Hemindra Hazari

9 July 2019

On 26 June 2019, confronted with a contempt petition filed in the Supreme Court of India by Right to Information Act, 2005 (RTI) activist, Girish Mittal, the Reserve Bank of India (RBI) finally disclosed the hitherto confidential annual inspection reports, called risk assessment reports (RARs), of select banks for the years FY2013, FY2014 and FY2015.

These are State Bank of India, Axis Bank, ICICI Bank and HDFC Bank.

The RAR, conducted by the RBI after the end of the financial year, is a comprehensive document about its assessment of the bank for that year. The RBI grades every bank with a rating from 1 to 4, with 4 being the worst and 1 the best.

The RBI collects considerable material from banks, which is fed into a model that is weighted, and calculates a risk number. Neither the weightage nor the detailed calculation is disclosed to the banks. After discussing the draft report with senior management prior to its finalisation, the RBI has the final word and the bank has to show signs of improvement in the subsequent year on the weaknesses highlighted in the report. In this article we evaluate the RBI’s RAR of Axis Bank in FY2013, FY2014 and FY2015.

Axis Bank: RBI Risk Assessment Report

(Note: Colour coding not in original report Source: RBI sourced via RTI)

The RBI’s RAR of Axis Bank for FY2013 presents a poor portrayal of the bank’s governance, leadership and banking ability. The core skill of managing a bank is risk management, and the banking supervisor was of the view that this critical area needed to be “toned up”. According to the RBI, the business and control heads were working in segregated silos and “did not ensure that issues were brought before the relevant committees” for intensive examination and for guidance.

The RBI’s rating for risk governance, at 2.38, was even higher than the already high risk rating of 2.301 for the overall aggregate risk for the bank, which indicates how poor risk governance was at Axis Bank. Credit risk, at 2.36, was marginally better than risk governance, but nevertheless still higher than aggregate risk. The RBI found “major weakness in the quality of credit appraisal,” as there was a shortfall in the valuation of securities at the time of settlement, as compared to valuation at the time of sanction and origination, which pointed to lax collateral management.

The division which had the highest risk in the bank was market/treasury, at a very alarming 2.553. This division appears to have been mis-managed, as it had incurred operating losses on a standalone basis for 4 of the previous 5 years, and the bank’s internal systems did not separately identify income from treasury and from the bank’s internal customers through transfer pricing. There was also no independent verification of achievement of targets by treasury dealers. The bank did not maintain or monitor individual profit and loss for individual dealers. Worse, no disciplinary track record was incorporated in dealers’ performance appraisal in terms of breaches in risk limits.

A bank’s treasury is an extremely sensitive, sanitised and restrictive area, but Axis Bank’s treasury was apparently porous. The dealers extensively used Reuters Messenger (RM) which had “no audit trail and no oversight”, and the bank did not have a policy for its use.

In a violation of RBI policies, it was used as a primary means of communication with external customers in negotiations for pricing of deals. In both the derivatives and foreign exchange treasuries, there was no separate inter-bank desk and customers’ desk, resulting in “inter-bank dealers communicating directly with external customers”. The trading book and derivatives book were also headed by the same individual.

(Source: Axis Bank)

Despite Axis Bank reporting low gross NPAs, between 1.1%-1.3%, in the FY2013-FY2015 period, RBI’s RAR reveals that it was concerned with the credit risk at the bank. What is peculiar in the RBI RAR for Axis Bank over the 3 years is that, while the aggregate bank rating improved from 2.301 in FY2013 to 2.175 in FY2014 and to 2.151 in FY2015, the all-important credit risk rating only marginally improved from 2.36 in FY2013 to 2.346 in FY2014, and then deteriorated to 2.377 in FY2015. To grasp the significance of this, we need to note that in Indian banks, credit risk is the major risk, indeed it constitutes the overwhelming majority of risk weighted assets. In Axis Bank for FY2013, FY2014 and FY2015 credit risk assets were 85.2%, 84.4% and 83.8% respectively of total risk weighted assets. With the credit risk rating persistently remaining above 2.3, which the RBI considers high-risk, and credit forming the overwhelming bulk of risk weighted assets, it is puzzling for the aggregate risk rating of Axis Bank to have improved.

