gupta has made the astounding claim that India’s Government banks have a 47-year record of scams. Adi Godrej, chairman of the Godrej group, pitched in for privatization with an equally preposterous claim that “I have not heard of any major scams by the private bank.(sic) There is always something going wrong in companies from time to time, but it’s always more controlled in the private sector if at all and much better managed.” Ravi Venkatesan, the chairman of the Government-owned Bank of Baroda, no less, also contributed with “privatization of at least a few big banks is probably the only solution.” The nation is being warned that the fate that befell PNB will befall the entire Government banking sector, and private ownership is the only solution to provide sound management.

The underlying belief of the school of privatization of Government banks is that bank nationalization was a national folly in 1969, which bred managerial incompetence, moral hazard, a drain on the exchequer’s resources and crony capitalism. The protagonists of the privatization of Government banks fail to acknowledge the fact that before nationalization private sector banks were not reaching banking services to the agrarian sector and small industries, nor contributing to a more balanced development of the economy. They ignore the fact that the banking sector was rife with mismanagement: in the two decades before nationalization, 736 banks either failed or had to be taken over by other banks.

In June 1969, before nationalization, there were only 1,833 rural and 3,342 semi-urban offices of the banks. By March 1991, these figures rose to 35,206 rural offices and 11,344 semi-urban offices. Total offices during this period increased from 8,262 to 60,220. Such a massive expansion in bank branches, which to a significant extent reached banking to unbanked sectors of the economy, would not have taken place under private ownership, since private investors are concerned with profits over a relatively short period. It was only the Government which could direct the banks to follow a broader developmental agenda.

Due to nationalization, the Government was able to direct a share of total credit to ‘priority sectors’, productive and employment-rich sectors such as agriculture and small units, which had been virtually excluded by private banks. Nationalization led to a huge spurt in priority sector credit to total credit, from 14% to 37.7% in the same period. The share of agricultural credit in total non-food credit rose from 2% in 1967 before nationalization to 9% in 1970-71 and peaked to close to 21% in the mid-1980s. It should be remembered that the vast majority of the population draw their income from these ‘priority sectors’.

No doubt, there was a large unfinished agenda of balanced development and public welfare before the Government embarked on bank liberalization in 1991. Of course, this could not be the job of banks alone; finance can only play a supportive role to overall Government policy. There was also much room for improvement in the efficiency and customer-friendliness of banks. Nor were the banks free of corruption, mismanagement and interference by politicians. As in the rest of the public sector, such problems called for focused attention to improving public sector management, strengthening regulatory institutions and ensuring public scrutiny.

But rather than complete the developmental agenda, the policy of liberalization sidelined that agenda. Instead of improving public sector management and doing away with politicians’ interference, it simply pushed Government banks to chase quick profits in lending to the corporate sector. In the agrarian sphere, this shift of the banks’ focus led rapidly to the reduction of the share of agriculture in bank credit, the return of the moneylender and the phenomenon of farmer suicides; in industry, it eventually led to the ballooning of corporate bad debts.

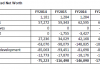

True, having to recapitalize Government banks to make up for corporate-sector bad debts is a drain of public funds. For that the corporate firms – including prominent members of Assocham — must be held to account and debts pursued. But even then it does not follow that Government banks are a net drain. On the contrary, a study by the research department of the State Bank of India, cited in the Economic and Political Weekly, “found that over the period 2005–06 to 2016–17, while capital infusion into the PSBs was Rs 1.29 lakh crore, the dividend paid out by the PSBs was Rs 75,000 crore and the cumulative income tax paid was around Rs 1.5 lakh crore.”

In the ongoing din for privatization of government banks, their proponents ignore the practices of exclusion practiced by private banks prior to nationalization. The industrial houses of that era not only were awarded a disproportionate share of industrial licenses, but used their banks to further concentrate the nation’s resources in their hands, ignoring farmers and small businesses.

Moreover, in the entire period of post-nationalization, the large public sector share in India’s banking lent a stability to the banking sector. Many private banks have failed since nationalization, but no public sector bank has done so. In praising private ownership of banks, the defenders of privatization appear ignorant of how privately-owned banks brought the global economy to its knees after the collapse of the investment bank Lehman Brothers, and the developed countries’ tax payers had to bail them out for their speculative activities and non-existent risk management. (Gross fiscal outlays for the bail-out in the US were a staggering 4.5 per cent of GDP, in the UK 8.8 per cent of GDP. For India, 4.5 per cent of GDP would be over Rs 7.5 lakh crore in the current fiscal year.)

Nearly a decade after the collapse of Lehman Brothers, global privately-owned and listed mainstream banks are being hauled up and penalised by regulators in the developed world for rampant money laundering (Deutsche Bank , HSBC) and rigging practically every market they operate in – Libor, commodities, and foreign exchange. In India we have private banks staff proudly marketing money laundering and shamefully exploiting their customers through cross-selling (i.e., selling an additional product or service to an existing customer). Yet for all these serious transgressions, which indicate a top-down driven business strategy, commentators, naively or otherwise, peddle the line that such misdeeds are the work of rogue employees. Nobody argues for nationalization of these private banks on the ground of such misdeeds.

