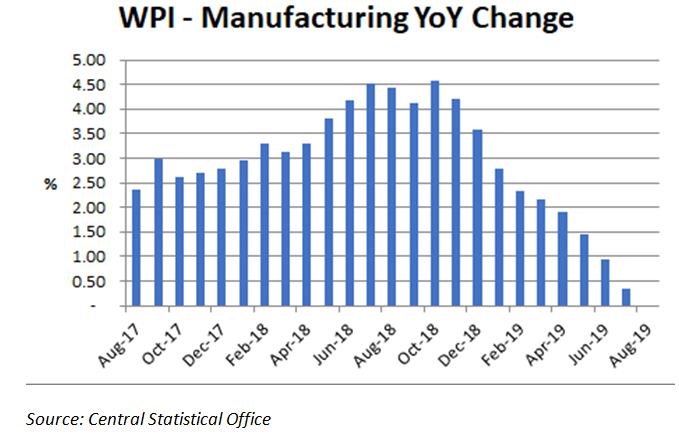

EXECUTIVE SUMMARY. The Finance Minister, Nirmala Sitharaman has announced the slashing of effective corporate tax to 25.17%, inclusive of all cesses and surcharges, effective from April 1, 2019, for domestic companies. Along with other relief measures this will result in a revenue forgone of Rs 1,450 bn (US$ 20.4 bn). This announcement resulted in a huge surge in the stock market on the expectation of the increase in corporate profits. The critical issue is whether this significant relief to corporate earnings will result in a boost to aggregate demand, investment, employment and sustainable economic growth in the economy. While shareholders will benefit handsomely from the reduction in corporate taxes and increase in profits it is doubtful whether the private corporate sector in a depressed economy where the Whole Price Inflation (WPI) for manufactured goods for August was 0% will play a counter cyclical role and invest in fixed assets.

Recent Posts

Most Popular

IndusInd Bank Board Protects Senior Executives Responsible for Fraud

One of the most shocking episodes in the history of Indian banking was revealed by The Wire.in in a recent exclusive: namely, that the...

Tata’s Outside CEO Battles Multiple Crisis After Bad Year

“For the future growth of the Tata group, Chandra has to find new businesses which can replace TCS’s cash generation which at this time...

Not a Private Matter: Did Axis Bank Share Price Sensitive Information to a Select...

An ordinary meeting of Axis Bank on December 15, 2025 with institutional investors had an extraordinary outcome, one which may need to be probed...

Does the IndusInd Board Run the Bank? Or Is There a Centre of Power...

Ashok Hinduja, chairman, IndusInd International Holding, told the press recently:

"Could you have as a promoter taken steps to avert the crisis at IndusInd Bank?

Money...

Cobrapost Expose on Cholamandalam & Murugappa Group | Cobrapost Press Conference Live Lootwallahas 2

https://www.youtube.com/live/JjL1S77TQXA

Venue: Press Club of India, New Delhi.

My commentary starts from 30:00 mins.

Couldn’t agree more …

Its nice to hear a sane voice amidst all the happy chirping which is all praise of the FM for her sops she rolled out for corporate.

While, corporate tax reform was due and is welcome…..

But I fail to.understand….when there are signs of economy under stress due to slowdown in consumption…. you could have done somehting that gets more money in hands of people who spend….I don’t see how this will ever help.

I hope something gets done personal income tax too…( people spend when they feel financially secure their future)