Axis Bank: Composition of Risk Weighted Assets

(Source: Axis Bank Annual Reports)

What is even more unusual is that it is the responsibility of senior management and the board of directors to monitor credit risk. Hence the credit rating risk score should be mirrored in the score given to the board and to the senior management. However, while credit risk remains poor, there is a significant improvement in the risk rating of the board and the senior management in FY2014 as compared with FY2013, prior to deteriorating in FY2015. While the credit risk score in FY2015 is worse than in FY2013, the score given to the board and senior management in FY2015 is significantly better than in FY2013.

The public and the stock market are now well aware from events post-FY2015 that it was the major mismanagement in the bank’s corporate loans which impacted the bank performance and along with other issues of operational risk and integrity of accounts contributed to the truncating of the fourth term of former managing director and CEO, Shikha Sharma.

There is therefore an obvious flaw in the RBI’s rating of the board and the senior management in its RAR, as it appears to be delinked from the credit risk score. One hopes that the RBI has corrected this from FY2016 onwards. Another critical shortfall in RBI’s RAR of Axis Bank for these years is its inability to comment on and rectify the strategic weakness in the Axis Bank board, which contributed to its poor performance and finally to the removal of its CEO, Shikha Sharma, by the banking regulator.

In all 3 years of Axis Bank inspection reports, while commenting on certain issues of the board pertaining to nominees of SUUTI (Special Undertaking Unit Trust of India) and Life Insurance Corporation (LIC) and certain other issues, the banking supervisor failed to highlight the elephant in the boardroom, namely the negligible commercial banking and corporate credit expertise on the board of directors of a prominent private sector commercial bank.

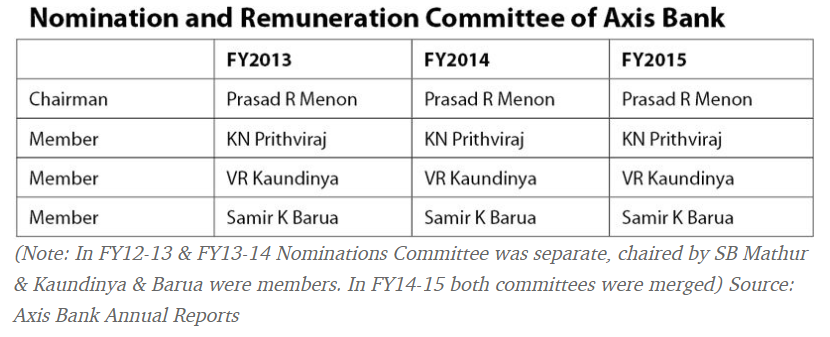

One of the many shortcomings of Ms Sharma and the Nominations and Remuneration Committee (chaired by Prasad R Menon) was their inability to select seasoned commercial bankers, well versed in corporate credit as directors on the board. Axis Bank was practically unique amongst commercial banks in India in that, during FY2013-FY2015, barring Somnath Sengupta (executive director, October 2012 – 2014) and his successor, Sanjeev K Gupta (ED & CFO only in FY2015, as he too, like Mr Sengupta, took early retirement) none of the executive directors had exposure to commercial banking, nor had they managed corporate credit or worked in a bank branch prior to their appointment in Axis Bank.

Ms Sharma, appointed as CEO in June 2009, had a background in life insurance, investment banking and retail finance with the ICICI group. V Srinivasan, prior to his appointment in Axis Bank in 2009, had a background in investment banking, fixed income, treasury and foreign exchange. Debt and treasury management has limited corporate credit exposure, as it deals in highly rated credit instruments requiring negligible credit assessment and credit monitoring skills. In the three years under examination, Axis Bank’s board of directors consisted of 13-14 members, and in each of those years, at best the board had only three (two in FY2013 and FY2014) experienced commercial bankers, one of whom was a non-executive director. Apart from the executive directors, the only non-executive directors who had commercial banking experience were KN Prithviraj and V Visvanathan (from FY2015). From FY2016 onwards it got worse, with V. Visvanathan (independent director) being the sole board member having commercial banking and corporate credit expertise; with the early departures of Mr Sengupta and Sanjeev Gupta the new executive directors such as Rajesh Dahiya (exposure to general corporate management) and Rajiv Anand (background in investment management and treasury) lacked commercial banking and corporate credit expertise.