In India, after 1991, some of the new private sector banks have become market favourities and are hugely profitable, as the regulator (the Reserve Bank of India) has permitted them to focus almost exclusively on the business-rich metropolitan and urban centres, while ignoring rural India and paying lip service to priority sector lending. Their business strategies are reminiscent of practices prior to nationalization. More than two decades since the entry of the new private sector banks, in 1991, RBI data reveals that as on September 30, 2017, for private sector banks, metropolitan centres accounted for 66% of their deposits and 74% of their loans, as compared with government banks 47% of deposits and 61% of loans. The heavy lifting of economic development – infrastructure loans, financial inclusion, employment-intensive loans to small and marginal farmers and the micro and small industries – were undertaken by Government banks.

When the economy was booming, the capital and infrastructural investments of the private corporate sector were financed largely by Government banks. That is, India would not have experienced the boom during 2004-2012 if the Government banks had not financed the investments. When the economy hit a tailspin, the private corporate firms went back on their commitments to public private partnerships (PPPs) and the loans turned bad, commentators unanimously blamed the poor credit risk management of Government banks, when in reality it was the private sector, with the blessings of the Government and the capital market, which recklessly ventured into infrastructure projects. The advocates of privatization blame banks but conveniently overlook private corporate performance. Based on their argument for privatizing Government banks for poor management, one can equally argue for nationalization of the private corporate sector for gold-plating projects, lack of risk management and poor operational management.

Much is made of the fact that the current market capitalization of all the Government banks, including State Bank of India (SBI), is lower than HDFC Bank’s valuation. The stock market and valuation of companies and banks has become the barometer of success as profit maximization became the primary objective. Indeed, even the RBI appointed P J Nayak Committee on governance in Indian banks in May 2014 recommended that the objective of the proposed Bank Investment Company (which would hold the government ownership in its banks) should be to improve financial returns (i.e. profit maximization) of the banks. Yet the main difference between Government and private ownership is that while the latter naturally operates to maximize profits, the former must have broader national objectives, with profit being only one of the objectives, subordinated to objectives of development, in an economy where vast swathes of the population survive on very low incomes.

Since 1991, and with the stock market listing of all the Government banks, the Government has in effect introduced privatization through the back door, because once listed on the bourses, banks have to focus on profit maximization, as shareholders demand exclusive focus on profits and profitability. And as banks regularly need to raise capital to increase lending, their valuation multiple (the share price as a multiple of the profits and/or book value) is dependent on their profitability, and hence developmental objectives takes a back seat. Higher yielding infrastructure loans appeared attractive and nudged by the government’s emphasis on PPP, the banks rushed into these loans, which subsequently proved high-risk. A similar approach was adopted by Axis Bank and ICICI Bank, which are private banks.

The blind faith in the market for the efficient allocation of resources and profit maximization should have received a jolt with the Lehman crisis. In the USA, banks fail regularly and since October 1, 2000, 555 banks have failed and have been acquired by other banks. If the large Government banks in India are privatized in the name of efficiency and the objective of achieving higher financial returns to shareholders, the practices of the global banks may be adopted, with all the major markets Indian banks operate in being manipulated, customers exploited in the name of cross-selling to generate higher profits, and, more importantly, more lucrative compensations for the senior management. The recent mis-selling of life insurance in Rajasthan by the private sector ICICI Bank and its subsidiary, ICICI Prudential Life Insurance, is an outstanding example of how both companies colluded and targeted low income and financially illiterate customers of ICICI Bank to mis-sell life insurance. The notion that more private players in the market would be beneficial for customers and result in financial inclusion is fallacious. When it comes to low income customers, the private sector in banking either ignores the segment or shamelessly exploits them.

In a country like India, where a significant section of the population is low-income, it is imperative for the bulk of banking assets to be controlled by the State to achieve the objectives of national development. Private sector banks should never be allowed to have a large or dominant market share, because it will lead to a lopsided economic model where banking services will be concentrated in the economically developed areas, essentially in metropolitan and urban centres, while rural India, where the bulk of population resides and employment takes place, will be neglected. Moreover, by privatizing Government banks, the Government’s influence to play a counter-cyclical role in the economy, especially during a downturn, would be negated. The post 1991 reforms focused on the inefficiency of Government expenditure and how it should be curtailed to allow for more “productive” private sector investment, but in the current slowdown, some of the same advocates are arguing for Government firms to be at the vanguard of investment i.e. to play a counter cyclical role, as the private sector is reluctant to invest.

Instead of privatizing the Government banks, the Government could simply buy out the non-Government stake in the banks. As it is the Government and the Life Insurance Corporation hold a dominant stake in Government banks, and as most of these banks trade at a significant discount to their reported book value, the buy-out by the Government will not be expensive. Such a buyout does not mean that the banks will not pursue recovery of the bad debts or that management autonomy cannot be given or human resources management cannot be improved. Without the quarterly demands of profit maximization, the Government can be at the vanguard of balanced developmental and inclusive growth, rather than corporate-led growth and corporate scams. If not now then, when can we re-nationalize the Government banks?

Hemindra Hazari is an independent market analyst.

This article has been republished in The Wire and is cited here.