In the light of recent events in Yes Bank and in many government banks, we can see that, even though the inclusion of experienced commercial bankers on the board of directors is not a foolproof mechanism for prudent credit risk management, a negligible and token presence of such expertise on the board of a bank is a major red flag.

It is apparent, that the RBI did not consider the lack of commercial banking and corporate credit expertise on the board of a prominent private sector bank as a major risk factor which needed to be addressed – this in a bank which had 84% of its risk weighted assets in credit and 45% (FY2015) of total credit in corporate credit. This was all the more important when the RBI had given Axis Bank a high risk credit score exceeding 2.3 in all the 3 years. It appears that the board, especially its NRC, was oblivious to the need to get experienced bankers on the board in order to rectify the high risk credit score that RBI RARs were giving the bank.

Unfortunately for Axis Bank shareholders, the board of directors, and the banking supervisor’s inability to address this gaping and visible hole, contributed to the bank’s corporate credit quality rapidly deteriorating.

In FY2013, the operational (non-IT) risk was 2.423, which indicates high risk, and the RBI observed the bank had a high turnover of staff, e.g. while the bank recruited 15,217 employees, 9,033 staff quit the bank, and at the entry level, and in the sales and front office, attrition rose significantly. The sales culture has put tremendous pressure on the front office to sell financial products, and in the industry, at the base level, there appears to be high turnover, as staff move to other banks in an attempt to escape the pressure.

The RBI also noted the high and rising incidences of both internal (staff) and external (customers) fraud. It also noted that the bank had deemphasised staff training, as expenditure allocated was low. Although the rating improved over the next 2 years, it became a major issue during demonetisation, when bank staff were arrested for money laundering.

In FY2014, the RBI’s RAR scored the bank’s liquidity risk at 2.475, as it was concerned with the bank’s dependence on short-term funds and volatile CASA (current and saving accounts) deposits; the bank’s average cost of term deposits was higher than the median and average rate offered by major banks in the market. The bank’s liquidity was also constrained due to its reliance on top depositors for funding short-term 14-day liquidating assets. Since the liquidity risk rating improved to 2.19 in FY2015, it appears the bank addressed the issue. The objective of RBI’s RARs of banks is to highlight the weaknesses and improve upon the risk management of the bank. Contrary to capital market expectation, banks are in the business of managing risk and not only to maximise profits.

In the context of the three years of Axis Bank’s RAR being made available to the public via the RTI, one should credit RBI with having correctly identified the poor credit risk management of the bank from FY2013 to FY2015. However, the role of the banking supervisor is to also identify the accountability for the same and monitor its improvement.

In Axis Bank the RBI not only failed to hold the board of directors and the senior management responsible, but gave the board and the senior management a better aggregate risk score in FY2015 as compared with FY2013, while showing a worsening score for credit risk for those years.

Shockingly, the RBI inspectors were also unable to see the strategic risk in the composition of the Axis Bank board of directors and the virtual non-existence of commercial banking and corporate credit expertise at the top. Events since FY2015 have clearly revealed the failure of the Axis Bank board and its senior management in managing credit, operational risk and the integrity of the financial accounts. The RBI too has to accept responsibility for failing to act and to restructure the board at the necessary time. In this sense, then, the RBI RARs of Axis Bank, though interesting for students of banking, misses the forest for the trees.

You may also want to read…Finally, RBI Shares Inspection Reports of SBI, ICICI Bank, Axis Bank and HDFC Bank under RTIExclusive: RBI Inspection Reports on SBI Reveal Evergreening, Window-dressing, Cover-ups and Worse